[00:00:00] Danny de Hek: Good guys. Thanks for tuning into my, I think I’m gonna call this a tube cast cause I’m a podcaster, so I figured that out. I’m doing a podcast and a YouTube video at the same time. We’re gonna call them you YouTube cast. YouTube cast. Don’t know. I just realized something about this whole debacle of HyperFund, HyperCapital, HyperVerse and HyperNation as I’ve been doing a call out lately to people suggesting that they come onto a Zoom meet meeting and tell me their story.

[00:00:34] Danny de Hek: So I got this guy who come on my Zoom meeting today and I talked to him for about an hour. And if you have a look at the picture of the background, I’m actually going through editing it at the moment. And then I thought, well, I really need to do sort of about an intro and there’s something that I would really like to address now that.

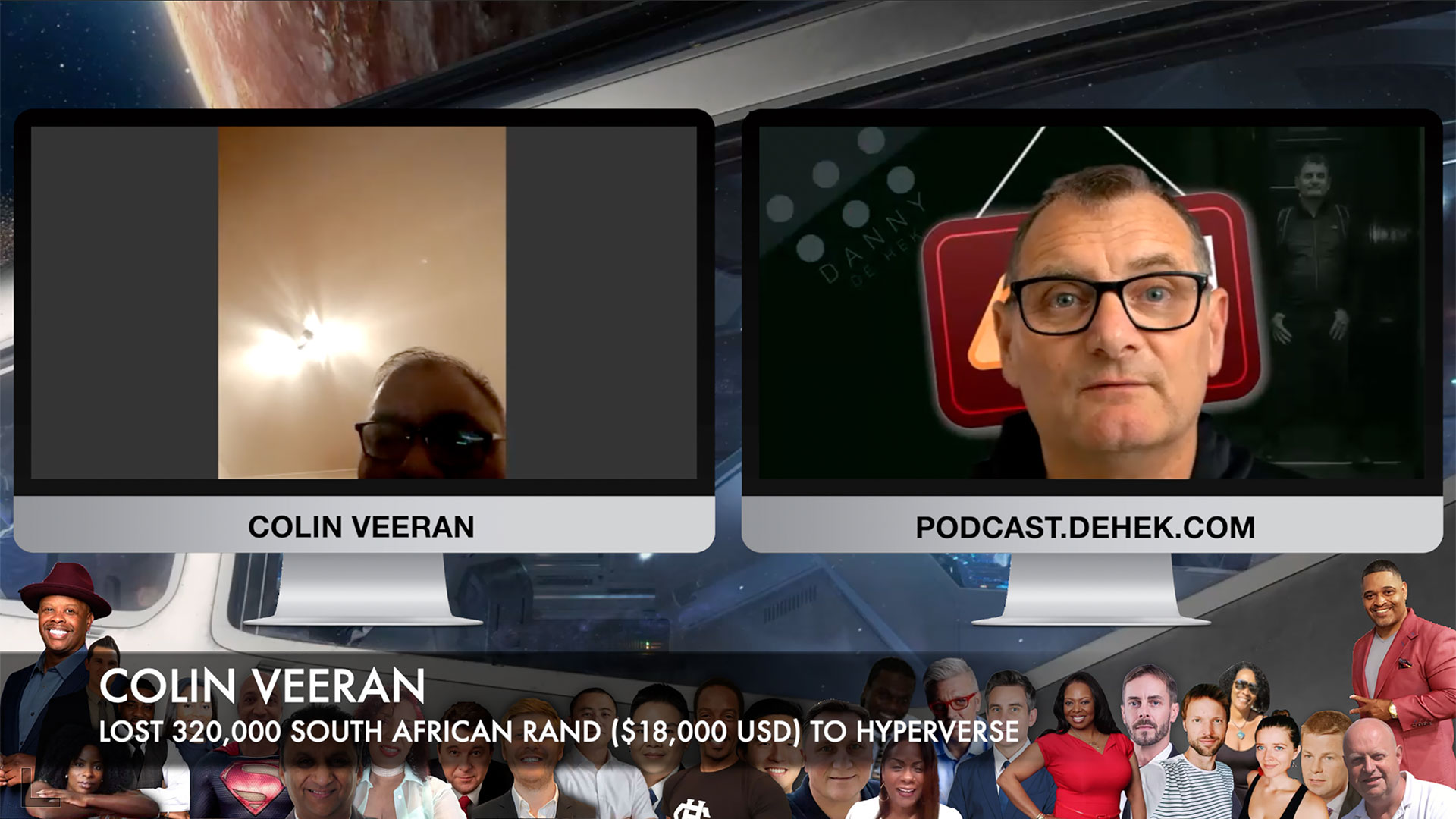

[00:00:56] Danny de Hek: I interviewed a guy by the name of Mike Lucas and I’m I think Colin is the guy that I’ve just been talking to for an hour, and the demographics of the two guys is practically the same. Colin, I hope his name is Colin. I better get that right before I carry on. Let’s have a look. Let’s have a look.

[00:01:15] Danny de Hek: Colin. Colin, It is Colin, right? Colin. Now Colin’s from South Africa and he took early retirement and used his, basically his pension money or retirement funds and put it into HyperVerse and lost a lot. And the same with Mark Lucas. And both those guys don’t have partners, a single, and they’re both being conned outta their money.

[00:01:44] Danny de Hek: And then I think back to the things I used to do. I used to run social group and I used to help a lot of people who were lonely. And I used to be incredibly lonely myself. And I do mention it briefly in the the podcast, but I’m suddenly realizing a lot of these people, incredibly lonely people who are starving for a community and also have put a lot of trust in a friend that’s recommended something to them.

[00:02:12] Danny de Hek: And it’s really making these people really vulnerable. And I asked Colin if he felt suicidal and he said yes. He, he has thought about it. Now that’s another side of it. It’s all very well put in money that you can afford to lose what they all tell you, you should only do that, but who can afford to lose any money?

[00:02:32] Danny de Hek: And this guy put in over 300,000, ran into it, which is, I haven’t worked it out, but I’m thinking it’s about $20,000. And, and now he feels, you know, like he could potentially, this guy could actually. Get so down and out that obviously he take his own life. Imagine that on your shoulders. That’s why it’s so important for us to have people who are brave enough to come and tell their story.

[00:02:58] Danny de Hek: And while I’m talking to him, he’s actually trying to figure out whether I think there’s actually an opportunity for him to get his money back, and I have to be the bearer of bad news, which is making me feel a bit vulnerable because I’m not a trained professional at dealing with people with mental illness or thoughts of suicidal thoughts.

[00:03:20] Danny de Hek: Personally, I’ve had two people in my family, my stepfather and my, my sister actually unfortunately take their own lives, so I know it’s a. Possibility that people do do that. So what I’ve reached out, I’ve got a good friend called Michael Hessey, and he’s a b he’s wrote a book about, you know, how do I help people with suicidal thoughts?

[00:03:45] Danny de Hek: And I’ve been to his book opening, and would you believe one of the best things that you can actually do is ask people point blank? Are they feeling suicidal? And if they say yes, then as a person that isn’t a trained professional, the best thing you can actually do is say to that person, Well, let’s get some help and I’ll come with you.

[00:04:06] Danny de Hek: So if you are talking to these people, you know, bear in mind this is a possibility, how some people are thinking and how down they are now. I just wanted to address that. Now I’ve reached out to my friend Michael and asked him if he would be willing to come. A YouTube cast. Hmm, I’m sure that’s right. And basically help us understand mental illness a little bit more cuz he deals with it every day.

[00:04:30] Danny de Hek: So that’s what I’m doing about it. But anyway, this is just a small introduction to the podcast I did with Collin. Now hopefully I have got his right. It is Colin, c o l i n. And we’ll hear now Collins from South. And I’ll merge this into the podcast, but thanks for giving me some of your time and some comments.

[00:04:49] Danny de Hek: And please do hit the thumbs up. Let’s get these videos out. Now, if you’ve got a story like Collins, I wanna hear from you. I want you to go to to hec.com and make a booking and let’s get together over Zoom and you can tell me your story. Let’s start speaking out. And let’s name and shame these people.

[00:05:07] Danny de Hek: It’s more about getting the message out to help others. And as I talk through it, there’s people now queuing up to get into these HyperNation meetings and they’re looking to put their money in. So we don’t want other peoples to be victims. And the best prevention that I can see is people getting more awareness out to the public about these Ponzi schemes and how to be cautious.

[00:05:30] Danny de Hek: This was the second time Colin has actually invested in a Ponzi scheme. So a lot of people aren’t once bitten, twice shy, it seems like. Twice bitten, not very shy, . All right, So enjoy the podcast and please do comment and any advice or tips that you can share please do let us know. And there’s one other thing I want you to listen to.

[00:05:54] Danny de Hek: Colin was going to reach out to one of the comments he saw in a YouTube video where someone said that such and such helped them recover their funds. If you ever see any messages under my videos, I’m not endorsing them. In fact, every day I’m deleting those messages. They are scams and you’ll lose more money.

[00:06:10] Danny de Hek: There’s no such singer as getting your money back. No one has a clever computer program that can hack the blockchain and get the transaction of your money that you put into HyperVerse back. So just be cautious there as well. There’s scammers who are quite happy to scam the, the people that have been scammed.

[00:06:25] Danny de Hek: All right, look forward. Enjoy the YouTube video. I’ll merge it in Now.

[00:06:47] Danny de Hek: I’m Danny de Heck and I’m just about going to go into a Zoom meeting with someone who’s emailed me asking for a meeting and they want to help

[00:06:56] Colin Veeran: getting their money back

[00:06:59] Danny de Hek: from HyperVerse. I dunno, you’ve been listening lately to any of the Zoom meetings promoting hibernation, but it is actually quite amazing what they’re asking people to do.

[00:07:10] Danny de Hek: They really are doing what they call peer positive peer pressure. So basically if you join up for HyperNation, you’re gonna get community rewards If you go to all the Zooms, so if you’re a new be you turn up in a Zoom meeting and there’s 200 other people in there with you, then you can just about guarantee that 150, if not more of them are actually already signed up for the system and they’re gonna chan you on and get you involved with HyperNation simply because you think everyone else is doing it, I’ll do it as well.

[00:07:43] Danny de Hek: But little do you know that these guys have already signed up already part of HyperNation and they’ve already got their friends. So everyone’s encouraged to really together. And it’s like a pack of wolves, isn’t it really? Who are going out there to rust up their friends and to see people and listen to these meetings.

[00:08:02] Danny de Hek: And I just, I’m overwhelmed with what they’re actually telling people. And you are going to get this, and if you get this, you get that. And the rewards are just Uncomprehensible always look like I’m crooked on camera. I don’t know how to do that. So my, I’m not used to wearing glasses all the time, so if I lift that glass up there a little bit still look like my eyebrows are crook on.

[00:08:22] Danny de Hek: Hello. Hello. Connecting audio. Hey, good day. How you doing for the audio? Should be too far away. There we go. We should be right. Can you hear me up? Hi, how are you? Ah, good. Thanks mate. Nice to have your voice. takes a, we while connect the voice through. Whereabouts are you calling from today? I’m from

[00:08:40] Colin Veeran: South Africa.

[00:08:41] Colin Veeran: And

[00:08:41] Danny de Hek: you Oh, cool. Joe Berg, is it? No, no, no. Devin, the other side. Cause I there’s a, it’s like the north island in the south island, isn’t it? When you meet South African, that’s, boy, you probably watch the rugby as well, do you? Yeah, just, yeah, Not too much. You guys are pretty vicious with the rugby with New Zealand.

[00:08:59] Danny de Hek: I tell you

[00:09:03] Danny de Hek: always, whenever we have a self African game, it’s like, Oh my goodness, we’re gonna get a beating, but it’s gonna be one hell of a, it’s more of a fist fight than anything else. So where you from? Danny? I’m from Christchurch. We’re based in New Zealand. Okay. Okay.

[00:09:16] Colin Veeran: Yeah. John La Boys. .

[00:09:19] Danny de Hek: Yeah. Wasn’t he legend a Yeah.

[00:09:21] Danny de Hek: Yeah. Course I still, you still watch replays of him and you’re thinking, what the heck? He’s he was a big la He used to climb, jump over people, didn’t he? Didn’t he? Oh yes, yes, for sure. Yeah. Like watching a camel play. Rugby really, to be honest. Yeah.

[00:09:35] Colin Veeran: Do you, do you mind if I smoke while I’m, while I’m

[00:09:37] Danny de Hek: doing this video?

[00:09:38] Danny de Hek: Oh, I hate smoking, but I, I’ve assumed that the fumes don’t come through the screen, so we should be alright. . Yeah. I used to say people, I don’t, I don’t mind smoking car tires cause used to be fun. Yeah. Yeah. What are you smoking? Not marijuana by any chance

[00:10:06] Danny de Hek: about that?

[00:10:08] Colin Veeran: It was a friend of mine that introduced me to

[00:10:12] Danny de Hek: Right. Isn’t that always the way I ask that question? And every time it’s the same. And he’s still in contact with that friend? No, not

[00:10:18] Colin Veeran: unfortunately. He doesn’t want deal with me anymore.

[00:10:22] Danny de Hek: Oh, well that’s good.

[00:10:26] Danny de Hek: Cause now you can name and shame them.

[00:10:28] Colin Veeran: Because I, I went I went to the rocket desk for information because every time I got in contact with him, I’m too busy to help me. Yeah. So I decided go to the rocket desk. That’s you know the rocket

[00:10:41] Danny de Hek: desk? No, I don’t, I haven’t heard of that. Rocket Desk

[00:10:46] Colin Veeran: Rocket.

[00:10:47] Colin Veeran: It’s information center for I

[00:10:50] Danny de Hek: Oh, right. Well you go talk me something. I’ve never got involved with it, so I’m not on a vend to get my money back. I’m just like to know how that works. And do they normally get back to you with pre formatted emails or is it every case is individually answered.

[00:11:06] Danny de Hek: Hello. Is do they normally get back to you with some form of answer or how does that work? You

[00:11:15] Colin Veeran: talking about the rocket

[00:11:16] Danny de Hek: test? Yeah. Like how much help and support do you get from them?

[00:11:20] Colin Veeran: Yeah, basically it’s like how to do withdrawals and stuff. I was, I was actually converting mine to Hvt. I dunno if you know

[00:11:28] Danny de Hek: what Hvt is.

[00:11:29] Danny de Hek: Yep. No, I know quite a lot about it. But I’m just not using that. Alright, so then hgs vts, like, so Bitcoin Rodney was given away 45 million worth of Umu, I think it was because it was worthless. Sorry. He was, But then you’ve got, you were converting it to Hvt, which is now worthless anyway, isn’t it?

[00:11:49] Danny de Hek: It’s being pumped and dumped and you’re stuck with all this coin that you can’t do anything with. Well, no one wants to transfer it. I think that’s the biggest scam of the whole picture to be honest, is they’re actually obviously pumping, dumping these coins and then they sell them off and that’s where they make their money.

[00:12:06] Danny de Hek: As well. Yeah. Alone running the whole company on memberships. And, and are you convinced it’s a scam now or are you still thinking it might come true with the payout? Whoa,

[00:12:19] Colin Veeran: there’s a lot of people that are optimistic about this. You know, it’s, And what, what do you think Danny?

[00:12:29] Danny de Hek: Well, I, I, I’m, it is just a Ponzi scheme, so basically that means that some people win and some people lose.

[00:12:38] Danny de Hek: And that’s the problem because you get the people who winning, telling you that they’ve made so much money, it can’t be a scam. And then you’ve got the, the poor people who are the ones feeding the rich people who are losing their money and their money’s all locked up. So it’s a, it’s a real oxymoron in a way.

[00:12:55] Danny de Hek: They. The video I put online last night was a meeting that Piny Na was telling people that in two or three weeks they’re going to pay back everyone’s one time rewards. So, And you’ve heard that before? No. Right. So have you put a thousand bucks in and you haven’t ever withdrawaled any money? Then he reckons that in three weeks, two or three weeks time, that everyone’s gonna get paid back, whatever they put in.

[00:13:30] Danny de Hek: So they’re gonna break even and he’s okay. So he’s quite that. That’s.

[00:13:42] Danny de Hek: How many people have actually put like all the wealthy people have already taken all their initial out and they’ve also taken a ton of other out so that that doesn’t affect anyone that’s done really well out of it. It’s basically for anyone that’s invested since April. Let’s say April. So did you ever take any money out of it?

[00:14:03] Danny de Hek: Yes, I have. I have

[00:14:04] Colin Veeran: taken some money out out of it. Yeah. Compared to Okay. Not all of it though. Yeah, but,

[00:14:14] Colin Veeran: And how much? A lot of money. I

[00:14:19] Danny de Hek: invested much is that mate.

[00:14:23] Colin Veeran: It was 320,000.

[00:14:25] Danny de Hek: Oh my god, mate. Oh. Just about fell over then, but I’ll fit myself, so I’ll stay standing. Oh my goodness. Wow. So it’s not your life savings.

[00:14:39] Colin Veeran: Well, just, I, I took used to,

[00:14:48] Colin Veeran: I invest

[00:14:49] Danny de Hek: part of my money. Wow. Mate. I just Oh, damn. No, that’s so the problem I see is a lot of people are hanging on to hope and what they want to do is appease the crowd. And basically, after watching the video last night, now I was in bed to give you an idea how dedicated I am to, to finding these RAs.

[00:15:09] Danny de Hek: I was in bed at quarter past 12 last night, and I got a message from a person telling me that here’s a video of panicky arc that’s just been released. Here’s the password. And I logged into a Vimeo account, saw the video. Got outta bed, ripped off the video and uploaded it to Odyssey so everyone can see it.

[00:15:30] Danny de Hek: And that video was only done 12 hours earlier and it’s basically panicky saying that everyone’s gonna get their initial investment out. Now if we use your case as an example, let’s say you’ve taken out 50 grand. I don’t know is even, I assume that you haven’t got your 320,000 out. No. No, I haven’t. Right.

[00:15:53] Danny de Hek: So where do they, if they are gonna give you your initial money out, you know, like you wouldn’t even be a high candidate, I don’t think, because you’ve already taken some money out. So they’re, they’re alleging that if people haven’t taken any money out and they’ve just rebid or even have put their money in and not touched it, that they are gonna pay back those people first.

[00:16:16] Danny de Hek: So because you have taken some money out, I’m guessing that if they find money now we’re talking $4 billion worth of scam here. Now they, if they are going to repay people the $4 billion somehow, cuz some people have already taken other people’s money and paid themselves and especially the people at the top, they have been taking out their money left, right, and center, which is contradicting what they’re selling.

[00:16:46] Danny de Hek: Right. You know, so I, I think first of all, there’s no money to pay anyone out because no one’s addressed that elephant in the room where they say, Well, where’s the money coming from? Because they reckon that HyperNation is a completely different entity and all what they’re doing to appease people or grab crowd from HyperVerse is offer them a discount if they transfer the money into hyper bond.

[00:17:09] Danny de Hek: And once you transfer your money into hyper bond, you’re actually four F four fitting you. That’s you saying that you agree to being paid out. And they, that means I believe that changes the liability. You know, if they’re trying to say, Oh, well you’ve actually agreed that you wanna convert your money from HyperVerse to Hyper Bond and then transfer it into HyperNation, and if you do that, then it’s worthless.

[00:17:39] Danny de Hek: You know, you’ve got this worthless coining or currency sitting in HyperNation. But however, you go back to HyperVerse and go, Well, I’ve never got my $320,000 out. They gotta say, But you have agreed to transfer it to a shit coining and put it over to Hyphenation. Do you follow the mentality of that? And does that make sense?

[00:17:58] Danny de Hek: Yeah. Yeah. So I think that’s where.

[00:18:02] Colin Veeran: You go. Okay. So you are saying basically that the people that are haven were drawn or will possibly get the money out, that’ll be the

[00:18:11] Danny de Hek: first choice. That’s right. So put it in and don’t do anything and No, no Rebus, no nothing. I think you’d be at the top of the ladder if they actually come through and say what they’re gonna do.

[00:18:25] Colin Veeran: Yeah. But then in my case now I’ve like almost,

[00:18:33] Danny de Hek: So you would be a complicated monster to them, and I bet they’d use it as an excuse that you’re not at the top of the chain. Well, what

[00:18:41] Colin Veeran: does it mean now that, that I wouldn’t even get the rest of the

[00:18:43] Danny de Hek: money out. No. Now remember, they’re just sort of stringing you along so that I I they’re making this up as they go because when I listen to panicky na talking last night, he basically is repeating stuff that I’ve heard people make up on the fly.

[00:19:01] Danny de Hek: So he’s, he’s listening to other people’s suggestions, and then he’s delivering that as a fact and something that’s going to happen. But I was in the same Zoom meeting or listening to the same leadership meeting where he was being told that for the first time. So it is just, you know, like, I know it’s, it’s a lot of money for you.

[00:19:22] Danny de Hek: You’ve put $320,000 in it and then you’re listening

[00:19:27] Colin Veeran: to these.

[00:19:32] Danny de Hek: Oh, right. And what’s that?

[00:19:36] Colin Veeran: It’s about

[00:19:39] Colin Veeran: it’s it’s probably about probably like $10,000.

[00:19:47] Danny de Hek: Oh, right, Okay. I didn’t know what the ram was. Just got me excited then, mate. So no, no. Still a lot of money. So I’ve got another, and he American and he, he currently has $197,000 worth of h hu sitting as an account, and he never withdrawed any money. And now he is, he’s still obviously got his money tied up in there, but theoretically he’d be similar to yourself.

[00:20:16] Danny de Hek: So you would have so you have taken out a third? Yeah. So that’s, Yes. Yeah. So, yeah. And when did it stop for you? April was it or match? May,

[00:20:29] Colin Veeran: Yeah. Last year. Yeah. Mm,

[00:20:31] Danny de Hek: last year. December? No, last year. Of April. April, Oh yeah, the same. So that’s oh, so is that April, 2021? When most people had it. Yes, Yes.

[00:20:43] Danny de Hek: Right. Cause I thought people were still taking money out even recently like this year. But, but I must have got that wrong. Yeah. Speak

[00:20:59] Colin Veeran: Danny. Sorry. What would your advice be to me?

[00:21:04] Danny de Hek: You won’t like my advice . Yeah, just I mean, you have to literally put it down as a learning lesson. The, because you know, I’m, you know, the behind email in.com website.

[00:21:21] Danny de Hek: Sorry, you say that again? Have you heard of the behind ml m.com website? They publish? No. No. They publish warnings about Ponzi schemes all the time. We’ve got Project Frugal who’s done 10 videos on this company, you know, showing people how there’s no, it’s just a big scam. And what people like yourself find the hardest to actually comprehend is that the people who are telling you that things are gonna happen are literally making it up.

[00:21:53] Danny de Hek: And whether they believe in it or not, it doesn’t make sense. So let’s say that HyperVerse does have a pile of money there and they’re gonna repay everyone. How’s that actually gonna work? For example, there’s Tron scans and you can see when people have withdrawed from HyperVerse, so, I can’t remember the date exactly, but let’s say four or five months ago, there was a, a massive withdrawal from HyperVerse account.

[00:22:27] Danny de Hek: So the money’s been stolen out of HyperVerse. So if they were going to repay you back into HyperVerse, then you gotta think, well, how are they going to, where is that money actually going to come from? Are they going to trust the money out of HyperNation back into the HyperVerse Hvt, That coin’s worth nothing.

[00:22:52] Danny de Hek: So how are they gonna actually physically pay you the money? And then how are they gonna, are they gonna ring you up and say, you know, get a mate. How you doing? We understand you’ve got money with us. How would you like to be paid today? You know, are they gonna, Yeah, it just doesn’t make any sense. No one’s talked about the mechanics of receiving the payment in the first place, let alone where is the money gonna come from?

[00:23:18] Colin Veeran: Sorry, Danny are you, are you screwed up with cash effects or

[00:23:23] Danny de Hek: Oh, no. Well, I’m not involved in it, but I know all about it cause that was the very first one I actually heard about. Yeah. Are you in there as well? Any idea what’s happening

[00:23:34] Colin Veeran: with that? The same thing.

[00:23:37] Danny de Hek: Well, it is mate. I mean, I, I’ve done a video about this and I said, it’s like a casino and you’re walking down the road and all of a sudden the flashy lights of the casino have all these wonderful signs up saying that you’re guaranteed to win.

[00:23:51] Danny de Hek: Come on in. And as soon as you go in the doors, they ask you, convert whatever money you’ve got on you into them, play money. And then you go in the casino and everybody in the casino is actually encouraging you to have a, a flutter. And the people sitting with you at the tables or next to you at the machines are all in and on the game.

[00:24:13] Danny de Hek: They’ve been told that if they hang out at the casino, they could win a big prize. And that’s what the VIP v i p fives are doing. So you’re betting having a great old time with all these people who are telling you about their winnings and how much money they won, and you just part of the casino atmosphere.

[00:24:31] Danny de Hek: And then you decide on, I’m going to, I’m going to leave, or I’m gonna buy I’m gonna put my name down for one of the brand new cars that’s gonna be delivered next month. And the casino keep giving, giving these billboard adverts telling you that wonderful things are gonna happen in the casino as long as you stay in the ecosystem.

[00:24:47] Danny de Hek: And then you go to leave and they go, Oh you need to convert your money to leave. Now we can only convert it to you know, milk tokens. And you go, But I don’t want milk token. You know, I, I want what I, I used to buy. Oh no, we don’t do that. You have to convert it and then you have to convert it to this, to that, to this, to that, to get your money out if you can.

[00:25:08] Danny de Hek: And then they’ll say, Oh, but we’ve ran outta money at the moment. Do you mind waiting for a wee? And it’s, and they’re all the same mate, because there’s no such thing is, you know, the rewards that these companies are offering cause it’s mathematically impossible. You know, if you think about 300, they reckon, I heard the other day that 1.6 million people have invested in HyperVerse.

[00:25:30] Danny de Hek: Now if you do the mess on that at $300 a ticket, you’re talking, you know, billions. So all of a sudden, Ryan j or Sam Lee are going to come out with the money. You know that they’re worth and they reckon they’re worth billions. Now, Ryan j, the guy that’s meant to be worth billions and have 300 enterprises, hasn’t been anywhere to be seen for eight months.

[00:25:56] Danny de Hek: Nora Sam Lee. Okay, so now one point Ryan Drew was gonna guarantee the return on investment, even though it wasn’t investment and he put a hundred million dollars up. That was when it was, I think it was when it was HyperCapital maybe. HyperFundd, yeah. But in 2021, Ryan J took a job that was paying $120,000 a year.

[00:26:21] Danny de Hek: Now a guy with 300 enterprises under his belt and you know, a 300 enterprises under his belt. Why is he taking a job with 120,000 a year? He worked there for six months, you know, Then you got Sam Lee, who was based in Australia, Australian born, and he basically got Blockchain Global, which they used to rave about as the, you know, the amazing company that’s associated with HyperFundd and HyperVerse.

[00:26:51] Danny de Hek: And he managed to get that on the Australian share market, and they had 50 million invested. And then he took off with the money at the beginning of the year, same time that you’ve, you stop, you withdrawals and now the liquid are trying to find, so, so at the end of the tunnel. Say that again? Light at the end of the tunnel.

[00:27:12] Danny de Hek: Is there any No, mate. I mean, it’s just stringing what they’re doing. They’re just buying time. They’re keeping everyone, you know, hanging in there. Hope Emma hope’s a wonderful thing. I mean, I, I used to be in a religious cult, so they, they basically tell you that it’s all gonna be good at the end, have faith hanging there.

[00:27:34] Danny de Hek: But it is just, it is just a load of porky so they can get further, you know, so that the longer they, you have hope and you aren’t angry they get to take off with the money and the harder it is to recover that money. You know, and also, you know, a friend of yours introduced you to it. It’s hard for you to look, I would recommend going after your friend that introduced you to it because he’s provide you financial advice, which I’m probably sure he has to be registered to do that.

[00:28:05] Colin Veeran: Yeah. But I think he was angry with me because when I wanted to do a withdrawal, I normally do it through him. And for some reason I stopped it and I, and I got to the information center and I got my information and he was quite angry about it. And now when I’ve call him, he doesn’t take my calls.

[00:28:23] Danny de Hek: Right. If you bank did that, Sorry, Imagine if you bank did that to you, . Yeah. Yeah. So, I mean, what I’m thinking of is so did he, did you pay him cash and he create the accounts for you? Yes.

[00:28:43] Colin Veeran: Oh my, Well I

[00:28:43] Danny de Hek: transferred the money in to his account. Sorry. So you transferred the money to his account, you

[00:28:55] Colin Veeran: was Luna account

[00:28:58] Danny de Hek: and was it his,

[00:29:02] Danny de Hek: so why did he have to get involved in the transaction or was he involved in the transaction? Yes, he was. Right. Do you think the money actually hit hyper versus, or do you think he’s running his own Ponzi scheme himself?

[00:29:21] Colin Veeran: I’m not sure, man. It’s very hard because look, if he paid me like close to hundred thousand ran, so I don’t think he left the money with him.

[00:29:31] Colin Veeran: Pay that.

[00:29:32] Danny de Hek: Well he would’ve cuz he would’ve been running his own Ponzi scheme and paying yet of, that’s exactly what HyperVerse is doing. So, If you went to HyperVerse and you wanted to invest 320 ran, you would have a wallet address to send the money to, and you would basically need to have that into your money would have to be in a, in s d t, in a crypto wallet.

[00:29:59] Danny de Hek: And then you would, you know, do a withdraw and deposit it to, So why would he have to get involved? There’s no reason. So your mate I reckon’s taking

[00:30:14] Colin Veeran: Okay. The only reason he was, he was the one that introduced me to the to I, and he said I was invest my money in that. And but it, everything seemed so legit because everything was done in a crypto wallet and stuff like that and Yep.

[00:30:27] Colin Veeran: You know I never had everything, I used to get emails and stuff like that telling me that the has been completed. So it was all

[00:30:36] Danny de Hek: legit, right? So what I believe you would’ve done is, so you can log to, you can go to hu dot the HyperVerse.net I think it is, and you can log in and see your account there.

[00:30:48] Danny de Hek: Yeah, yeah. All right. So what people were doing at one stage is they couldn’t get them money out. So they were gifting people, memberships, and then they were telling people you can have a free HyperVerse membership. And they would use their HU that they couldn’t get out to purchase those memberships, and then they would give people that.

[00:31:13] Danny de Hek: So I reckon I wouldn’t be surprised, and I’m not saying this is the case that your, the guy that introduced you to it probably set you up an account using his HU in the back end and then gave you ownership of that account. But in the meantime, siled your money out through a crypto wallet of his own.

[00:31:32] Danny de Hek: Because why would you need to go to him to do withdraws? Why wouldn’t you just go into your account, convert your HU into mof, and then request a withdraw from HyperVerse And once it’s approved, you see,

[00:31:51] Colin Veeran: you see, initially I wasn’t too clued up with the system. Yeah, I wasn’t So you were showing me like how to do it and stuff

[00:31:59] Danny de Hek: like that?

[00:32:00] Danny de Hek: Yeah. Well, the, the, I think the, the honest truth of it is that a lot of people aren’t clued up with the system or the terminology or how it actually works. So I think that’s how they get away with it, might, you know, and these, I, Keith Williams is the big player in this game and I, I’ve heard in the grapevine from quite a few people that he’s taking cash from people and then he’s got so much cash he doesn’t know what to do with it.

[00:32:26] Danny de Hek: So it’s literally turned into money laundering, hasn’t it? So I, you know, I just don’t, the way your friend had to handle the money when you were dealing with another company, theoretically he should have either been showing you on a screen share where to deposit the money, you know, and I’m not sure how Luna Pay works and I’m not sure how he managed to, cuz that crypto wallet key, no one knows where that actually goes.

[00:32:51] Danny de Hek: It could be anyone’s, couldn’t it? Yeah.

[00:32:55] Colin Veeran: You see that that account is basically, it’s like a banking account basically. Yeah. You know, where the money gets transferred into the account and you withdraw it. That’s basically, it’s

[00:33:08] Danny de Hek: what it all, I honestly don know how they go about doing it, mate. So I don’t understand why your mate would be grumpy with you if you went direct.

[00:33:17] Danny de Hek: Obviously he stopped paying you guys so he stopped paying you because always is ran outta money or he, he’s losing money himself. And I, I’m pretty sure that you could, you know, it’s like asking a, somebody to help you set up a bank account, isn’t it? And then you go to the bank directly and the bank says, Oh who are you?

[00:33:39] Danny de Hek: And you go, I’ve got an account with you guys. I like to withdraw money. Well, it’s just money. I suppose we should, no real reason why I need to use the paid the person to help me withdraw the money when I, I can go direct to the bank myself. I mean, why would somebody get grumpy with that? Yeah. Yeah. So, I mean, I don’t know.

[00:33:59] Danny de Hek: Yeah. And you personally like this money you’ve obviously invested in cash and that hasn’t gone well for you? Well,

[00:34:08] Colin Veeran: I made the withdrawal, but it’s still pending.

[00:34:10] Danny de Hek: Okay. So you’ve done cash effects.

[00:34:15] Colin Veeran: I’m just, I’m just like wanting my money out of it. So I did a complete withdrawal, so I’m not reinvesting in, in cash effects.

[00:34:22] Colin Veeran: So the money that I’m, that I’m wanting out at, I think it’s about a thousand dollars.

[00:34:29] Danny de Hek: Right. Have you looking at any other investment opportunities at the moment? Well,

[00:34:38] Colin Veeran: you know what? I’m so skeptical after this episodes, you know what, what cash effects and hyper I bus. I, I, I would be skeptical.

[00:34:45] Colin Veeran: You

[00:34:45] Danny de Hek: know, I think you should be more than skeptical. I think you should just realize that anything to do with crypto investments, anyone that’s asking you to put your money into a crypto wallet is just going out the door, mate. I mean is, I mean, I’ve, I’ve got 50 crypto opportunities in a list and I, I did a video and I went through all of them to show people.

[00:35:08] Danny de Hek: You know, how many other like-minded opportunities there are out there? None of them, All of them are, I mean, even if you just used HyperVerse, which is the one I’m more versed on. I mean, what they’re promising people is they’re building, becoming part of the metaverse and they want people to be part of the ecosystem and it’s, you know, they want a community.

[00:35:31] Danny de Hek: So they’re actually, instead of paying advertising to promote it, they decided that they’re gonna get their community members and give them three or four times their reward just because they’re a member of this new universe. Sorry, Danny, are

[00:35:43] Colin Veeran: you part of the as well?

[00:35:46] Danny de Hek: No, no. I, I’m nothing. I’m hate the bastards.

[00:35:50] Danny de Hek: So, , the a friend of mine that I haven’t heard from, from four years, we were actually looking for a house to. And we got to be in the cover of the newspaper here locally. And, and one of my friends saw it and he said, Oh, look, if you, if you’re still renting a house and you wanna buy a house, you should, I’ll pick you up on Wednesday night and I’ll take you to this meeting.

[00:36:11] Danny de Hek: And I said, What? And he is a multi-leg market. And I said, What are you promoting? And I’ll finish up being HyperVerse. And I said, I can’t believe you’re trying to get me in a Ponzi scheme to lose my money. . Oh, it’s not a Ponzi scheme, it’s a retirement fund. And he’s still promoting it as far as I know today.

[00:36:28] Danny de Hek: And so once he did that, I’d started doing videos ex you know, proving that this is a Ponzi scheme and it’s not legit.

[00:36:35] Colin Veeran: So he still optimistic that this is going to come, right?

[00:36:39] Danny de Hek: Yeah. And then I found the guy that introduced him to it. Now he, he Rick Tarnu, he’s a guy that’s he’s meant to be a chairman of Naar Naar, who’s a really big organization here in New Zealand.

[00:36:52] Danny de Hek: And this guy’s been promoting Ponzi schemes all his life and multilevel marketing, and he’s friends are there. So I did a video just exposing him the other day. So he’s threatened to come around and he wants to, he said, If I don’t take the video down, he’s gonna come around and do terrible things to me,

[00:37:10] Danny de Hek: So I’m going, Well bring it on, brother. But no, I can’t stand people that promote these schemes because they’re just telling lies to get people’s money and they’re just profit sharing and rowing about building their own down line. And all the guys at the top are taking out all the money. So if they believe what they’re selling, they should leave their money in.

[00:37:26] Danny de Hek: But they’re not every single one of them have made millions of dollars. All these v p fives, I mean, I got a guy that recruited 200 people. He’s made $200,000 US out of recruiting 200 people. And he said he just, you know, told it to a few friends and then, and then everyone else is, he’s got 6,000 people in his down line.

[00:37:47] Danny de Hek: And he’s disgusted now that it’s a Ponzi scheme, but in the meantime, he’s taking $200,000 out of it and he’s one of the small guys.

[00:37:54] Colin Veeran: Yeah. Yeah. But what, So so, so then what, Okay. Once again, the, the question is what do I do now? You just don’t just be

[00:38:06] Danny de Hek: optimistic. Yep. You don’t invest in any other Ponzi schemes and don’t get involved in crypto investments.

[00:38:14] Danny de Hek: That’s the best advice. You’re, you know, like, all,

[00:38:19] Colin Veeran: Well, I caught my years now I’m not gonna invest anymore in, in, on this, basically is if I can get my money back out from, from I, which seems to be a, like a very remote possibility. Yeah. But you

[00:38:34] Danny de Hek: well, everyone wants their money back, mate, don’t they?

[00:38:36] Danny de Hek: Everyone wants their money back, you know, like, I mean, it’s, it’s like a shop’s, a bank’s been robbed and the robbers are coming and lood all the money, and they’ve come and dressed as sheep, but they’re actually, and now they’re telling the people that are part of that bank that there’s an opportunity that these wolves are gonna come back and pay the people they stole from

[00:39:06] Danny de Hek: You know,

[00:39:09] Colin Veeran: you did make a lot of sense in what you’re saying, you know, like initially when you said that they’ve taken the money out. I mean, where did they get the money to come back into the account and pay the people?

[00:39:20] Danny de Hek: Yeah, I mean, I’d love to have an op, an opportunity, not an opportunity. I’m, I’m not ever gonna give anyone an opportunity.

[00:39:28] Danny de Hek: I’d love to have a solution. You know, and as. They just keep painting this picture of hope. Cuz I, I used to be in a religious cult and they used to tell us that we were all gonna live on a paradise earth forever. And all the bad people were gonna be wiped off the earth. And I used to sit there in the audience listening to these ministerial servants and elders and bethle people telling us these stories that I truly believed.

[00:39:53] Danny de Hek: And I go into these Zoom meetings and they’re telling everyone to be part of a, who doesn’t wanna be part of a community. There’s a lot of lonely people out there who like being part of a community and here’s a community that all have a common interest. They like making money. And as soon as a newbie turns up in this community, everyone welcomes them and gives ’em big hugs and high fives and, you know, and people go, I love this community, but no one’s talking about this money that they’ve put in.

[00:40:21] Danny de Hek: Everyone that I look at these Zoom meeting have invested money. So they’ve got an interest to be there. And then no one’s saying, Well, when do I get my money out? Because they don’t wanna upset the community. That seems so positive.

[00:40:34] Colin Veeran: Yeah. So, So you would say that if I could get my money out, try and grab it as quickly as possible if I had to get it out?

[00:40:43] Danny de Hek: Yeah. And this is the part, I mean, give you another example, mate. I used to be this is a, an illustration. I used to be in prison and it used to be in a jungle and I managed to escape once. And I remember climbing through the wire in the fence and I’ve been in there for five years and it wasn’t a bad prison.

[00:41:04] Danny de Hek: But anyway, I got out, no one knew I had escaped and then, I’m, I’m walking fast, not really. And then all of a sudden the lights come on and the sirens go off and they realize that I’ve escaped. So I better start running. So I’m running for my life. Next thing I hear dogs barking. I see spotlights. I, and then I hear people getting closer to me and I look behind me and there’s a guy running real close to me with a machete, and he is trying to catch me and catch me down.

[00:41:32] Danny de Hek: And I’m running, I’m pounding. My chest is pounding, and I see you clearing. And I run through this clearing and I’ve actually just ran off a cliff and I’m falling. And, and then I’m thinking, Oh shit. I’m in a real bad state now. And then I, I managed to grab a, a tree and I grab onto a branch and I’m hanging another, this branch for dear life, and I can’t hang on anymore.

[00:41:55] Danny de Hek: And then I look down and I’m half a foot off the ground. And that branch that you’re hanging onto is called Hope. And you’ve been through an ordeal. You thought your life was, you know, your money was gone. But what you really need to do is let go of that hope, because that hope you’re putting all your energy, all your thoughts into that one branch, and you just need to let go of your money and walk away from this stuff.

[00:42:23] Danny de Hek: And that, that’s what keeps you involved. So when you say, If I get my money, you still, you know, like even, I mean, who wouldn’t, Well, I mean, who wouldn’t delete their account with HyperVerse? No one, because they’ve got you by the balls. You’re invested, you’ve put money into something, it’s real money for you.

[00:42:44] Danny de Hek: And then they’ve wipe that slate clean and then you are hoping that they’re gonna come back and put it back. And cause of all the technology and the, you know, the crypto knowledge and the, the high tech talk and the Mr. Hs and stuff like this, you, you are bamboo at a wee bit with the technology and you’ll put your hand up like everybody.

[00:43:06] Danny de Hek: And they’ll say, I don’t quite understand how it all works in the blockchain. And, and that’s how they’re doing it. And that’s what, that’s a smoke screen. You know, at the end of the day, they’ve told you it’s not an investment. You’ve invested your money, they’ve promised you a return on your investment, which I’ve relabeled as rewards.

[00:43:25] Danny de Hek: And and then when you talk money, there’s, Oh, it’s not money. I’ve, I’ve been in Zoom meetings with Keith Williams and said, Had you steal money from people? And he goes, Oh, no, no, no, no, we don’t. We have crypto and we don’t pay out money. We pay out rewards. And they, that terminology down to a pat for a reason, you know?

[00:43:46] Danny de Hek: Yeah,

[00:43:47] Colin Veeran: yeah. It’s very actually pointless me even talking to Keith Williams because I mean, he’s, to tell me he is very optimistic about it and just hanging there. He was probably gonna tell me,

[00:43:59] Danny de Hek: Oh, mate, I’ve I’ve been messaging Kish Patel, Mate . So when Keith Williams become the global sales representative, I don’t think he knew about it.

[00:44:09] Danny de Hek: So I sent him a picture and said, How silly is Keith Williams sticking his neck out in, in a trucking block? So Kish comes back and basically says that the people that are in the community, he’s still lying to them and he couldn’t do it anymore. And I thought, God, only, you know, and you think, Oh my God, but he’s off point, another Ponzi scheme.

[00:44:30] Danny de Hek: So and the other day I’m actually working with a reporter at the moment for the last 10 weeks, and we’ve, he’s put in a story together about me busting these, these Ponzi schemes. And the problem that he’s having is he, he wants to find the person that’s taken all the money. And I said, Well, it’s, you know, it’s at least 500 VIP five s who have taken the money.

[00:44:50] Danny de Hek: How do you, how do you wrestle all those people together? I mean, who you know, you know, And then who’s got the money and where is the money? You know, and who did they steal the money from? Oh, well they’ve taking $300 off this person and 800 off this person. You know, it’s just a mess. So it’s a very clever Ponzi scheme.

[00:45:10] Danny de Hek: Yeah. And Keith Williams, he,

[00:45:12] Colin Veeran: you So I, I, I would say I, I mean, I’m very, very much distressed at the moment. I mean, you know, it’s like, I think about it every day. Look, it was, it was the spare money that I had. Now I’m with Yeah. You know,

[00:45:31] Danny de Hek: I feel for you. I, the guy I dunno if you watched the video, Mike Lucas, he you’ve got Cal Patel doing videos.

[00:45:39] Danny de Hek: One week before I interviewed him and he said what did he say that pension funds were just a Ponzi scheme. The government has been running a Ponzi scheme because everyone pays into their pension fund and there’s more money going out than going in. So people lose credibility of all the scare tactics or other things that’s happening.

[00:46:03] Danny de Hek: So this guy might lose, had Withdrawed, there’s money out of his pension fund, which was 25,000 US dollars and invested into HyperVerse hoping that within 600 weeks he’s gonna have $75,000 to put back into his pension fund. So, you know, and he’s hoping that he’s gonna get his money out. And he said he, he can’t, he’s 61 years of age and he is already on a a disability benefit.

[00:46:30] Danny de Hek: Sorry. And that was his, Yeah, his retirement nest. And it wasn’t very big, but it was what he is gonna retire on. Yeah. He asked me the same question, mate.

[00:46:41] Colin Veeran: Yeah. So, you know, I’m, I’m really, really disappointed at this point in time as I speak to you. You know, I really don’t know what to do. That’s why I’ve turned to you.

[00:46:50] Colin Veeran: I’ve, I’ve seen you on YouTube. I’ve, I’ve seen the videos, some of your videos and stuff, and I thought maybe you might be the best person to talk to. Look, I’ve got some or clarity on the look. It’s basically, it’s a point scheme and you know, there’s, there’s nothing much I can do about it, you know, just a bad investment investment on my side, you know, and

[00:47:19] Danny de Hek: I should learn from that.

[00:47:21] Danny de Hek: Well, it’s a hard listen to learn when people steal your money, mate. Yeah. Do you, So, I dunno, do you wanna help other people who are investing at the moment? Sorry? Do you wanna help save other people? That are investing in Hyn Nation at the moment? What, what?

[00:47:41] Colin Veeran: Oh yes. I would definitely people

[00:47:43] Danny de Hek: not what, Yeah, what message would you tell someone who’s considering getting involved in hibernation?

[00:47:50] Danny de Hek: Don’t

[00:47:51] Colin Veeran: even waste your time. It’s just p scheme anyway. So, you know, they, they’re gonna promise you a lot of things and it it not when the material is Yeah.

[00:48:01] Danny de Hek: So, so that’s, if I could

[00:48:04] Colin Veeran: put a lesson for me, you know, I mean, I got caught and look at it now, I’m just trying to get my money out.

[00:48:11] Danny de Hek: Yeah. And the worst thing about HyperNation going forward is that people in HyperNation, the lady, if you go to my YouTube channel, at the top right hand side, there’s a link that goes off to Odyssey.

[00:48:25] Danny de Hek: Now Odyssey is like a YouTube channel, but they don’t, you don’t get told off for what content you put on there. So I’ve uploaded a video of this lady, I’ve gotten her name. And basically she said that she’s bought a 10. She told, she convinced her husband to buy a $10,000 purple nft. So they’ve, even though they’ve lost a lot of money in HyperVerse, she’s now convinced her husband to buy a $10,000 nft, which means that she can build a team and get those high rewards now that she’ll be out there recruiting people like yourself to invest.

[00:49:07] Danny de Hek: Now, unless you start recruiting or you’ve bought a purple, purple, NFT is gonna be very hard for you to get you know, a commission from referring people into it. So, so what they’ve basically done, they’ve got the sales team and they’ve made them invest more money into HyperVerse, which is basically a cash grab.

[00:49:28] Danny de Hek: These people that invested $10,000 are now gonna hang onto it like a bone, because I’ve literally, this lady basically said she’s mortgaged her house to get the money. They are hell bent at lying, cheating, stealing, convincing people like yourself that it’s a good thing to invest. But the reality is they don’t wanna lose their $18,000 investment.

[00:49:49] Danny de Hek: And yeah, those same people have made, probably a lot of them have made millions of dollars already from HyperVerse. And now this is a rinse and repeat, and they’re the ones that are gonna make the money. So all you can do is if you have 300 ran, you are hoping that you are just gonna get 900. These guys are hoping to build a team of people and they’re hoping that they’re gonna get, you know, million US, 2 million us, because they’re recruiting people and they’ve done it before, so why can’t they do it again?

[00:50:19] Danny de Hek: So it’s a very violent. The thing they’re about to rinse and repeat and do again. And that’s why I’m trying to get in early. Like yesterday there was a Zoom meeting with about 90 people in it and it’s HyperNation are running these meetings. 90 of the people in the Zoom meeting isn’t many considering what they have had.

[00:50:38] Danny de Hek: And you can just about guarantee that 60 to 70% of those people are already invested and they’re just in the crowd chanting people who are new that it’s a good thing to get involved and every, you know, because they’re all invested, you know, it’s just a, once you’ve got skin in the game, the audience just changes.

[00:50:56] Danny de Hek: You know, the enthusiasm in the audience, you do you understand what it, the techniques they’re using just make me sick , to be honest. Yeah.

[00:51:06] Colin Veeran: Yeah. It’s just so

[00:51:07] Danny de Hek: frustrating, you know, Single mate. You married, have you got kids? What, what about you personally? Like

[00:51:17] Danny de Hek: clientele, mate? You know, that’s,

[00:51:22] Colin Veeran: Yeah, I’m just down to nothing at the moment. You know, all my, all the spare money that I had, I invested in I perverse, you know? Yeah. Yeah. So I’m

[00:51:35] Danny de Hek: down to nothing. Are you, how’s you state of, how’s your state of mind? Like like do you have suicidal thoughts?

[00:51:46] Colin Veeran: Eh, sometimes. Eh, sometimes because I dunno what to do.

[00:51:50] Colin Veeran: Mm-hmm.

[00:51:52] Danny de Hek: Yeah. Have you got friends, like, have you, I mean, this is massive mate. Don’t underestimate what’s just happened to you. Yeah. I mean, you know, like you, you know, like somebody’s just literally coming stolen your, what you’ve worked your life for, like, you’ve worked at the airport or security, did you say?

[00:52:12] Colin Veeran: No, no. I, I worked at the flight,

[00:52:14] Danny de Hek: Flight center. Right. And that’s basically your retirement redundancy, isn’t it? Yeah, yeah, yeah. Well feel for you, mate. I mean, I, you know, like as I said to Mike Lucas, I mean I’m, you know, like all these people like, you know Keith Williams who’s theoretically saying that they’re blessed by God and, you know, and in a good, like the new position that Keith Williams has got, he reckons God appointed him it

[00:52:41] Danny de Hek: So if they’re good law you know, if they really are, you know, followers and believers of you know, God, then you think they’ll do the right thing and help people like yourself, but they don’t. They just keep withdrawing the money they can and run off with it. I mean, I was just thinking if you wanted to help other people, what would really work is, let me use this sort of this recording to actually warn other people.

[00:53:05] Danny de Hek: How do you feel about that? So you say that again? So if you wanna help other people who are sitting on the fence thinking, Should I invest in hibernation? I mean, now if I can use this recording of us to, you know, warn other people, then that’s where I really see the value in having a chat. Which, you know, I mean, it’s, but a lot of people are worried, you know, about their identity or, you know, the fact that they might forfeit the fact that they’d get their money back.

[00:53:34] Danny de Hek: But the reality is it’s just you know, that’s that hope that they ask people to hang onto, isn’t it? Yeah. Yeah.

[00:53:42] Colin Veeran: But the thing is Danny the problem is right now I wouldn’t even advise anybody to get it because I’ve, I’ve been caught with a Ponzi scheme and I definitely don’t want other people to get involved in this again.

[00:53:57] Colin Veeran: And I definitely wouldn’t involve myself in any other Ponzi scheme again, if I can just get my money out and I walk away quietly. And that’s it.

[00:54:06] Danny de Hek: Yeah. Well that’s not gonna happen, mate. I mean, I, I’d love to be able to say to you that you think about, you know, like there’s a few other facts that make it impossible.

[00:54:17] Danny de Hek: The fact is they’ve been promising to give one times rewards back to people for at least four or five months. Not one person has received any of the money back to date. You know, and obviously there was be, like I said, there was a big trans transaction where somebody stole all the loot out of it could have been Ryan J who knows.

[00:54:40] Danny de Hek: And then I reckon, you know, there’s so many theories on it. Oh, mean, I reckon that HyperNation is a completely different entity altogether. Yeah. You know, and, and, and the only money that’s going into the system at the moment is going into HyperNation, you know, and there’s people doing withdraws in HyperNation already.

[00:55:03] Danny de Hek: So what does that tell you? It’s working well, it’s working and building credibility and the people that are withdrawing just taking back drip, feeding the money that they’ve already invested back in. So if you put 320 random and you can take out a hundred thousand dollars and you’re thinking, Oh, great, you know, wait until I get my 900 out or my million ran is what you would’ve been going for.

[00:55:30] Danny de Hek: Then you are just, you’re sitting there chanting it on and you’re also telling everyone else at the, in the meantime that it’s great because you want this, you want it to be sustainable and stay afloat. So, yeah, you know, and then you’ve got like cashing, Was it real good one? Because a lot of people, what they

[00:55:48] Colin Veeran: may, the only one I asked you is these people like Keith Williams and stuff like that, are you in constant contact?

[00:55:55] Danny de Hek: They hate my guts mate. . I mean, I, I, I send the messages and I know they, like, I’ve, I’ve chatted to Keith Williams about, we’ve had about 40 text chats together and I’ve done it via LinkedIn. So I chat him on LinkedIn, but anything to do with Telegram or WhatsApp, he doesn’t reply to me. And initially he was reading my messages, so I, I put videos of him online and then I send him a message to the link of the video and I jumped into a leadership training meeting just yesterday.

[00:56:31] Danny de Hek: And when I got in there, they knew who I was. And Jackie Homes, whatever name is kicked me out, said, Oh, it’s Danny De Heck. And then they kicked me out. So no one likes me there and I’m not helping them, or it’s not a Danny versus HyperVerse sort of tug of war. It’s me and a bunch of people are, Got YouTube accounts trying to create warnings to people and or you know, we’re trying to say, Look, your story is more valuable than anything mate, because you are a normal person that have listened to these leadership sorry, listened to the Zoom meetings.

[00:57:12] Danny de Hek: Listen to a friend who introduced you to it, made an informed decision with the facts that they gave you. And then you’ve got someone who’s telling you all about it, showing you how well they’ve done, and then you’re thinking, Oh, well if he’s done it, I’ll do it. All the crypto jargon that they use, I bet you don’t understand it now, I bet your mate doesn’t understand it either, and because it’s so complicated and he’s done it, you just walk in a straight line and follow.

[00:57:41] Danny de Hek: And then you might as well go large like you did. I mean, you didn’t put 300 ran in, you put 300,000 ran in, you know, because, you know, you the thought of being, you know, everyone likes investing money mate and making money. I mean, I’m not, you know, So, Yeah.

[00:58:04] Colin Veeran: Yeah. So, so it’s, it’s, it’s actually, it’s coming down to nothing at the moment.

[00:58:11] Colin Veeran: It’s just, I, I should just hope and pray I get my money out .

[00:58:17] Danny de Hek: Well, yeah, being part of a religious cult in the past, I don’t think praying is gonna help. Cause God theoretically just appointed Keith Williams, the global sales representative. Yeah. No, no. Sorry mate. I thank you very much for your talk. Yep. No, that’s right.

[00:58:37] Danny de Hek: Can I use this and help others mate? Sorry, can I use this recording and help others?

[00:58:47] Colin Veeran: Not sure about that. Then

[00:58:49] Danny de Hek: why not? Do you want somebody to, to it as well, or do you think your message can help others? I don’t wanna

[00:58:59] Colin Veeran: be exposed you.

[00:59:01] Danny de Hek: Yeah, Well exposed for what?

[00:59:04] Colin Veeran: I mean, like, I, I, I, I don’t want people to say, Hey, I know that guy and, and you know, Okay. No, no, you can use it. That good one. You

[00:59:13] Danny de Hek: can, Yeah.

[00:59:16] Danny de Hek: It really, I mean, that’s gold to me because it, it’s basically you’re just the perfect, you know type of person. I mean, you, you’re single. You how, how old are, Do you mind if I ask. 57. 57. So from Mike Lucas, 57, Mike Lucas, the last guy I interviewed, he was 61 years of age and he was thinking about his retirement.

[00:59:43] Danny de Hek: I’m 52, so you know, it’s a, Yeah. Hey, if you, if you do need someone to talk to and you are feeling down, you know, feel free to reach out to me. You, there’s a, a group that we have called Ponzi Scheme Busters. Do, do you hang out on Telegram?

[01:00:03] Colin Veeran: Yes, I do have

[01:00:04] Danny de Hek: Telegram, Yeah. All right. So I’ll give you a link to my telegram group and we’ve got a nice group of people there.

[01:00:12] Danny de Hek: That’s, it’s all, I run the whole lot. So no one’s going to try selling you anything. But they are people that keep me in the loop of what’s happening. So if you look in the chat box now, you’ll see a link. And going there and, and there’s some really nice people in there that if you just say that you’ve just been chatting to Danny then you’ll, I’ll, I’ll welcome you anyway.

[01:00:38] Danny de Hek: Yeah. But you know, like all the big people in this game, I’ve been chatting to them as well. And as I said you know, the newspaper guys been working with us for the last 10 weeks, so hopefully we’ll get some more awareness out there. And that, that’s really the, the, the trick to what we’re doing here, mate, is making people aware.

[01:00:56] Danny de Hek: And if there is an opportunity to get your money back, honestly, you’ll be the first to know. Yeah.

[01:01:04] Colin Veeran: Would you be the first to

[01:01:05] Danny de Hek: know, Wow, I, I got outta bed at quarter past 12 last night and uploaded a video telling everyone that they’re promising that they’ll get their money back in three weeks time.

[01:01:15] Danny de Hek: And it, you know, I mean, I mean, do I wanna listen to a bunch of thieves? Giving guidance on how they’re gonna give back the money they stole. I mean, it’s, I, yeah, well, I think I would be one of the first to know definitely , because I’ve, the thing is like in these groups, I mean, I’ve got 60 people in my Ponzi scheme, Buster Group, and now I’ve got another group, which is called Scam Busters.

[01:01:41] Danny de Hek: There’s 300 people in that one, and these guys have been fighting these things for five years. And anything that goes down that’s big on the internet, we get notified and then we go out investigating it. I mean, one

[01:01:54] Colin Veeran: would be able to pop me an email, should you Yes. Something about it.

[01:02:00] Danny de Hek: Of course. Yeah. No, well obviously stay tuned to my YouTube channel.

[01:02:03] Danny de Hek: But No, definitely. And I, I mean, if I do a video, I won’t put your your contact details on there, but, Oh, now there is something else to be wary of. There is a company that’s out there claiming they can get your, Your money back and they keep posting on my YouTube channel that if you search for such and such on Instagram he will help you get your money back.

[01:02:26] Danny de Hek: Now they are total scammers. I’ve done that and asked them for help and tell them I’ve lost my money. But they want you to pay them money in crypto to buy software to unde, decipher your undecidable crypto key, and then if they get your money

[01:02:43] Colin Veeran: route,

[01:02:54] Colin Veeran: YouTube. And I found these people, people said that thank you very much for assisting me, and we managed to get our money out and

[01:03:01] Danny de Hek: stuff like that. Yep. So I get 50 of those spam light comments on my YouTube channel every day. And I delete mine every day. And I’ve wrote to YouTube and said, Can you stop these people posting this shit on my channel?

[01:03:15] Danny de Hek: And they go, No . But they I’m rampantly deleting them and the reason I delete them is cause people see them on my channel and they think that I’m endorsing them by if I leave those comments. So I’m quite diligent. There’ll be a couple on there now cause I haven’t cleared them yet. It’s about what time is it now?

[01:03:35] Danny de Hek: 10 o’clock in the morning over here. So yeah. Just don’t fall victim to that. Cause that’s scamming the people that have been scammed. Number two, mate. Yeah. Stay. Yep.

[01:03:50] Colin Veeran: Just, just wanted to tell you that I already appreciate your talk. It was very comforting and stuff like that, you know? Thank you. You, Yeah.

[01:04:00] Colin Veeran: And you know, I’m really in fact You gave me a little bit of hope earlier when you said that in three weeks time to get the money out, and then after that, when you told me that it’s, it’s mo mostly for people that Evan were done at all. Yeah. But then they’ve been promising for a long time. They, they’ve been promising that like, like, like maybe big enough last, I mean, end of last year they’ve been saying like, you know, you gonna get your money out or everything’s gonna come.

[01:04:31] Colin Veeran: Right. It’s all, it’s just a total awash. Yeah. As far as I’m

[01:04:36] Danny de Hek: concerned. And it’s worse than that mate, because think about how many people would’ve invested and never rebid and never took any money out. There’d be very few people that just threw their money in there and never touched it. So, and yeah, let’s just say they decided that just to keep this Mickey Mouse.

[01:04:59] Danny de Hek: Company going as long as we can, we actually are going re repay those people. I mean, it, it’s a $4 billion scam. So let’s say they put 10 million into repay that demographics of people, you know, it’s just gonna give people false hope. People like yourself. The first thing you’re gonna go, Well, I, I’ve, I haven’t got my initial investment back.

[01:05:21] Danny de Hek: And they go, Oh, but you have taken some money out. So you’re in a different level. Yeah. Yeah. I, I, I, I’m a, I’ve hacked into people’s computers before who have tried scamming me. You know, the first thing I tried doing is deleting their hard drives. I mean, I’m not the nicest person to piss off on the internet.

[01:05:41] Danny de Hek: And when I was new to the internet 20 years ago, I could literally hack into a hacker’s computer. And technology’s changed and VPNs, it makes it a lot harder now. But these, these guys, I often sit there and think, Now, what would be my next strategy? If I was them, how would I keep this community going as long as I can?

[01:06:02] Danny de Hek: Let’s pay back 10 people of influence. So, you know, when you’re watching these launches and they have these competitions and people win the prizes, they, people who won the prizes last time were only gonna be given the prizes if they did a promotional video endorsing HyperNation previously. Yeah.

[01:06:24] Danny de Hek: With HyperVerse, they did the same thing and the people that won those prizes had to do videos endorsing the company to get the reward. It’s all rigged. Yeah. So if anyone’s going to get paid out money, I’m pretty sure that they will find people who have the biggest mouths and they will pay them back their initial investment knowing that they will spread the word that they got their money.

[01:06:48] Danny de Hek: And that will rumble through the community as they’re paying the money out. And instantly they’ve just got three or four more months grace from these people that they’ve stolen money from , you know? And it’s not rocket science really, you know? Yeah. I mean, what have you got, you know, like, I’m, I’m worried about your, your mental health here, you know, because you’ve lost a lot of money.

[01:07:13] Danny de Hek: Is there something else that you can focus on? Like, have you thought of starting a, like are you working at the moment? No, I’m not. Right. So is there any reason why you couldn’t work?

[01:07:29] Well

[01:07:30] Colin Veeran: I’ve taken my early package early retirement, right. At, at, at 55. Right. You know, and they opened and I took. And then now I’m sitting with nothing.

[01:07:45] Colin Veeran: The only income that I get every month is from, from my annual.

[01:07:50] Danny de Hek: Yeah. And you’re the perfect clientele. That’s exactly the people that are taking money from the, the retirement money you see? Yeah. Yeah. What about getting some sort of like part-time job or doing some community work or something like that just to keep your mind focused?

[01:08:08] Danny de Hek: Because if, you know, like I used to run social clubs and I actually had two people, you know, take their own lives. And one of them didn’t get found for I think two, two months. You know, because they had no friends and they were isolated. You know, I’m not saying that’s your ordeal, but a lot of lonely people out there really struggle with, you know, having friends around them.

[01:08:32] Danny de Hek: And that’s why, you know, these communities online are quite comforting. And obviously we’ve just had covid as well. And I’m sort of thinking that it might be a good idea for someone like yourself who’s had a, a real ordeal. You’ve lost your money sitting at home alone. Maybe it’s a good idea to get out there in the community and do something over in charity or find a part-time job so you’re around people.

[01:08:56] Danny de Hek: Well moment, you know, to get something

[01:09:00] Colin Veeran: it’s bit difficult. You know, It’s a bit difficult. Yeah. All right. You know what, thank you very much for your insistence for your

[01:09:08] Danny de Hek: talk. I really appreciate it. No, it’s nice talking to you mate, and thank you for helping other people by speaking out. I really do appreciate that.

[01:09:15] Danny de Hek: Yeah.

[01:09:16] Colin Veeran: As I said to you, if you got any information, just pop me in email, you know, like regarding any news about HyperVerse. Yep. That is, if you the first to know.

[01:09:27] Danny de Hek: Yeah, yeah. And I’m sorry mate, but you try not to hang onto that branch. You know, when you look down the brun, you know, you’ll, you’ll feel free.

[01:09:38] Danny de Hek: Yeah. You know, and it, you know, like, I mean, don’t shut your account down. There is miracles, but you know. No good stuff mate. Yeah. Alright, Thanks a lot Dave. Free toes me whenever you like. Alright. Okay, cool.

[01:09:56] Colin Veeran: Thanks. Bye. Hey

[01:09:57] Danny de Hek: dude, bye.

[01:10:00] Colin Veeran: Day

[01:10:01] Danny de Hek: mate.

Leave A Comment