At first glance, the website looks like a quirky new streaming platform where creators can earn money and viewers can profit by buying and reselling “keys.” But beneath the slick interface lies a bonding-curve pyramid scheme designed to funnel deposits into the hands of overseas fraud networks.

Crypto scams are constantly reinventing themselves, and Simps.com is the latest example.

How It Claims to Work

The site promises the streamers will earn 5% of every “key” sold during their broadcast. Viewers are told that each time a key is purchased, the price of the next one increases, creating the illusion of profit potential. Simps.com encourages users to set up a crypto wallet instantly with just an email or phone number, and to fund it through Coinbase or Apple Pay.

On the surface, this sounds like an innovative way to monetize livestreaming. In reality, it’s a speculative trap. The system only works if new buyers keep entering. Early participants may see apparent gains, but only because later participants are paying inflated prices. Once deposits are made, victims often find that withdrawals are blocked, delayed, or tied to sudden “fees.” This is the same playbook used in pig-butchering scams, where victims are groomed into investing more and more before being cut off entirely.

The Fine Print: TOS Red Flags

A closer look at Simps.com’s Terms of Service reveals even more troubling signs:

- The company denies responsibility for your funds, stating it has no custody or liability if assets are lost.

- It explicitly says it is not an exchange, broker, or financial institution, confirming it operates without regulation.

- Users must waive nearly all legal claims, even in cases of fraud or theft.

- Disputes are forced into private arbitration, with no option for class actions or jury trials.

- The platform grants itself broad rights over user content, allowing it to copy, modify, or use anything you upload.

- No clear jurisdiction or corporate entity is identified, leaving users with no enforceable protections.

These clauses are designed to shield Simps.com from accountability while leaving users exposed.

Privacy Policy Red Flags

The Privacy Policy is equally alarming. It allows Simps.com to:

- Collect excessive personal data, including wallet addresses, transaction history, and social media information.

- Track users extensively through cookies, device data, and email interactions.

- Claim broad rights to use and share your content and metadata.

- Share data with “business partners” and transfer it during “corporate events,” meaning your information could be sold or handed to unknown overseas entities.

- Avoid naming a clear jurisdiction, making it nearly impossible to enforce privacy rights.

In short, the privacy policy confirms that Simps.com is not just risky financially — it’s also a data-harvesting operation.

More Than Just a Scam Website

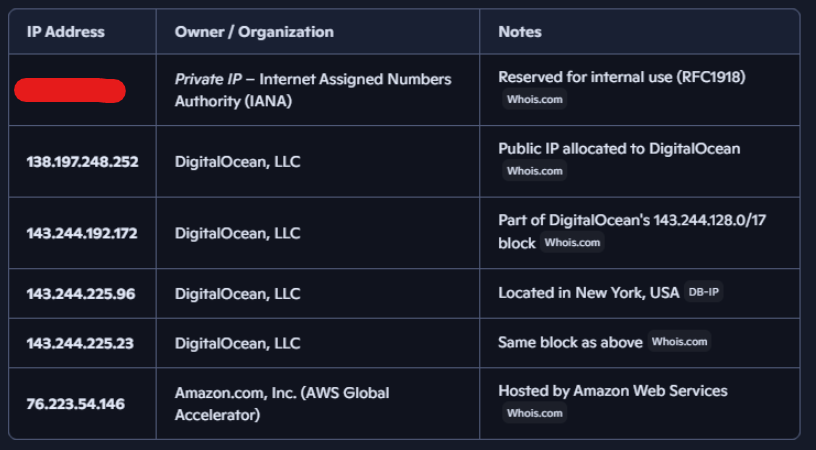

Upon further investigation of the I.P. address, we found out the domain was created in 2021. It was recently bought by new owners within the last year, although we cannot find information about the owner. The I.P. address traces back to Vercel Inc, an A.I. cloud company and it appears to be registered out of Iceland. The only information we can find about the owner is that they registered with Digital Ocean, LLC. Due to the lack of information, we must assume Simps.com is not an isolated operation.

It shows every sign of being part of a larger fraud network that:

- Registers domain through offshore services with privacy shields.

- Rebrands constantly, abandoning one domain and launching another.

- Funnels stolen funds into illegal overseas activity, including organized crime and, in some cases, human exploitation in scam compounds.

This is why engaging with sites like Simps.com is not just financially risky — it also means indirectly fueling criminal enterprises.

Exposing the Scam

There are several red flags that expose that Simps.com is a scam including:

- Guaranteed returns or “instant profits.”

- Anonymous ownership and no regulatory licensing.

- Bonding-curve mechanics that collapse without new buyers.

- Withdrawal restrictions or sudden “fees” when cashing out.

- Terms and privacy policies that strip users of rights and protections.

The Bigger Picture

According to the Canadian Anti-Fraud Centre, Canadians lost nearly $23 million to crypto scams in 2024 alone, and less than 5% of victims report their experiences. That underreporting allows scams like Simps.com to keep cycling through new names and domains. By exposing these tactics, communities can help others recognize the patterns and avoid becoming victims.

Simps.com is not a streaming innovation. It is a crypto scam disguised as entertainment, built on a pyramid-style bonding curve that inevitably collapses. Its Terms of Service and Privacy Policy confirm that the operators accept no responsibility, harvest user data, and hide behind offshore anonymity. Its ties to overseas fraud networks mean your money, data, and digital identity could be funneled into organized crime.

The safest move is simple: do not deposit, do not connect your wallet, and do not engage. If you encounter this site, report it to your local fraud authority and share the warning with others. Speaking out is one of the most effective ways to protect your community.

Besides, the name is totally meme-able…

By Beth Gibbons (Queen of Karma)

Beth Gibbons, known publicly as Queen of Karma, is a whistleblower and anti-MLM advocate who shares her personal experiences of being manipulated and financially harmed by multi-level marketing schemes. She writes and speaks candidly about the emotional and psychological toll these so-called “business opportunities” take on vulnerable individuals, especially women. Beth positions herself as a survivor-turned-activist, exposing MLMs as commercial cults and highlighting the cult-like tactics used to recruit, control, and silence members.

She has contributed blogs and participated in video interviews under the name Queen of Karma, often blending personal storytelling with direct confrontation of scammy business models. Her work aligns closely with scam awareness efforts, and she’s part of a growing community of voices pushing back against MLM exploitation, gaslighting, and financial abuse.

Leave A Comment