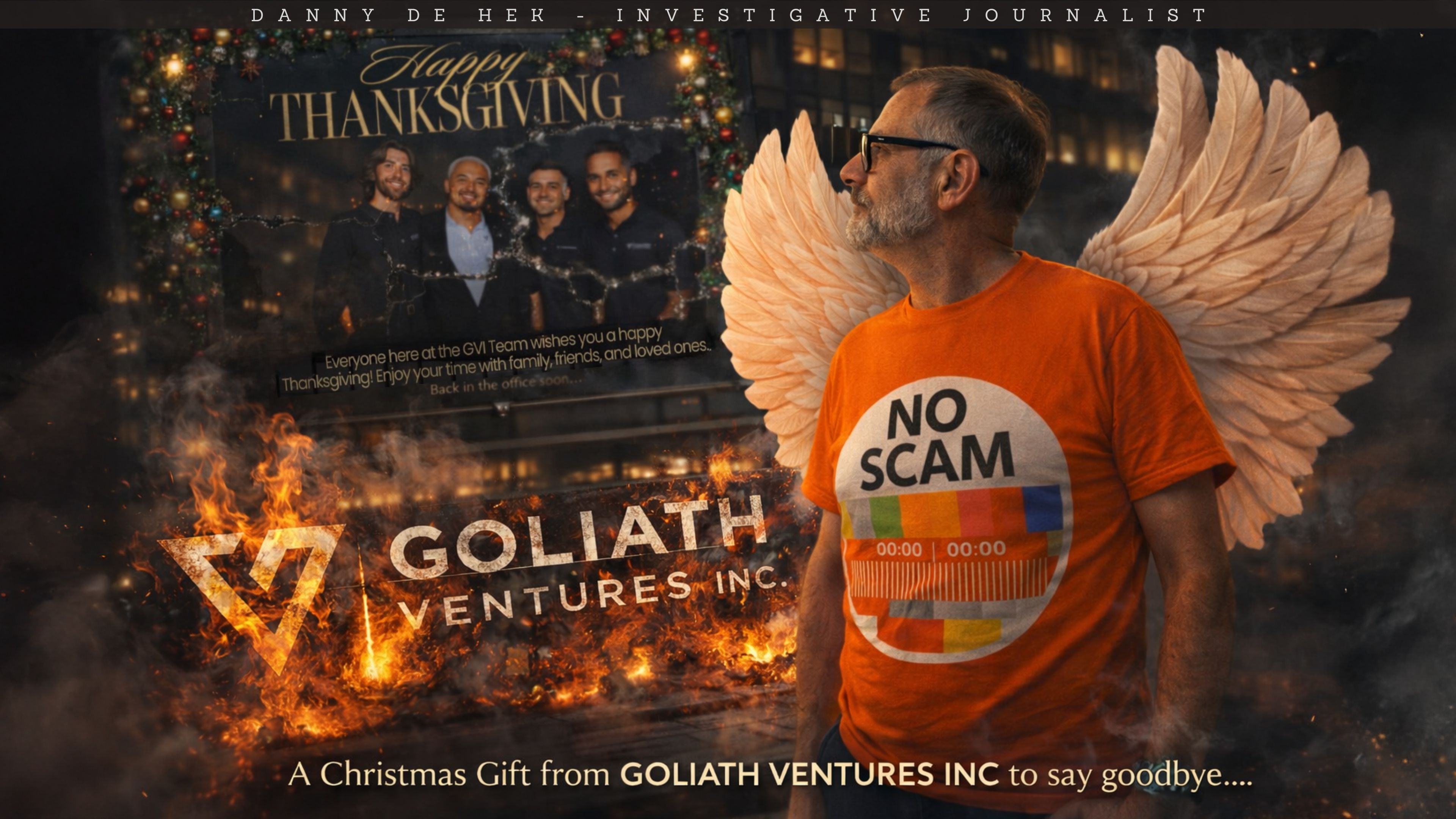

For weeks, partners of GOLIATH VENTURES INC were told that distributions were imminent. Specific dates were given. Confidence was projected. Assurances were repeated.

Those payments never arrived.

What followed was not transparency, but silence — and then a lengthy “Operational Update” newsletter that attempted to reset expectations without addressing the core failure: promised payouts that did not happen.

What followed was not transparency, but silence — and then a lengthy “Operational Update” newsletter that attempted to reset expectations without addressing the core failure: promised payouts that did not happen.

Instead of providing first-party evidence, trade data, or verifiable performance metrics, the update relied on generalised language, third-party examples, and future assurances, while avoiding the most basic questions investors were asking in real time.

At the same time, Goliath showed no visible difficulty spending millions on a luxury promotional event, even as partners were told delays were merely “administrative.”

“After the party ends and the music stops, reality has a way of surfacing.”

This blog documents what was promised, what failed to occur, what explanations were offered, and what evidence was not provided — using the company’s own communications, timelines, and public actions.

This is not opinion.

This is their own words measured against observable reality.

Promised Payout Dates That Were Quietly Abandoned

Only weeks before the Newsletter was released, Goliath communications stated that distributions would be paid on December 15 and December 18.

Those dates came and went.

In the “Operational Update,” there is:

- no acknowledgement that these promises were made

- no explanation for why they were missed

- no accountability for resetting expectations to January

Instead, the narrative is rewritten as “two consecutive months of delays,” as if the specific commitments never existed.

Missed deadlines are one thing. Pretending they never happened is another.

That alone represents a serious breakdown in credibility.

Lavish Spending While Claiming Operational Delays

At the same time partners were told distributions were delayed, GOLIATH VENTURES INC hosted a large, high-production event, widely reported by attendees to have cost millions of dollars.

There were:

- no visible signs of restraint

- no scaled-back production

- no cost-saving measures

A platform experiencing genuine operational or infrastructure constraints does not simultaneously delay partner payments while spending heavily on branding, optics, and events.

This contradiction raises a fundamental question: why were promotional activities prioritised over financial obligations to partners?

The Event Was Paid — In Full

One additional detail needs to be stated clearly. While investors were being told that payments were delayed due to “administrative” and “banking” issues, we have verified intelligence confirming that the venue used for the million-dollar promotional event was paid in full. There were no delays, no complications, and no issues when it came to settling the bill for the event itself.

That distinction matters.

It shows that when it came to luxury, optics, and celebration, funds were available and obligations were met promptly. When it came to investors waiting on promised distributions, the explanation suddenly became about patience, infrastructure, and timing.

This is not an allegation.

It is a documented contrast.

And it raises a simple, unavoidable question: why were event vendors paid without issue, while investors were asked to wait — again?

Banking Excuses That Do Not Match a Crypto Payment Model

One of the most glaring inconsistencies in the newsletter is its reliance on explanations involving:

- traditional banking infrastructure

- wire transfers

- institutional banking coordination

Yet Goliath pays distributions in crypto.

Crypto payments do not require legacy banking rails, wire processing, or institutional approval to transmit funds. Blaming banking delays for crypto payouts does not align with how blockchain payments actually function.

This mismatch suggests either misdirection or reassurance over accuracy.

Either way, trust is undermined.

A Long Letter That Explains Very Little

The newsletter is polished, professional, and lengthy, yet substance is conspicuously absent.

There is no clear explanation of:

- where partner funds are currently held

- what specifically prevented payouts

- whether reserves are accessible

- what concrete milestone must be reached before payments resume

Instead, readers are presented with broad phrases such as “administrative timing adjustments,” “institutional-grade solutions,” and “emerging financial infrastructure.”

Length is being used in place of clarity.

Third-Party Data Used as a Substitute for Proof

One of the most telling aspects of the “Operational Update” is what it attempts to prove — and what it avoids proving.

Rather than providing first-party data showing Goliath’s own performance, the letter relies on third-party industry statistics to justify its business model. It cites publicly available data from platforms such as DeFiLlama, referencing transaction fees generated by major decentralised exchanges like Uniswap, to argue that liquidity-based strategies are capable of generating revenue at scale.

That logic is fundamentally broken.

No one disputes that large decentralised exchanges generate fees. The question partners are asking is not whether Uniswap makes money — it is whether GOLIATH VENTURES INC is generating revenue in the way it claims.

If the model were functioning as described, the most direct form of reassurance would be first-party evidence:

- actual trades

- realised fees

- historical performance data

- verifiable wallet activity

None of this is provided.

Instead, the letter substitutes external market success for internal proof. In a period marked by delayed payments and growing concern, the absence of first-party data is not a minor omission — it is a critical gap.

The Audit That Is Always “Coming”

The letter repeatedly references:

- audit-driven recommendations

- an independent third-party audit

- a forthcoming audit report

Yet it provides no verifiable detail. No auditor is named. No scope is defined. No confirmation is given that funds themselves are being audited.

“Audit pending” is a familiar narrative in distressed platforms. Until an audit report is actually released, this remains a promise — not evidence.

Silence at the Top

Despite missed payments and escalating concern, Christopher Delgado has not addressed partners directly through a live briefing, open Q&A, or transparent engagement. Communication remains one-way and carefully filtered through newsletters.

In legitimate financial operations, leadership becomes more visible during crises, not less. Silence at the top is never reassuring.

The Silence of Compliance

The newsletter leans heavily on compliance and audit narratives to justify delays. That raises another obvious question.

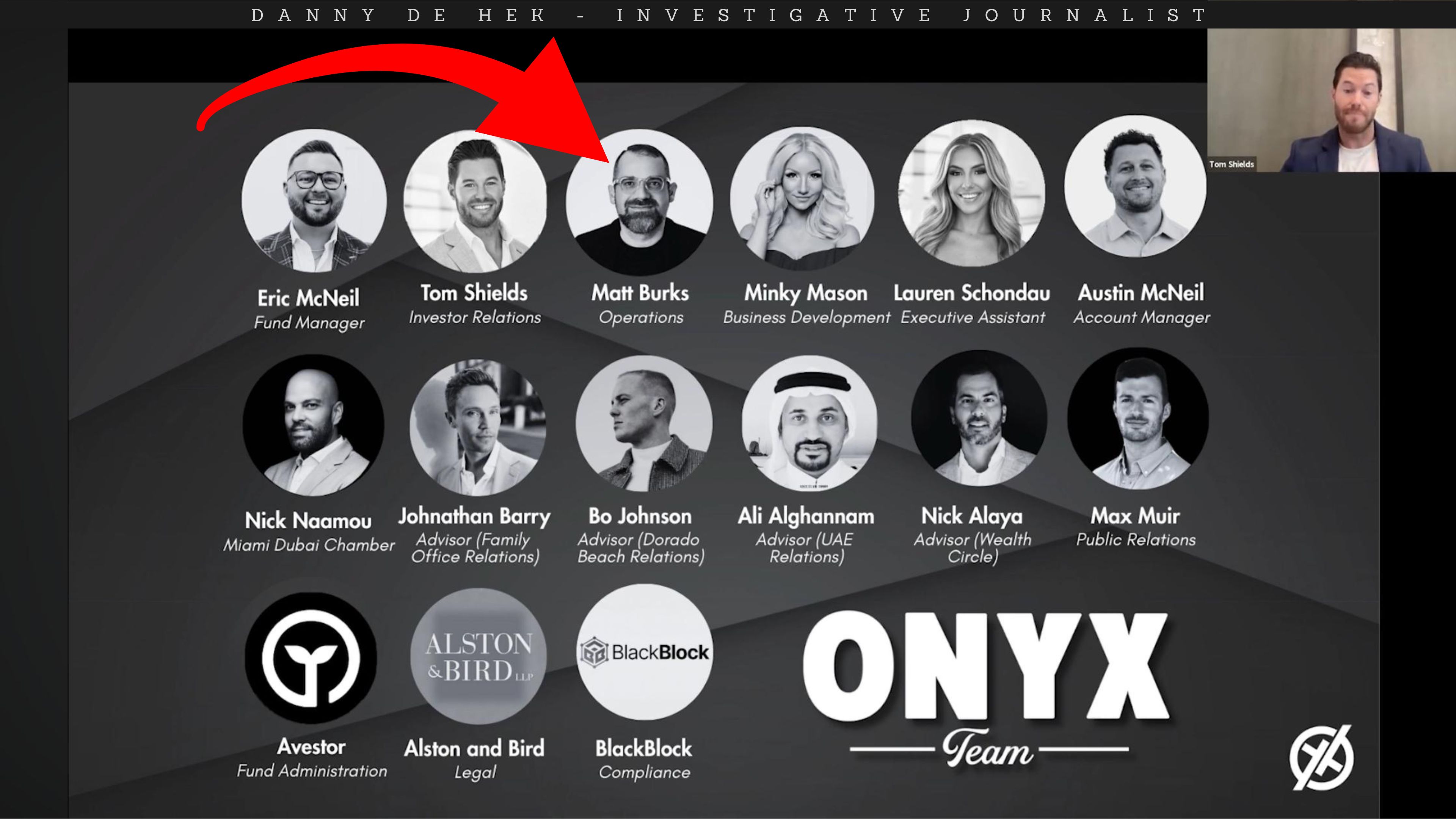

Where is Matt Burks, the individual publicly associated with operations and compliance oversight?

If audit-driven recommendations halted distributions, compliance leadership should be front and centre explaining what failed, what changed, and what has now been resolved. Instead, compliance is invoked but not visible.

In credible operations, compliance does not operate silently during a crisis.

Promoters Step Back as Pressure Builds

Another shift has occurred outside official communications.

Tomo Marjanovic, previously vocal and publicly aligned with the platform, has noticeably reduced visibility.

When confidence is real, promoters amplify. When risk becomes real, they go quiet and brace.

This is not an accusation.

It is an observation.

Social Media Silence and Narrative Containment

Alongside the missed payments, leadership silence, and promoter retreat, another clear behavioural shift has occurred. GOLIATH VENTURES INC has effectively wiped its social media presence, including LinkedIn.

At the time of writing:

- historical posts have been removed

- public engagement has been disabled

- comments are turned off

- only a single post remains visible

This is not typical behaviour for an organisation seeking to reassure partners or restore confidence. When companies operate from a position of strength, they communicate more and preserve transparency.

Reducing visibility and deleting public history instead signals narrative control and risk containment.

This shift coincides with delayed distributions, unanswered questions, executive silence, and growing external scrutiny, reinforcing that the organisation is no longer managing growth, but managing exposure.

Third Parties Begin Cutting Ties

Since this investigation began circulating publicly, real-world consequences have followed.

Onyx Reserve, an unrelated investment entity that had publicly listed Matt Burks, has removed his name and affiliation entirely after reviewing publicly available material relating to his involvement with Goliath Ventures Inc.

Shortly thereafter:

confirmed direct outreach, internal due diligence, and immediate distancing. They stated that no funds had been sent to Matt Burks or Goliath Ventures and that continued association posed reputational risk.

Third parties do not take these steps lightly. They act when risk becomes real.

Investor Sentiment Has Shifted

Behind the scenes, the mood has changed.

Investors are:

- comparing notes

- preserving screenshots and communications

- discussing legal pathways

- identifying potential persons of interest

- preparing documentation rather than waiting

This is not panic.

This is the calm before the storm.

The FAQ That Avoids the Core Question

The FAQ section restates earlier claims and denies insolvency, yet avoids the central issue entirely.

Why were people promised payments that did not happen?

That question remains unanswered.

Conclusion

Taken individually, each issue raises concern. Taken together, they form a clear pattern:

- broken payout promises

- narrative resets without accountability

- lavish spending during alleged delays

- banking excuses for crypto payments

- vague audit assurances

- missing leadership

- compliance silence

- promoter retreat

- social-media containment

- third-party distancing

- investors preparing rather than waiting

This newsletter does not restore confidence.

It documents the collapse.

Ongoing Update

This article will be updated as new documents, statements, or firsthand accounts emerge. If you are a partner, insider, or affected investor with written payout promises, contracts, wallet addresses, transaction records, or internal communications, preserve them.

What is saved during the quiet moments often becomes critical later.

This is one of those moments.

A Call for Investors and Insiders to Come Forward

If you are an investor, promoter, or insider connected to Goliath Ventures, this moment matters.

What is unfolding now is no longer about patience or belief. It is about missed payment promises, contradictory explanations, vanishing transparency, and a growing pattern of damage control rather than disclosure. When communications stop matching outcomes, documentation becomes critical.

If you hold contracts, written payout promises, wallet addresses, transaction records, internal messages, or first-hand knowledge of how funds were handled, that information matters — not just for you, but for others trying to understand what is happening.

You do not need to navigate this alone. If you are unsure how to approach law enforcement or regulators, I can help point you in the right direction, including appropriate contacts within agencies such as the FBI or RCMP, depending on your jurisdiction.

Investors are also encouraged to connect with one another, compare notes, and preserve evidence. I have set up a WhatsApp Group for affected parties, but you are equally free to create your own private groups and coordinate independently.

https://chat.whatsapp.com/Jkiw3NgeLAlEKGewOzEC66

History shows that what is documented early often determines outcomes later. If you have information, now is the time to preserve it and come forward.

Previously in This Series on Goliath Ventures

- Glossy Promises, Shaky Contracts

Goliath Ventures Exposed – Glossy Promises, Shaky Contracts, and the Dark Reality of Guaranteed Returns

Where it all began: inflated promises of 60% returns backed by contracts that were flimsy at best. - The Compliance Illusion

Goliath Ventures Exposed Part 3: Christopher Delgado, Matt Burks, BlackBlock and the Compliance Illusion

The smoke-and-mirrors routine — how Burks and BlackBlock tried to pose as “independent” while being insiders. - The Smear Campaign Claim

Chris Lord Delgado Claims “Smear Campaign” – Goliath Ventures Exposed in My Full Response

Delgado’s pushback — calling legitimate questions a “smear campaign” while victims kept piling up. - The Bookkeeper’s Vanishing Act

The Bookkeeper’s Vanishing Act: Chris Delgado, Nadia Bringas, and Goliath Ventures

When the money trail grew hot, Bringas dissolved her company in Florida overnight and popped back up in Wyoming. - The Fake Audit

Pull Money While You Can! Goliath Ventures Ponzi Exposed by FAKE Audit. Florida Ponzi Scheme SCAM

A so-called “audit” that turned out to be nothing more than a Mailchimp blast with zero financial data. - The Missing FinCEN Registration

Goliath Ventures Inc (Christopher Delgado) and the Missing FinCEN Registration: Why It Matters

Digging into why a real investment firm would never operate without this registration — unless it was hiding. - Collapse and Clawbacks

Goliath Ventures Inc Florida Ponzi Collapse, Coming Clawbacks and Arrests

The unraveling accelerates: clawbacks loom, and indictments draw closer. - The Securities Question

The Unregistered Securities Problem: Why Goliath Ventures’ Contracts Are Likely Illegal

Breaking down why Goliath’s contracts were never legal in the first place — a fatal flaw in their setup. - What Real Funds Look Like

What Real Quant Funds Look Like Vs. Goliath Ventures, FL Ponzi Scam

Today’s deep dive: exposing how every part of Goliath’s structure collapses under scrutiny. - Stolen money, gifts, and uneconomical deals

Who Is Still Profiting From Goliath Ventures Inc, Orlando Ponzi? Don’t Drop The Soap.

Unusual developments connected to the Goliath Ventures Ponzi scheme, which is now imploding. - FBI Director Kash Patel, Ron DeSantis and even Andrew Tate

Goliath Ventures Ponzi: Verlin Sanciangco & My Liquidity Partner (MLP) Scam Rebranded.

Goliath Ventures Inc ponzi scheme has been running for a lot longer than most people realize. - I just got sued for telling the truth

Danny vs Goliath: New Zealand Journalist Sued by Christopher Delgado’s GOLIATH VENTURES INC.

I uncovered what I believe is a large-scale Ponzi scheme. - You now have 3 copyright strikes

Dirty Tactics: How GOLIATH VENTURES INC Is Abusing YouTube’s Copyright System to Silence Journalism.

Your channel (as well as YouTube channels associated with it) is scheduled to be terminated in 7 days. - Crypto Crash!

Crypto Prices Crash! GOLIATH VENTURES Investors Should Be Very Worried.

Questions Goliath Ventures Investors Should Be Asking - Filed a 22‑page Motion to Dismiss

Florida Orlando Ponzi Scheme Sues New Zealand Journalist, $150,000 Bribe Attempt.

This lawsuit isn’t about protecting a reputation—it’s about damage control and intimidation. - You didn’t escape the scam — you benefited from it

Whistleblower or Opportunist? The Anatomy of a Non-Whistleblower Who Protected Goliath Ventures.

To show what a real whistleblower looks like, and what one doesn’t. - The Banking Breakdown

GOLIATH VENTURES INC’s Secret Bank Switch: The Collapse Behind the “Transparency” Spin.

A false transparency update masking a banking crisis and ongoing promotion. - Director of Administration at Goliath Ventures Inc

Stephen Davis: The Fire Chief Who Walked Out of the Firehouse and Straight Into a Financial Inferno.

There is one path still open to Stephen Davis — the only path that honours the uniform he once wore. - Goliath Ventures Inc has now collapsed

Goliath Ventures Payouts Stop: Insiders Pull 10’s of Millions While Everyone Else Waits.

Paid their romantic partners and family members tens of millions since 12/Nov/2025. - Behavioural pattern is the same

Andrew Tate’s Hyperliquid Wipeout – And Why Goliath Ventures Investors Should Pay Attention.

High-risk gamblers calling themselves “genius traders,” sitting on terrible risk management, and using other people’s trust. - Goliath Ventures December Breakdown: What Investors Must Know

Goliath Ventures: Chris Delgado and Jonathan Mason Ruin Christmas! Canadians, Hide Your Wallets!.

Delgado’s deceit deepens as victims face mounting pressure, collapsing trust and urgent accountability. - Tomo Marjanovic’s “Brotherhood” Post

Tomo Marjanovic, #GoliathStrong and the Miami Dinner That Exposes Goliath’s Collapse.

And loyalty is the last thing a failing scheme demands before the crash. - Rapidly Unfolding Financial Collapse

Goliath Ventures Inc Dec 15–18: Payouts Promised – Where is The Money? Where is Christopher Delgado?

Investigating Goliath Ventures’ missing payouts, executive distancing, jurisdiction shifts, and evidence pointing to a collapsing Ponzi structure. - Broken Promises, Vanishing Transparency, Accountability Looms

The Collapse of GOLIATH Ventures Inc: Missed Promises, Narrative Control: The Calm Before the Storm (this article)

Delayed distributions, opaque explanations, missing proof, leadership silence, heavy spending, and growing investor coordination emerge.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand

Leave A Comment