Facilitated by DANNY : DE HEK meetings are recorded for our Podcast, we’ve been doing this since COVID-19 if you’re interested in joining in with us check out our Website.

Transcribed by Otter

Danny de Hek 0:01

Heidi Hi.

Helen Oakes 0:05

Hi de Ho

Danny de Hek 0:07

Good morning. Welcome along to WHAT : DE HEK Podcast. Today we have elite six members. We’ve got an engineering guest, Brian Morrison all the way from Blackpool in the UK. Our first international guest we’ve got a couple of Aucklanders we will pass right by them. Well I’d like to do is just introduce who’s in the room today. Our topic is…

Helen Oakes 0:30

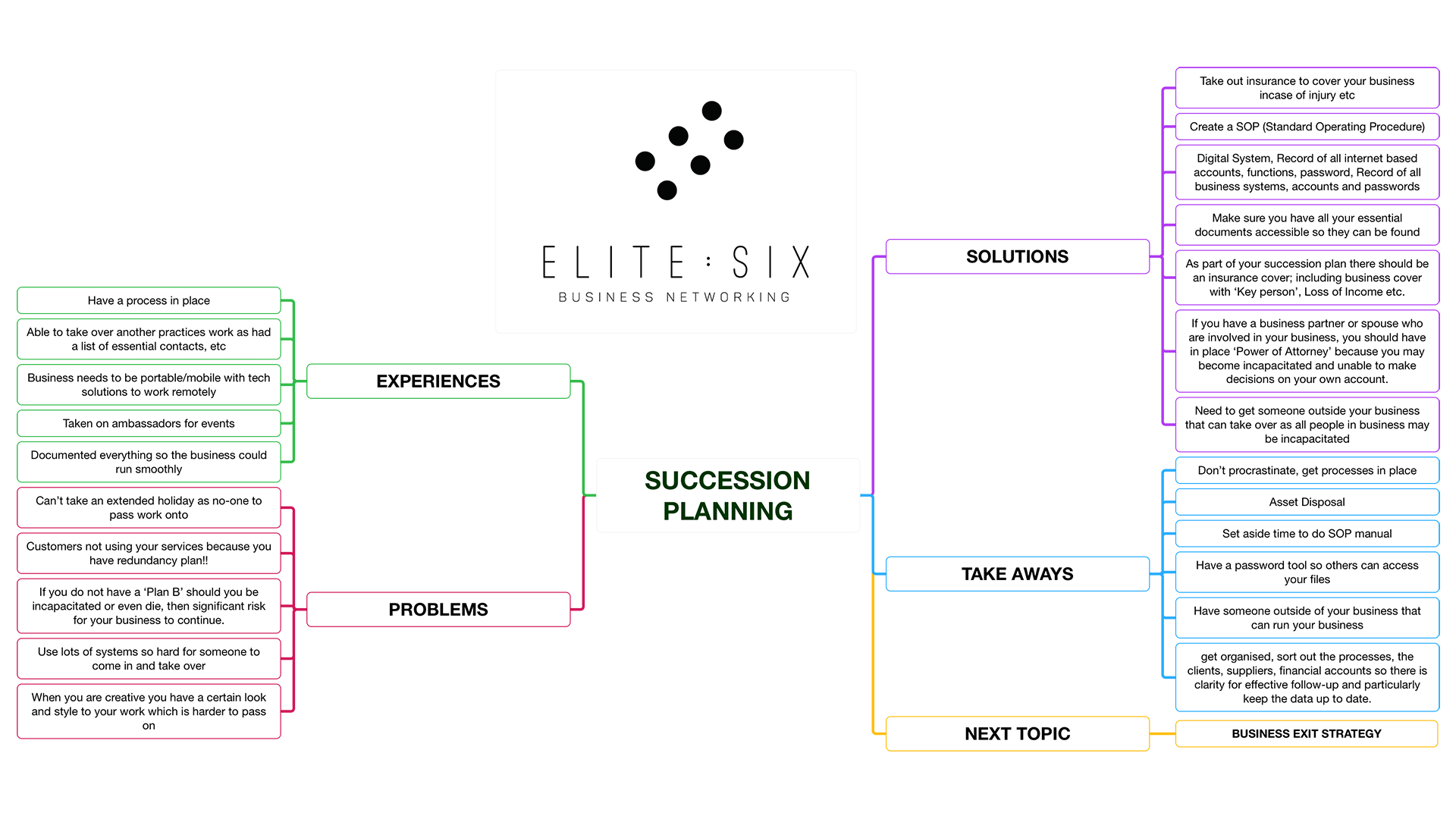

Succession Planning

Danny de Hek 0:31

Thank you couldn’t have done it without you. Now, a few few literary rules, we’ve got a checkbox at the bottom. If you’ve got any comments that you’re making, after you’ve made them, if you could just put them in the chat box below, then we’ll build our mind map that we use on our podcasts are only a podcast. We do use it on the podcast, but we use it on the blog after the show. So I really value you’ve given us your comments. Now everyone in the room has an elite six membership profile. So when you speak, I make it when people click on your name it goes through to your elite six membership profile. Now Brian, I set one up for you Just yesterday. So I don’t know if you’ve seen that. But it’s really cool. Surprise, you’ll be able to see it afterwards. So don’t give any details about who you are. So what I’m gonna do is just gonna go around the room and everyone introduce himself on my screen and top left is Rob.

Rob Woolley 1:21

Hello, my name is Rob on from Academy antiques in Academy training. I buy and sell and specialise in English porcelain. But I also public speaking how to overcome stuttering leadership and management.

Danny de Hek 1:35

Brilliant just for the carry on, I might just get down people to put the mic on mute if they’ve got background noise. Otherwise, just leave it open for now. So we’ll carry on. We’ve got Stefano, and Jaline, and nearly they’re halfway there.

Jaline Pietroiusti 1:51

Hey, everybody, so Jaline and Stefano from the odd wave. We are the e commerce specialists. We build ecommerce stores. And we do a lot of support and integration as well into different systems. So we do water wise, and look after three young girls that are keeping us extremely busy as well. At the start of school, but yeah.

Danny de Hek 2:16

And they are all at school now.

Jaline Pietroiusti 2:18

Yeah, they all in school.

Danny de Hek 2:21

We had really good attendance this week and a face-to-face meeting because I’m at school and Brian.

Brian Morrison 2:30

Hello, my name is Brian Morrison from the UK. I’m the founder of a company called BizSocial networking. We’re an online business networking community, communicating with the whole world. And what’s different about us is that the company was set up for me to continue my charity work. So we give away 50% of all our profits for people in recovery from addiction and mental health.

Danny de Hek 3:00

Good stuff mate that is nice I like that, I can’t give away my profit because I haven’t made any for a long time. Sound good David Clarkson save me.

David Clarkson 3:11

I’m from dynamic communication. We teach presentation and public speaking skills. We build more confident, more competent, more credible communicators. We also do some business training. And my the other string to my bow is that I run a Military Museum in Burnham in Christchurch we’re just out of Christchurch.

Danny de Hek 3:42

Brilliant. And you’ve wrote a book and would it be cooled off memory Dare to Deliver?

David Clarkson 3:48

Funny you should say that Danny yes?

Danny de Hek 3:50

Yes, that’s great book. I have actually listened to some of it. I can’t claim to read it because I have not read a book of my life.

Shaun Jin 3:56

Shawn is shown here from quality clean in Christchurch, New Zealand. Doing pest controls and nada poverty relatives. We offer a one stop shop for property management. And we currently doing the healthy home standard checks as well.

Danny de Hek 4:18

Brilliant. So basically anything in the house that’s moving that you don’t want Shaun will come in and kill it for you. Lachlan!

Lachlan McNeill 4:26

I’m Lachlan McNeill from a Acorva Technical Recruitment. I deal with I am a technical recruiter, I find engineers and architects for companies and they also help people with careers.

Danny de Hek 4:35

I need a new one.

Lachlan McNeill 4:37

Yes, right. You need a new shirt.

Danny de Hek 4:39

Hi, I’m gonna take this off in a minute.

Lachlan McNeill 4:41

No, nothing wrong with that.

David Clarkson 4:42

I leave the shirt on Danny.

Paul Starling 4:46

Hockey referee.

Danny de Hek 4:48

This is actually quite stylish look.

Lachlan McNeill 4:51

It is quite stylish. Danny. I’ll give you that.

Danny de Hek 4:55

For me, Right, Paul, Paul Starling. What

Chris Cameron 5:00

Were is your whistle.

David Clarkson 5:04

Don’t put up with any cheek Danny

Danny de Hek 5:07

No it ok, I can handle it. I get as much as I take and probably give a bit more Paul.

Rob Woolley 5:14

I am Paul from Rangiora and we run Canterbury Computer Services who specialise in looking at small businesses IT needs and as a sideline also do kiwisouvenirs.co.nz exporting Kiwi Souvenirs around the world.

Danny de Hek 5:34

Brilliant. So those little wee fluffy sheep now this might really make Brian get excited if you want a fluffy sheep. Paul has one of their funny sheep. You just let us know and Paul will send one your way. It’s probably gonna hole box of them there. Really good stuff. I’m about to ask my beautiful assistant here. What she does.

Helen Oakes 6:03

I’m Helen, I’m a Photographer and a digital creator. And I run some online stores, online businesses.

Danny de Hek 6:11

And we haven’t quite finished it. But if you go to helen.co.nz and you go down to his store, you can have a sneak preview of her new digital download store where you can download it and buy her art. We’ll do that later. But it’s we advert for Helen. I haven’t quite finished. We started doing it yesterday and then we started drinking wine. Got a bit off topic. All right, Chris, the best karate club in New Zealand spokesperson CEO

Chris Cameron 6:39

Chris Cameron from Shizoku Martial Arts (Karate & Self Defence). We educate, inspire and empower people to be their best providing martial arts education, life skill education and self defence workshops.

Danny de Hek 6:52

Not really good. It was that noise. Good. All right, Mark, come on. I know you’re on a holiday at the moment.

Mark Glanville 7:01

Yeah G’day guys

Mark Scown 7:03

Anyone who’s got the luxury of being on there I cook on beach as we speak. But get in mind you’re not really a Mark Scown insurance broker located in North Canterbury just out of Christchurch. My speciality is working with small businesses and individuals. And I guess my extra speciality is being able to preserve premiums for people over time to to provide long term affordability and sustainability through through doing a bit of a core of levelled options and things like that and potentially saving our clients. Several $100,000 over the term of the cover.

Danny de Hek 7:46

Good stuff so if you’re looking at getting insurances Mark been with us for a couple of years, at least I think you don’t get any award for it. Sorry, but

Mark Scown 7:54

Four long years now.

Danny de Hek 7:56

Jesus, I will remember your name soon, if you need insurances get Mark to look at them. Now. I didn’t realise we had two Mark in there. So Mark number two now.

Helen Oakes 8:08

Mark G. Yep.

Mark Glanville 8:09

Yeah Mark G. You’re right O. Well most of you know me. And I’ve been part of ELITE : SIX for I don’t know Danny’s three, four years, three years, maybe?

Danny de Hek 8:20

I don’t care. Obviously, I’ve got that wrong. I’m not gonna have a guess.

Mark Glanville 8:23

I won’t, I won’t count all the times I haven’t gone.

Danny de Hek 8:29

Other people will get ideas and copy it.

Mark Glanville 8:30

I know. I know. At any rate, I’m a funeral director. I’ve managed a funeral home in Sydenham. And yes, just great to be online. I am on holiday. And so sort of just thought I’d hop on and say G-day.

Danny de Hek 8:47

Na brilliant. Nice to have you here and what? Who I am I’m Danny de Hek . I’m actually the I started what is that at ELITE : SIX. I purchased a franchise eight, nine years ago and dissolved it. And now I run and facilitate business networking events myself. The good thing, which I loved about ELITE : SIX at the moment is we are getting a few people who are busy and are dropping into our meetings and are slowly coming back. And we’re actually quite, we’ve had a couple of people that haven’t seen for 12 months back in. So don’t feel because you haven’t been here for a while that you can pop in and say hello, because this is actually broadcasted live onto our Facebook, closed Facebook group. And if anything gets out of control, just delete it later on. However, we got a lot of people watching who don’t actually join in so it’s really nice to see a good number of people here. As I said, yesterday, we had a good 12 solid people in a face-to-face meeting and I just want to grow this little baby. And it’s good. So today’s topic is Succession Planning and I thought for a change I wouldn’t do all the talking or Helen perhaps and would let Rob facilitate the meeting. So we’re gonna do is we’re gonna share the screen, and we’re gonna see how our mate Rob, has a go. So can you see that On your screen there, Rob, and hand it over to you.

Stefano Pietroiusti 10:04

I can Okay, Danny, thank you very much. I thought you were kidding when you said it before, but we’ll get right on with the show succession planning. So first of all, we’re going to start off by Lachlan, because I think it was Lachlan’s idea Lachlan define succession planning for us.

Lachlan McNeill 10:22

Well, I think there’s two aspects of succession planning. But ultimately what it’s all about is having a process in place so that when you eventually move away from your business, that you have the results that you want, you have the that that’s essentially it. But the other part of it is, in terms of, even if you’re not planning to leave, if you get hit by a bus, the classic scenario is Do you have something in place that allows you not to lose everything? Or do to minimise the, the the, what’s the word that the disadvantages to that being hit by a bus? That makes sense.

Rob Woolley 10:59

Yes to minimise the disadvantage of being hit by a bus is really important.

Lachlan McNeill 11:04

Exactly right

Rob Woolley 11:04

So if you could not carry on with your business, Could somebody walk in tomorrow and take it over? So here we’ve got any experiences about when you either couldn’t work or you chose not to go on a holiday or whatever? And, and somebody coming in? And, and managing or taking over your business or not being able to? Mark? Do you even end up in a scenario where you want to go on a holiday Mark Scown? And if you go away, does he rethink shut? Yeah, you’re on mute, mate.

Mark Scown 11:45

Yeah, sorry. And my business, I can work remotely. So sadly, even when I go away, I’ve connected to my potential client base and existing client base. So I guess the the benefit of working solely individually, in my own company is that I have the freedom to do that. But you’re right, I probably couldn’t take an extended Well, no, on kainate, extended overseas holiday for three or four months. I guess I could maintain my clients, but I couldn’t generate new ones effectively. So potentially a difficulty there in that transition, if that was the case.

Rob Woolley 12:28

Excellent. Are there any other examples of when you have have gone away and everything is had to grind to a halt? Yeah, like the other Mark who who operates a funeral home? Yeah, like, how do you end up managing that?

Mark Glanville 12:49

Well, I manage staff. And so I have to make sure that the staff are there to operate the business while I’m not around. However, I’ve got other experiences where I was a local funeral director for eight years. And my job was to walk into the business and operate the business while the owners were on holiday. So very similar scenario, but it’s sort of ran the other way, where I was the one that was lined up to run the business. And what the owners of the businesses did is head down simple things in place like current phone number lists. So there was a list of phone numbers, people I could run to run the business. So all the contacts and connections that were required, by had on a very clear list of phone numbers, and that that was essential. Now the part of course, was having the access to the costings and products that were available to sell. And the funeral industry, they’re, you know, no brainer, sort of caskets, but then we’ve got cemetery contexts, and all just how everything works in a funeral home. So I just sort of pick up all that sort of stuff. And usually I only had half a day when I walked into a new business to learn everything about them. So I had to be organised. So I think it’s key to be able to walk away from your businesses to have that organisation ready to go. So it’s taught me to have good phone number lists, good pricing, good access to products and, and having someone that can actually walk in and do it too, which is half the battle.

Stefano Pietroiusti 14:42

Yeah, and I think I think you raised like another potential issue there with anybody who was new into the business. If you’re hiring anybody, yeah. like are they able to, like arrive in and learn the ropes? Where do they get the information from? Is that the Other people? Or is your list of villains, all of that information? Paul, you operate yourself? Do you have any employees? And do you have any succession planning?

Paul Starling 15:15

No, I don’t have any employees. However, almost two years ago, my wife was terminal cancer. So we basically documented everything. So I was going to be taking over the accounts. And it’s all written down. Anyone that needs to take it over, they can just take it all over.

Danny de Hek 15:41

You let that laps we bit now hav’t you, your let that laps we bit now, haven’t you?

Paul Starling 15:48

Most of it still documented, the only thing that I’m in the process of documenting now is the passwords. So if I kick the bucket, my kids can actually still get into all the systems and close the business down, so to speak.

Stefano Pietroiusti 16:08

I was wondering, you know, in the event of illness, so obviously, right, we got, you know, like a neat working programme here. And Brian has is one of the Brian, if you’re unwell, who, who runs the meetings?

Brian Morrison 16:24

I actually, I’ve noticed started taking on an ambassador for each of my networking events, who runs them on my behalf? If I am ill. All right, excellent.

Stefano Pietroiusti 16:40

Sorry, there is a public speaking trainer here. And most public speaking trainers usually work on their own Dave, if you had a cause to run, and you were unwell or late, do you have any processes in place?

David Clarkson 16:59

As I’m particularly fortunate in that regard, Rob, I’ve had my wife working with me now for about three years. And if I wasn’t able to function, for whatever reason, hit by a bus or something like that, and there was a course either about to start or in progress, then she would just be able to pick it up and carry on from where I left off. So I’ve got that cover.

Danny de Hek 17:25

I feel sorry for Bus drivers, I’m just want to put that out there.

Stefano Pietroiusti 17:30

Well, at least this morning, they getting a really bad rap, I do have this mental image of all of these people getting hit by buses, but you can’t we all put our thinking caps on and think if anything was to happen, if we did want to go away on a holiday, or if we were sick or unwell or injured or anything like that. Do we have any processes that people can walk in and do what we do? Or if we don’t have any succession planning at all? What are the potential problems of that?

Mark Scown 18:05

Yeah, I actually see that there’s two aspects here. One is when you’re taken away temporarily from our work, and we’re talking about a temp, or someone coming in, and picking up amazing manual set of processes to to conduct the business. But I guess the other side is the true sense of what the succession planning is. And that is when you are, you know, either retiring and you’re thinking about your firm either being wound up or sold as a going concern, or passed on as a legacy to your children or some other other party. So that’s, for me is where that succession planning comes. But equally, in my insurance game, when I’m working with small business people is, is the fact that if you get hit by the big red bus, or in our case, it could be you could get a green one. And then you actually what Insurance Solutions could you have. And many firms where they are co owners or directors have actually taken out insurance on each other. So that in the case of death, that there is sufficient funds in the pot aid to keep the business solvent or keep it going or have it in such a state that of solar bills are paid off. So consider it as a going concern.

Stefano Pietroiusti 19:30

Yeah, well, I guess, you know, we hadn’t actually thought that there are some times when there is no obvious successor. And so insurance is the only alternative. I just wondering as well. If if people were to create a succession plan or otherwise known possibly is a standard operating procedure for what they do. What do you think the advantages of that might be? Or the disadvantage If you don’t have one.

Helen Oakes 20:05

I think, Rob, the advantages would be that someone can just come and step in, and hopefully take over your business. If you didn’t have one, you could be without money. And yeah, without any sort of income and work interface, so it really pays to have some sort of isapi, I guess, what is the standard operating procedures?

Stefano Pietroiusti 20:32

Standard operating procedure? How about we have a show of hands of who actually does have a standard operating procedure or a succession plan? We’ve got 1 2 3. Well, kinda three and a half, we have three and a half or Lachlan’s a half or maybe once a quarter? I’m not too sure. So how, how about we played a mental exercise here, I considered that we were going to create one tomorrow. What do we think we might learn by creating one? Stef..

Danny de Hek 21:11

We don’t have one.

Stefano Pietroiusti 21:15

All servers procedure in place will actually make you aware of current processes, you can actually start identifying problems in place would actually help improve existing processes to something it’s really important. Absolutely. Shawn, if you were to create a standard operating procedure, can you imagine that there would be any advantage right for you in doing so?

Danny de Hek 21:45

Was experienced or problems?

Helen Oakes 21:51

You’re on mute Shawn.

Danny de Hek 21:53

We can lip read. He says he said a nice breakfast.

Rob Woolley 21:56

You’re on mute. Shawn.

Danny de Hek 21:58

There you go. We’re watching you. Makes the podcast good.

Rob Woolley 22:04

Still on mute my friend.

Danny de Hek 22:06

You’re right. He’s got Android phone.

Rob Woolley 22:08

While he’s working out Chris if you were to create a standard operating procedure, or not. Can you see advantages or the disadvantages in doing so?

Chris Cameron 22:24

Yeah, I mean, standard operating procedure, you got to make sure it’s documented down. We have religious team that were built up to be able to take over classes and classes are all documented and watched happen so that they continue for a period of time. If I got knocked out completely, then I guess you want to you got to consider whether or not you want the business to continue? Do you have employees? Do you want to continue to provide for them after you’ve gone? And your family and things? And so you should have that succession plan put in place? And you might want to probably, if you think of it like a well. And it’s probably to two wills, short term and long term. So and the short term effect of you being incapacitated, what has to happen? And what would be your long term wishes for the business as well, which can be sometimes fatal. And obviously with a board, probably not. It would be worthwhile most businesses considering having a governing board that if you are not able to make decisions, then other people have authority which has been delegated down to make those decisions.

Danny de Hek 23:38

Can I am chime for a sec. I think I was just thinking when I had my New Zealand’s Information Network, I used to look after about 100 businesses website. And they used to literally put 99% of their internet advertising with me, they were all concerned that if I did die, that the whole business would fall over because the websites became an integral part of the business. So what I did at that time was I put an insurance in place where I could actually have someone come, we could afford to hire, you know, a replacement Danny or I could to help my business groomed in a way it could be sold. Not that I was grooming my business at the time to be sold, which would have been a good idea. However, I had enough money in there I think it was about $200,000 to actually get somebody in there. Because my clients wouldn’t use my services anymore. At least I knew that I had, you know, a plan of exit. So I think that was really interesting for me at the time.

Rob Woolley 24:45

I think you raised some excellent ideas here. Right? There was another person who wanted to come in there who was there, Mark Scown.

Mark Scown 24:52

Yeah, I’m just picking up on Chris’s comments and about wills and things. And I’ve got about three or four clients who are lawyers and one of them specialises in power of attorney and those sort of features. And I think if you are in business with a partner or spouse, then it’s absolutely imperative that you have got, well, they have parent power of attorney over each other. Because effectively if you get incapacitated and unable to work, then then that person only who has power of attorney can act on your behalf in a business sense. Otherwise, you’d find that your whole will your finances, and the bank systems will lock in lockout people are irrespective of whether you’ve got password access or not. So that’s a crucial thing to have.

Danny de Hek 25:46

Yeah, yeah, that was cool. Um, one other thing, I’d like to say, we just got to keep us on time, Rob, we’re running out there, just letting you know, I have a close friend of mine is really up to speed with IT. And he knows all my passwords and everything, I got total trust with them. So I’m hoping that if something happened to me, Helen may not know as much about accessing all my stuff as he does. So this over the years, I’ve trusted this guy for 20 plus years. So I mean, that’s another one too. It’s not a business partner. But I know as much about him as he knows about me. And it’s just nice having someone like that that’s not in your house. That’s away in case your house got burned down. He knows where I keep all my cloud stuff, and all the passwords and access files and all that sort of stuff.

Stefano Pietroiusti 26:28

You raised some interesting points. Right? So one point that has arrived up is that if you’re a sole trader, it is a consideration that you need to protect your customers, particularly if you’re providing an ongoing product or service, if you die, who was going to recover the websites or the files, documents or anything like that. So that’s an interesting point. I would like to, to go to Lachlan and say, why do you have half a succession plan? What is the half you’ve got? And why do you not have the other half?

Lachlan McNeill 27:09

Well, it is the succession plan says I have so pays for the recruitment work I do. But that’s what we’re going to put on half is what I haven’t really got as a start here button. You know, for example, if someone walked up to my desk, they wouldn’t know where to stop, because I use three different recruitment systems, I have a lot of stuff going on. And I really realised sitting here I thought it should ever start here. But which is okay, if I’m not here, this is what you do to start, this is where I put my stuff, this is where this is, this is where that is. Because I have so many different versions of stuff going around for various reasons. And some different systems, I could save someone, probably days worth of just mucking around by saying start here this is this is where I put less things. This is where my esops are, this is where that is. So that’s why money.

Stefano Pietroiusti 27:58

I think is an interesting one here is that if you go to write out a process for anything, and I have in training is a you end up writing down here, here’s how you do it, step one, step two, step three, etc, etc. And once you write all the steps down, you actually realise Oh, maybe if I change one step, I could remove a few other.

Lachlan McNeill 28:21

Simplified things. Yeah,

Stefano Pietroiusti 28:23

Yeah. And I think, has anybody considered a whether you have a mental block actually writing down what you do? Or what the opportunities you may discover, if you were to create one mark, in the funeral homes you like, have you realised that by winding down the processes, you have actually discovered new ways of doing things?

Mark Glanville 28:51

Well, I guess we’ve discovered that there’s a new thing called health and safety. And a lot of jobs that we’re doing have to be listed down step by step for health and safety esops. And so therefore, you know, a lot of the stuff that was in the the actual esops that we have for the business on how to do our job, are actually in the health and safety notes as well. So I guess we’re doubling up in some places now, more than sort of cancelling things out but actually, our job gets more and more complicated as the years go by. But at the end of the day, we’re you know, what we do as a people thing, so you can’t really write down people skills. But you can write down the processes that are required to complete what people need us to do. So yeah, I don’t think there’s anything we can cut out of that.

Danny de Hek 30:01

I got another side point, if you want to have a bit of a spanner in the works, I’m just sort of thinking like if I die, I don’t really care about my business too much. Unfortunately, however.

Mark Glanville 30:10

That’s very selfish of you Danny

Danny de Hek 30:13

But I’m thinking, What am I

Mark Glanville 30:16

I always say get a will, an executive and a POA. You probably need one of those. And a end of life plan as well. That’s the new thing.

Danny de Hek 30:30

It is a good idea that you’ve got a booklet on that. I’ve seen that before, haven’t you?

Mark Glanville 30:34

And yeah, it’s actually something that you go to your doctor about

Danny de Hek 30:39

it because I was in a Rotary Club, the average age of the Rotarians are 71. I was 40 at the time, and I think one of those books went flying around the Rotary Club, and I thought, what a cheek I’m only 40. However, what I was thinking of, if I were just to sort of say, Look, when I die, I don’t care about my business, I’m a sole trader, sorry, Helen, I would be more interested in what assets I actually have in my business that are groomed or to be either sold or used by somebody else. And that could be an interesting way of looking at your business. Now, I know you’re an antique dealer, Rob. So have you suddenly passed away, then theoretically, you’ve got a garage full of antiques, it would be an asset to some other antique dealer. So that some of you could have a value on perhaps so you could tell you wife. Look, it’s worth $25,000, don’t let it go for a penny less. Now you have an asset to sell, even though they may not want to carry on the business.

Rob Woolley 31:32

I think I think there’s a few things around succession planning that came up for me because because succession planning and standard operating procedures, I think are very tied in. Although I guess a standard operating procedure in terms of succession planning assumes that the business will continue once you’ve moved yourself out of it. And in my particular business as an Antique dealer if you take the dealer out of the business, you don’t have a business. Right, that’s the long and the short of it. So all you do have is stock. And there are various ways to dispose of the stock. Yeah, like auctions. Yeah, like online. Yeah, like whatever. Or even, you know, like rubbish dump was some of it. But as easily the stock is is the business, which means a succession planning and my place in terms of the business would just be to call up an auction rooms, right. And it’s all gone. Right out of the business. There may be other assets to disperse. However, on the subject of solutions. I think sometimes if we were to for sale sales to write or create a standard operating procedure, what I think there may be a lot of new opportunities uncovered of how to do it better. was just wondering, has anybody had a mental block about actually writing down what they do and analysing what you do? Why do you do it the way you do it?

Danny de Hek 33:12

Now you’ve opened a hornet’s nest.

Helen Oakes 33:15

I am Rob I think, for me, being creative. It’s I have my own style and my own way of shooting. So it would be kind of hard to say to someone, right, I want you to cover that event. And that’s what I want from it. Because for my sports events, you’ve got to understand the sport, not that other people couldn’t cover it, because they definitely could. But when you you have some creative elements in it, you do it a certain way. So you would have to, I guess, pass that to someone and say you wanted it done a certain way or Yeah.

Danny de Hek 33:51

And that’s why I’ve encouraged Helen to actually change your branding from her brand, to her own name. So helen.co.nz instead of modedevie.co.nz because at the end of the day, people are hiring Helen because she is Helen and she’s got that, that look and feel about herself.

Helen Oakes 34:07

I do have a when I edit, I have a set of deco presets, which I put on photos, so they have a certain look and feel and they’re sort of like my signature look. So I could definitely pass the editing on to someone that they could do what I do.

Rob Woolley 34:25

Yeah, right Mark Scown

Mark Scown 34:28

I’m a bit like you, Rob and Helen, in a sense that my succession planning if I was to kick the bucket now is that I’ve put in putting in place as we speak really around who will buy my client base because immediately comes up for offer. In terms of you know, there’s three and a half 4000 insurance brokers out there who sell insurance, but I think I’ve got a particular niche anyway, so I don’t see any value in getting someone to come along and continue to run the business. So you effectively just get wound up and my business be sold on through agencies.

Danny de Hek 35:10

I never knew there’s any other insurance advisors out there. You didn’t tell me this

Mark Glanville 35:16

Run across a couple.

Stefano Pietroiusti 35:19

If I can just ask a question of anybody who hasn’t spoken too much, if you if you do not have a succession plan, or a standard operating procedure, is there any particular reason why you don’t have one?

Rob Woolley 35:36

We will go to Jaline

Jaline Pietroiusti 35:41

No. Well, Stef and I work together. Um, so if something should happen, we’re kind of both on the same page. But there is a few things we need to kind of write down. It’s like banking details, social media, everything that we do, because he’s got passwords on our nerve. And yeah, vice versa. I’m the director of the company. And if something happened to me, he doesn’t have power of attorney. So obviously, we need to get all those things sorted. And yeah, I’m glad we’re having this discussion. Because Yeah, we’re just so busy focused on getting a business running and making money you forget about the important stuff. So yeah.

Helen Oakes 36:22

You should use one password and connect it somehow between you two and then you can access each other’s passwords. Yeah, no, if you need an emergency or someone’s not there.

Brian Morrison 36:38

Were like, I know a couple where they they said the exact same as what Jaline and Stef are saying. But the both unfortunately, it’s not nice. But the unfortunately both died in an aeroplane accident. You have to look elsewhere as well. And not just between you both? Yeah.

David Clarkson 37:00

yeah. Yeah. Just to go on from what Brian’s saying. And I agree with you, Brian. I think one of the interesting things, especially for couples that work together, like what Jaline and Stef, myself and Margaret do the same thing. And what we have done is we have actually sat down and gone through literally our whole life. And we’ve said, you know, these are the bank accounts, these are the automatic payments that she makes, and that I make all the various different things that we have. And that’s a great way, if you just do it for yourself, personally, or as a couple, do it like that. And then you will see all the things in actual fact, you need to cover if you want to do the same thing to put on a succession plan for your business. But the beauty of having done what we’ve done, and we’ve done that, particularly for our lawyer, and so he’s got a copy of that. And we update that on a regular basis because passwords change, bank accounts change suppliers of one sort or another change. You know, who’s your doctor, who’s your dentist? How do you get a hold of these people in the event of especially as Brian says, you have a couple get killed together in a car accident or in a plane crash. So that’s those are some things to bear in mind. But it’s a good way to do your own first, and then you’ve got a pretty fair idea about what you need to do to do one for the business.

Brian Morrison 38:39

Solicitor, how would your solicitor found out? You died?

Mark Glanville 38:46

I can answer these questions. Yeah. All right. Okay, first of all, the information that we have gathered, and this could include pre funeral arrangement information, it could include wells could include POA’s. And any important information about bank accounts, passwords, insurances, stock investments, any other interest that you need people to know, you actually have to have an a place that your executor knows where to look, and let them know where it is. And this is super important. And I’ve had lots of experience around finding information in the top drawer on, you know, on the left side of the Duchess, or wherever it might be. And even if that leads them to finding information on the computer, but it’s it’s so important because there’s so many situations out there where people don’t know there’s money out there. And it takes years and years for a company to discover that somebody has died and then There are actually there’s companies out there that it’s their job to search the world for people that are to inherit money.

Danny de Hek 40:08

I had that once I got, I thought it was a scam. And at the end of the day I received, I think it was $40 from my Australian Auntie, and this company has just been a scam. And I keep coming here, clear off my screen.

Mark Glanville 40:24

I had a guy last year that received $10,000 from one of these situations, and they found them through one of our death notices we put on the paper. And so this was from somebody overseas and Europe. And I thought it was a scam too. But I researched it, worked it out. And I said to the person, look, I think this is real, he got his lawyer involved, and got 10,000 bucks out of it.

Danny de Hek 40:48

If you need a guy like that again I happy to be that guy.

Mark Glanville 40:51

I just get messages from my friendly uncle in Nigeria. Yeah, yeah.

Lachlan McNeill 40:57

Got money they can’t get rid of

Mark Glanville 41:00

The $10,000.

Rob Woolley 41:02

If we move on to the last stage now

Mark Glanville 41:05

Sorry, Rob.

Stefano Pietroiusti 41:09

If we just move on to the last stage, which is the takeaways I’ve had a couple of takeaways just lead this discussion. And that is don’t get in front of a bus. And don’t fly on a plane with your partner. Because you’re likely to get hurt, or you’re both likely to die. Apart from that, what are the takeaways that anybody has got a lot of today’s discussion

David Clarkson 41:34

Documented, and make sure it’s available in an in an organised sense for somebody to pick up and follow.

Mark Scown 41:43

It is important, and don’t procrastinate. Get on with it.

Mark Glanville 41:50

And I think for me, we’re we’ve already got this information written down, revisited, make sure it’s up to date, and ready to go. So for anything, if I needed to walk out of my job tomorrow, for a new opportunity that might be coming up. It wouldn’t affect the business that I worked for.

Danny de Hek 42:09

And if I die tomorrow, Rob, you can take over next week over.

Helen Oakes 42:14

You can take as debts on Rob.

Rob Woolley 42:16

Thank you very much, Danny, the takeaway that I’ve got from this is that we do need to stop making assumptions and assume that everything will be fine, and takes your opportunity to work out. What do we do? Why do we do it? How could we explain it to anybody else if they had to come in? Or if it just all ended? What happens with everything we’ve got, you know, all of the assets? Well, eccentric cetera. So thank you very much for your input. And we’ll pass over to Danny.

Danny de Hek 42:52

I need some more takeaways.

Lachlan McNeill 42:54

I’ve got one here. Is that is that from what I’m saying? For most people, maybe most people is that seems quite an onerous task. But actually, I would think that if someone spent, let’s say, even you spent half an hour just writing down the core stuff, and a start here, so someone walked on my desk, or someone walked in there, it stuck out to you knew exactly what what was your domain and instructions and started, start here, and you spent half an hour on it, maybe an hour Max, you would save days and days of trouble just by starting that process. And that’s what I get. And you can have them fantastic. I’ve got screens and screens and screens of notes. But if people don’t know where to look

Danny de Hek 43:36

Thats cool as a problem I’m using as a link in the chat room. What was that regards? Who was it? That was it?

Lachlan McNeill 43:41

That was a checklist, a succession checklist I just found while I was looking for the granddaddy stop point, I don’t people can see the link.

Danny de Hek 43:51

Okay. And some people did give us some takeaways, but I didn’t get well. I know we’ve got them all on notes. So do put them in the chat room if you can. And thinking about a topic next week. I’ve just sort of thinking about what business assets do we actually have could be a I thought that could be a topic in itself. Like if you did look at your business and all your hard work for years and years. Is it worth looking at assets? And what is the business? Is it just for food was even asked to go to topic that they would think would be juicy one to discuss Mark?

Mark Scown 44:23

Yeah. Oh, Mark one first. And I just wonder about the assets thing because we all come from different backgrounds in different businesses that it actually could get a little bit untidy. And I’d be leaning if that was the sort of the topic would be how do we prepare our business for on sale? If you were stepping out of it

Danny de Hek 44:46

Exit strategy? Yeah, I like that is it too simple?

Jaline Pietroiusti 44:55

That’s so good.

Mark Glanville 44:57

Sounds like a plan.

Danny de Hek 44:58

Ha ha, very clever. So, are we actually saying I’m just waiting for Helen to do that? So actually saying, exit strategy, a business exit strategy?

Lachlan McNeill 45:08

Yeah,

Danny de Hek 45:09

We might all be laying on the beach next week with Mark. And because we’ve sold our businesses, I’ve got one of my websites at the moment that’s done quite well for drop shipping. And I stumbled into Shopify, is it what’s it worth, and they said it was worth $46,000 worth of sales last year, and they came back and told me it’s worth $25,000 US dollars. So I was quite surprised because I’ve got a few of those little websites. So I put it up for sale. But I didn’t realise I hit she hid an asset, because I was too busy making taking the money I was making from it. But now I’ve got 12-18 months worth of history on it, he has become an asset, which was a nice sort of pleasant surprise. So business exit strategy. how, we’re going to chop up some of the business. I had been listening to clubhouse quite a lot. And one of the things I did like here in the header, a guy that used to buy companies, and he bought a company, fitness company, and then he went and bought another failing fitness company. And because he didn’t have to have two sets of administration, that company started making a profit. And I thought that was quite good. So yeah, by moving some of your assets, or I really appreciate your time today. And I would like everyone to unmute the microphones and we are going to stop recording the meeting. And what I’d like to say is a nice big good bye in a big cheer. You know it we’ll see what happens. All right, on the count of three, we’re gonna say Goodbye, everyone!

Transcribed by Otter

P.S. If you like this podcast please click “like” or provide comment, as that will motivate me to publish more. Would you like the opportunity to be featured on the WHAT : DE HEK Podcast? You are welcome to INVITE YOURSELF to be a guest.

Leave A Comment