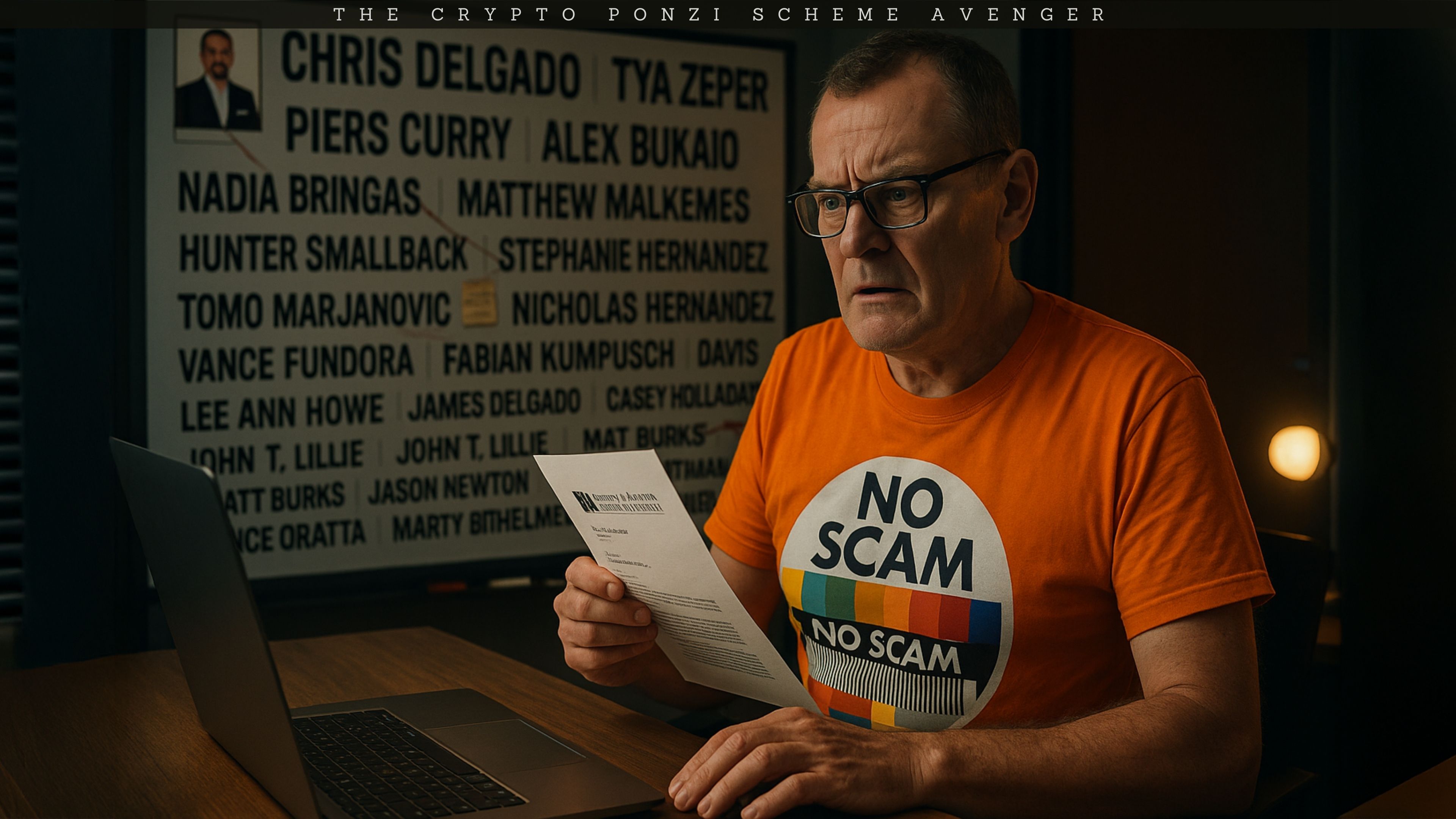

Goliath Ventures Inc., an unregistered and illegal hedge fund operated by Christopher “Chris” Delgado, Nicholas “Nick” Petrillo and Matthew A Burks in Orlando, Florida, is a cryptocurrency Ponzi scheme estimated to have collected over $500 million in investor funds.

The operation promised guaranteed monthly returns of 4-8% through “cryptocurrency liquidity pools” and 0% risk of losses (!!!) while providing no verifiable evidence of legitimate business.

Update: On 14/Nov/2025 Goliath Ventures announced to investors no money would be disbursed because of an ongoing audit. Please join this Whatsapp group if you are an investor in Goliath Ventures: https://chat.whatsapp.com/G8QREvRieztINVUe5gWECn

Federal investigations by Homeland Security Investigations (HSI), the U.S. Secret Service (USSS), the Federal Bureau of Investigation (FBI), the Securities and Exchange Commission (SEC), the Internal Revenue Service (IRS) and 1 more federal agency we cannot name are currently underway.

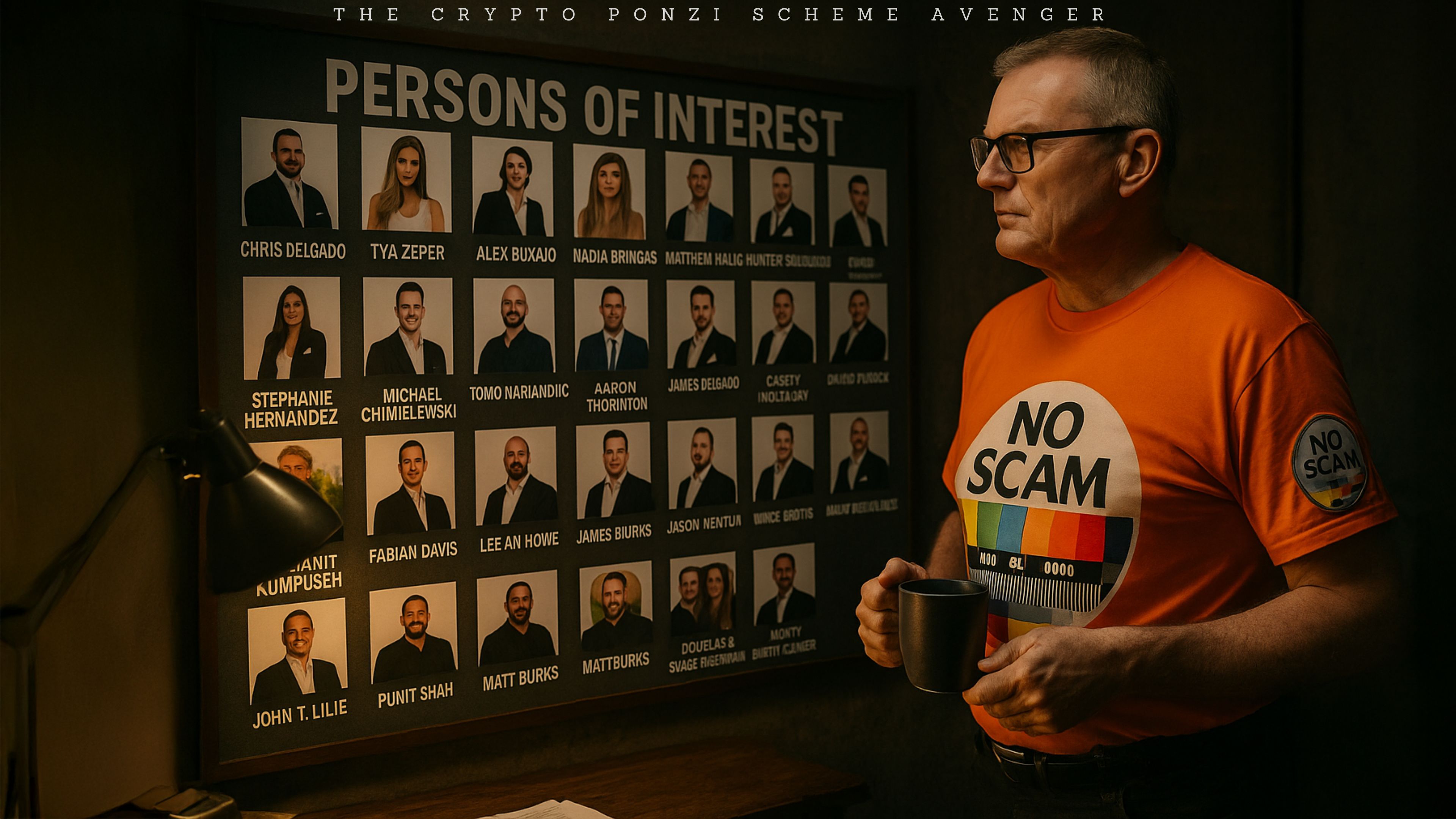

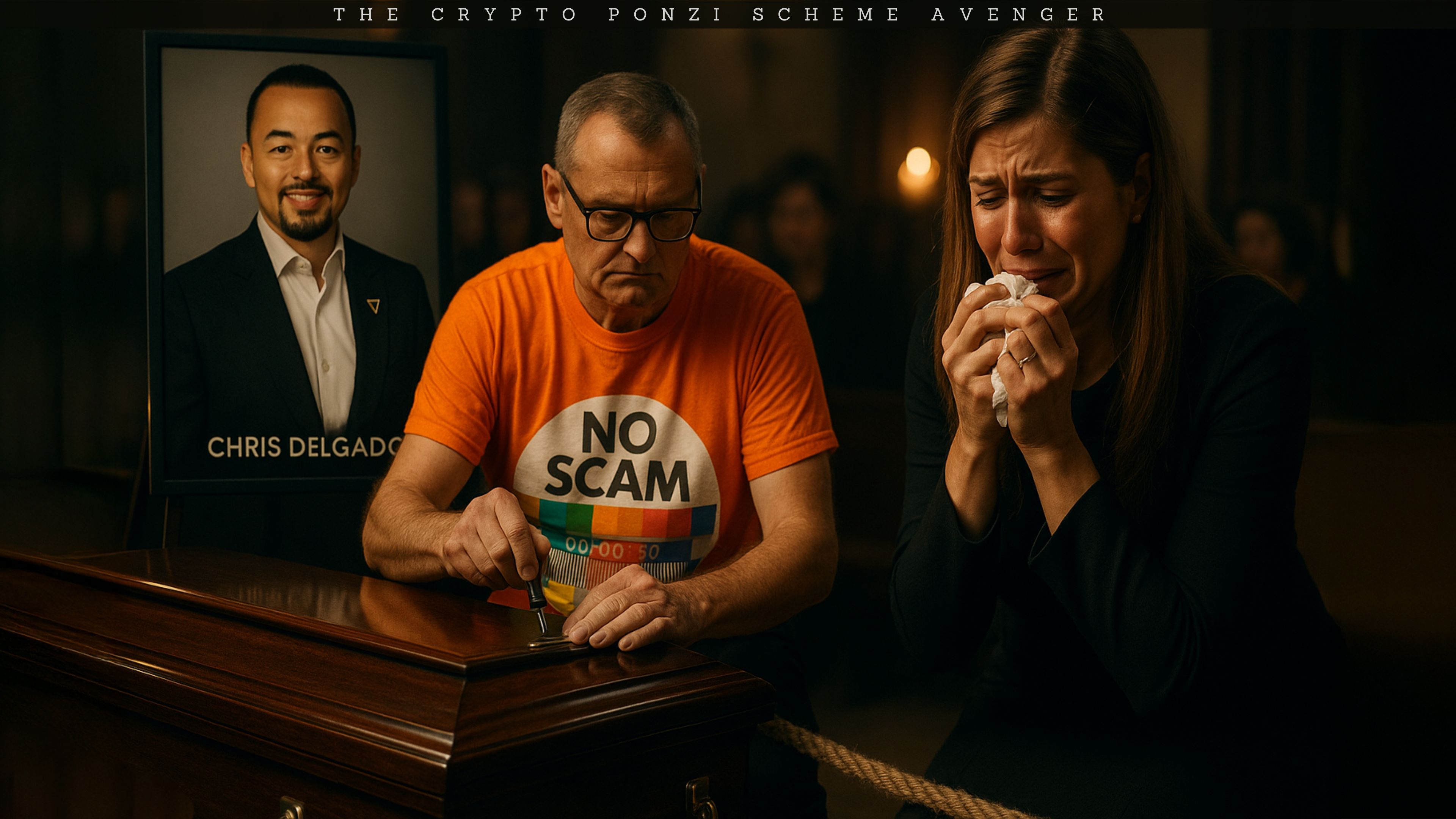

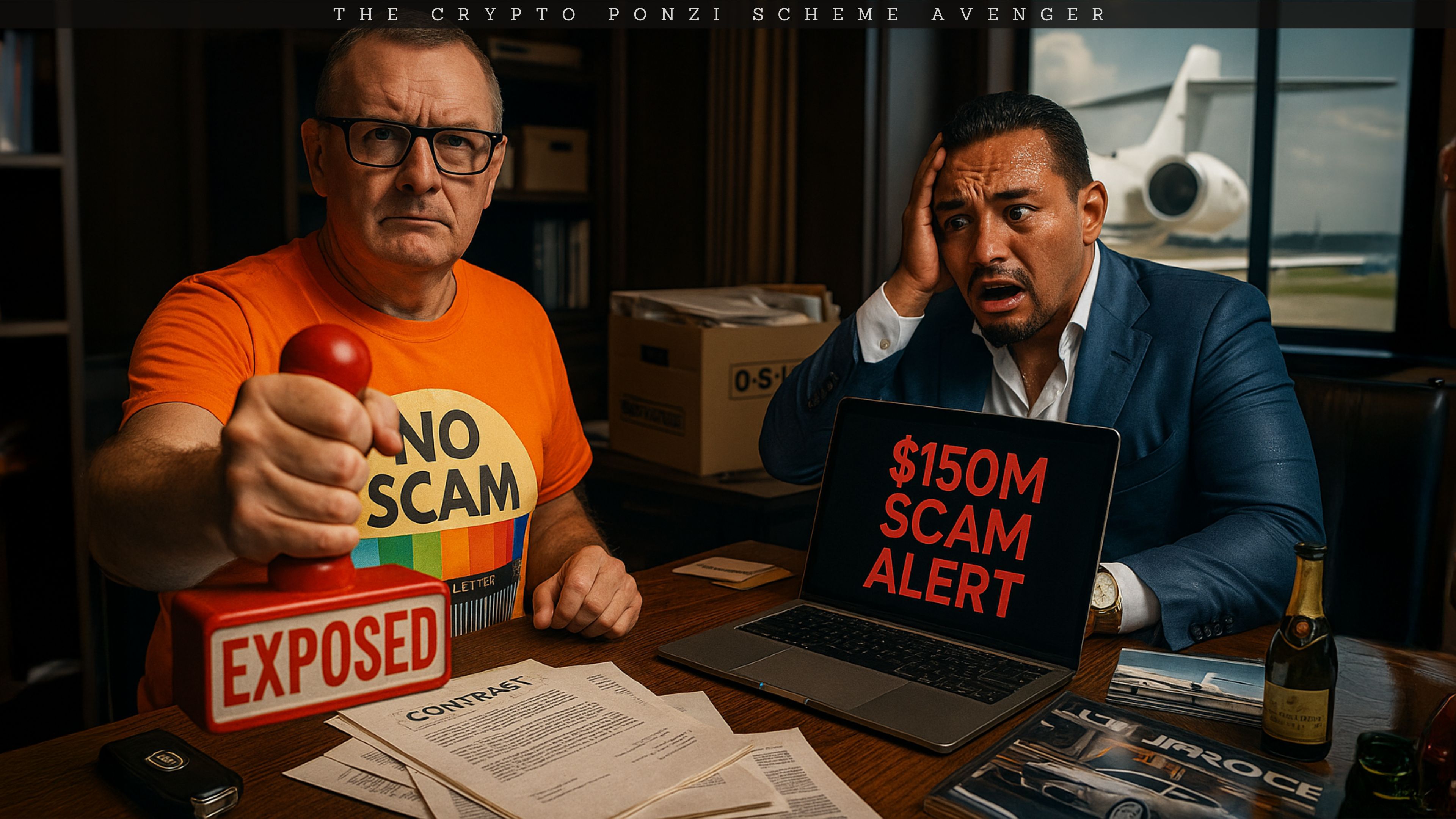

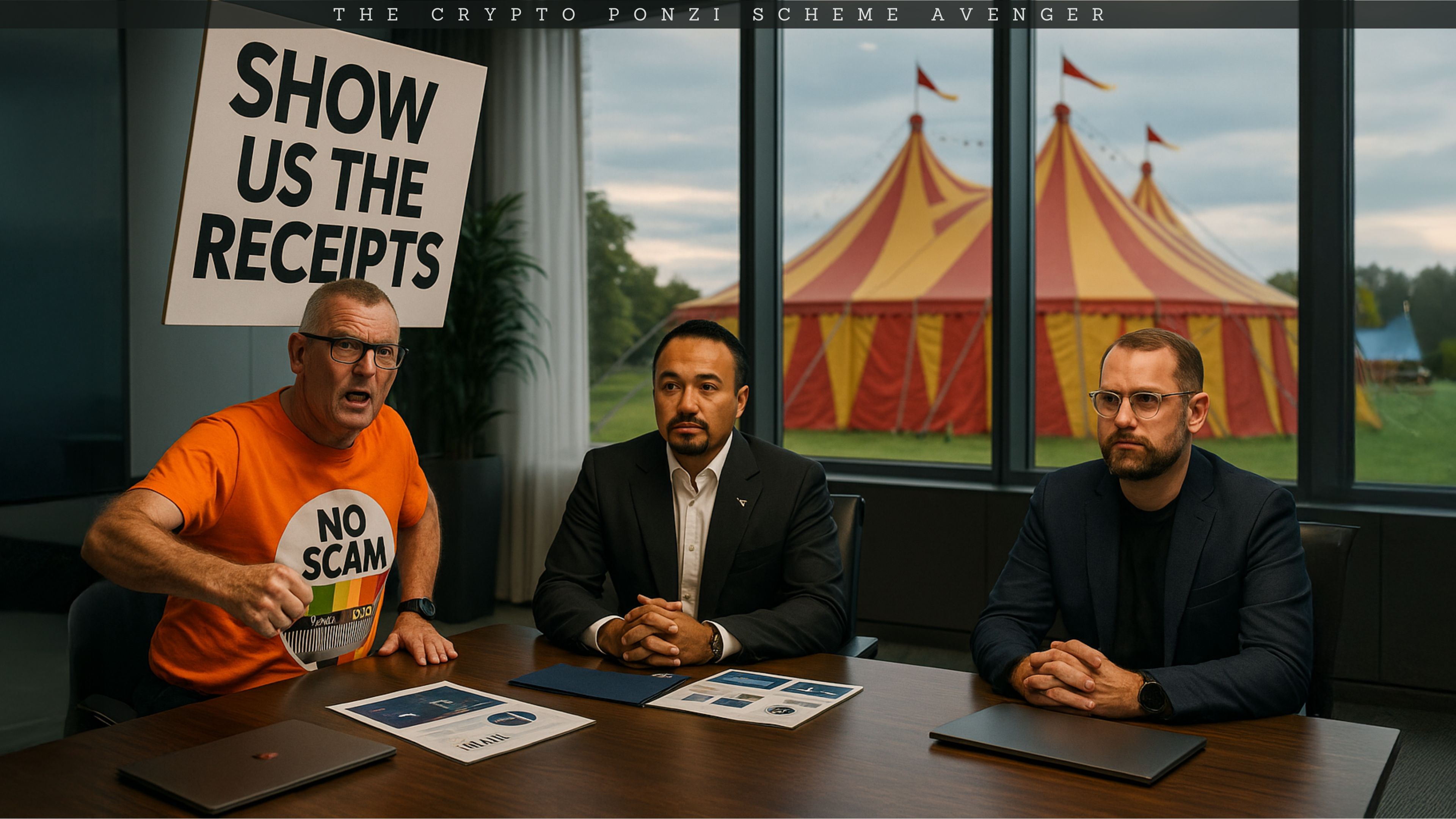

New Zealand based investigative journalist Danny de Hek has played a pivotal role in exposing the Goliath Ventures fraud. Danny de Hek was the first to raise alarm about this fraud and has gone about exposing a range of related criminal activity in Orlando connected to Goliath Ventures. Danny de Hek was sued by Goliath Ventures. Danny de Hek has been providing information to Homeland Security Investigations (HSI).

Chris Delgado and prolific crypto scammer Carl Moon Runefelt in 2022, both were involved in the My Liquidity Partner Scam

Liquidity Pools, Insured Investor Funds & Other Lies

Goliath Ventures claims to generate yield for investors by investing cryptocurrencies into liquidity pools on decentralized exchanges like Uniswap and Pancake Swap. Goliath Ventures promises 4-8% monthly returns with guaranteed principal protection. This is mathematically impossible – real DeFi liquidity pool returns average a fraction of the returns offered by Goliath Ventures, with significant risk and impermanent loss. No legitimate investment can guarantee 48-96% annual returns with zero risk as Goliath Ventures is offering.

Goliath Ventures contracts simultaneously claim they are “not an investment product” while promising fixed returns, guaranteeing principal, describing “profits” and “dividends,” and requiring minimum investments. Under the Howey Test, this clearly qualifies as an unregistered security. So Goliath Ventures is clearly breaking U.S. law.

Goliath Ventures also made the unbelievable claim (there’s video of Chris Delgado on stage bragging about this) of how investor funds in Goliath Ventures are insured and protected by “fidelity insurance.” The insurance policy claims to protect investor funds from errors, hacks and many other risks. But these are all lies and violations of U.S. law.

Obvious Ponzi Scheme

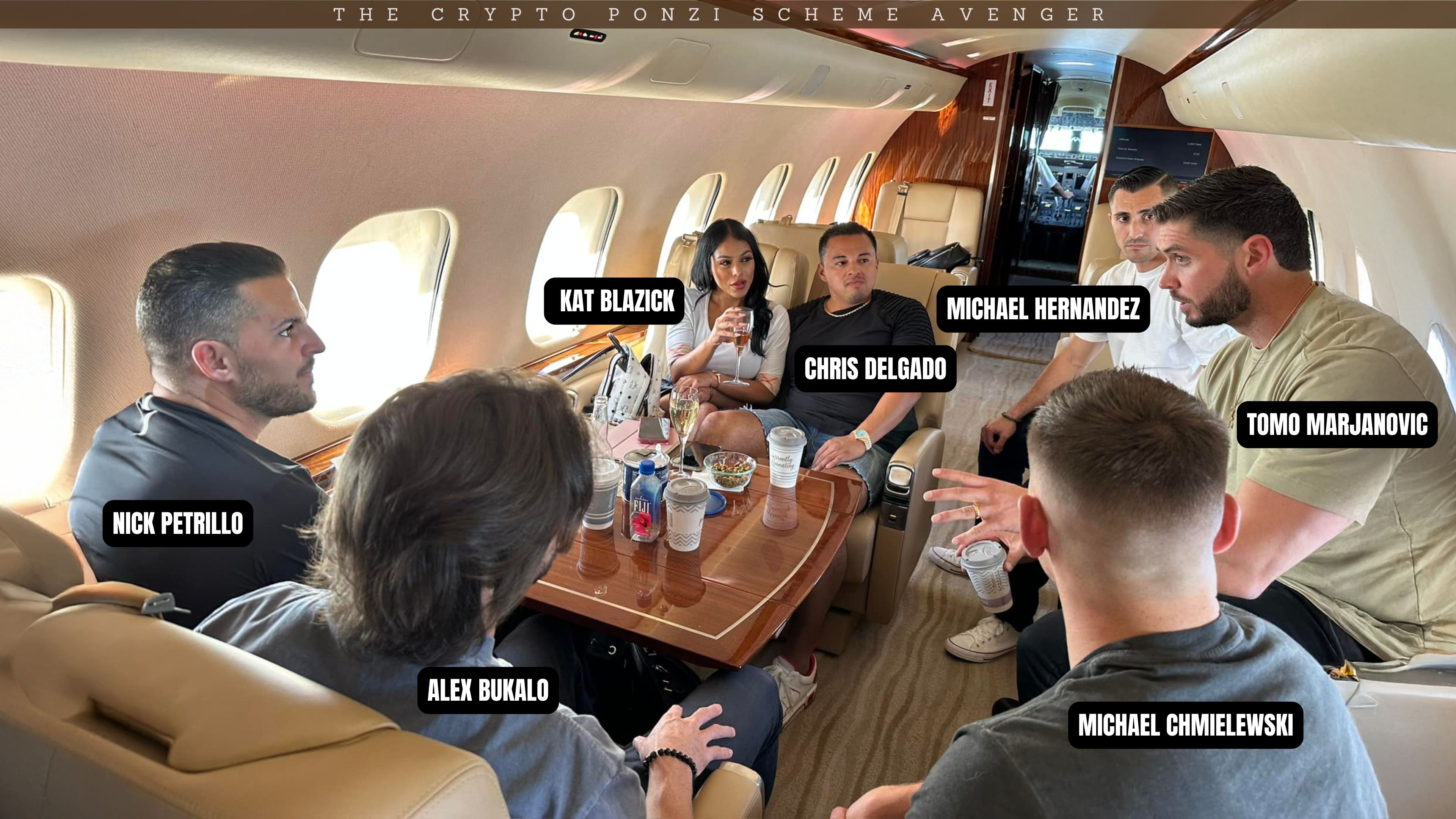

Guaranteed returns regardless of market conditions, principal guarantees, recruitment incentives with MLM-style recruiter payouts (recruiters are paid 1% of deposits brought in or given higher interest on their own deposits), increasing withdrawal delays (90-180 day clauses), manufactured legitimacy through fake “independent” audits, lifestyle marketing with Rolls Royces, Lambos, yachts, pretty women and private jets, and complete lack of verifiable on-chain proof despite claiming blockchain operations all point to Goliath Ventures being an obvious Ponzi scheme.

Early investors received fast withdrawals when the scheme was growing; recent reports state that investors are being told they can only withdraw in chunks of $25,000 when no such limit existed in the past. This is the final stage of a Ponzi collapse.

Joel Glick (Berkowitz Pollack Brant Advisors + CPAs) Audit Claimed By Goliath Ventures

Goliath Ventures claims to have engaged auditing services from Joel Glick (Berkowitz Pollack Brant Advisors + CPAs). But have failed to release any proof of having done so. Furthermore they have hidden the name of the auditor and the audit firm from even folks who have $10 million+ invested into the Goliath Ventures crypto investment.

What is a Ponzi scheme?

A Ponzi scheme is a type of investment fraud where existing investors are paid with money from new investors rather than from legitimate business profits. Named after Charles Ponzi in the 1920s, these schemes create the illusion of legitimate returns while actually operating as a financial house of cards. Ironically, Charles Ponzi worked in a restaurant and was fired for theft, similar to how Chris Delgado was fired from In-n-Out Burger for theft, this was before he started his large ponzi fraud.

Warning signs of a Ponzi scheme:

- Guaranteed high returns with no risk

- Consistent returns regardless of market conditions

- Pressure to reinvest or “compound” rather than withdraw funds

- Secretive or overly complex strategies that can’t be explained clearly

- Unregistered investments and unlicensed sellers

- Account statements not from recognized financial institutions

- Heavy emphasis on recruiting new investors

- Difficulty receiving payments or unexplained delays

Marketing materials that prominently feature “Insured and Bonded” claims while failing to disclose coverage percentages constitute material misrepresentation under Section 17(a) of the Securities Act and Rule 10b-5 of the Exchange Act. These provisions prohibit any device, scheme, or artifice to defraud and the making of untrue statements of material facts or omissions necessary to make statements not misleading.

The admission that insurance claims serve as a “deal closer” suggests intentional use of misleading information to induce investment decisions, which forms the basis for securities fraud charges.

The Original Sin Behind Goliath Ventures – MLP

Goliath appears to be a rebranded continuation of another crypto Ponzi scheme that blew up costing investors tens of millions of dollars – “My Liquidity Partner” (MLP) – a 2021-2022 Ponzi scheme run by Verlin Sanciangco, a Filipino realtor from California that collapsed after defrauding victims of tens of millions. Sanciangco was convicted of wire fraud and fled to Dubai before imprisonment. Verlin Sanciangco is currently believed to be living as a fugitive in the UAE. It is conceivable that Verlin Sanciangco may be pulling the strings of Goliath Ventures.

Chris Delgado’s career is one littered with failures. His first job was at In-N-Out Burger and he was fired for theft. Delgado then worked for a real estate investment passive income MLM, Grant Cardone and others. Then Chris Delgado was promoting the Ponzi scheme Traders Domain, which blew up and cost many people hundreds of millions of dollars. He then connected with Verlin Sanciangco and started promoting My Liquidity Partner.

Nobody in their right mind should be trusting Goliath Ventures, a firm run by a guy who was fired from In-N-Out Burger for theft, with hundreds of millions of hard-earned dollars. Just looking at his past, it is obvious that he’s been involved in a string of MLM and Ponzi scams.

Both My Liquidity Partner and Goliath Ventures use identical liquidity pool business models with guaranteed returns, domains registered within 20 days of each other in October 2021, Dubai operations, promises of investor funds being insured, charitable donations for credibility, and the same personnel including Chris Delgado, Nick Petrillo, Fabian Kumpusch, Vance Fundora, and Carl Moon Runefelt.

A January 19, 2023 photograph shows Chris Delgado meeting with Verlin Sanciangco, MLP Business Dev Officer Tina Lyu, MLP Chief Administrative Officer Anastasia Nepomnyashchikh, and Goliath COO Nick Petrillo – during MLP’s collapse phase.

SeedHunter and Kasta, two crypto projects tied to MLP, are also shown as projects of Goliath now.

Source: goliathventuresinc.com/active-projects/ and goliathventuresinc.com/acquisitions/.

Caught Red Handed With Fake Independent Audit

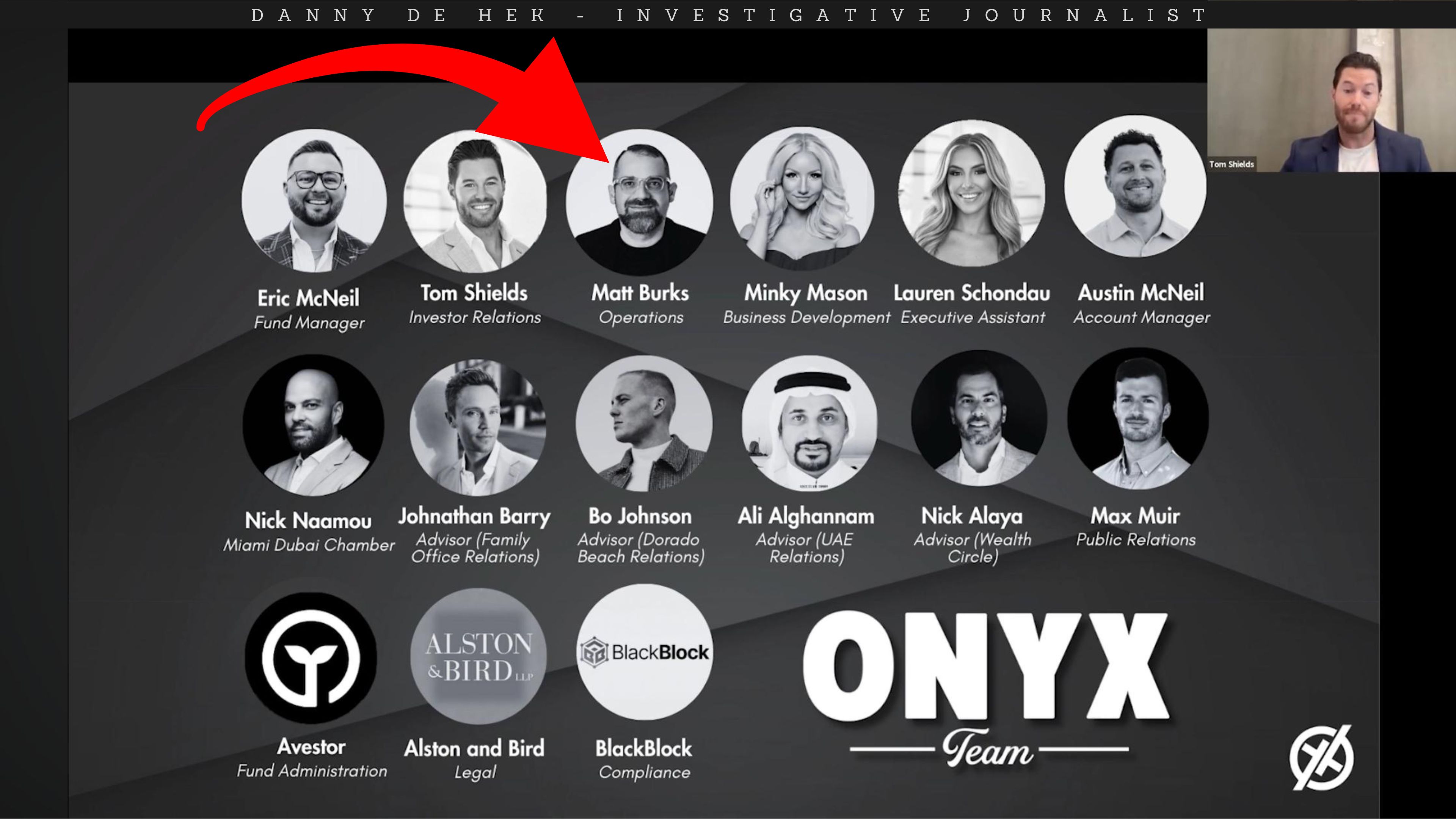

Goliath’s February 2025 “independent audit” by BlackBlock Management Services claimed they maintained “115% of partner balances at all times.”

The problem: BlackBlock CEO Matt Burks is simultaneously Head of Compliance at Goliath Ventures and Founding Partner of WealthMD (a Goliath feeder fund). Matt Burks is an employee of Goliath Ventures and therefore cannot sign off on an independent audit of Goliath Ventures.

When de Hek called Goliath Ventures out, they admitted to this in their response. Delgado himself admitted in writing:

“BlackBlock was, at the outset of its relationship with Goliath, an independent company… After being retained by Goliath as a third party, BlackBlock eventually became subsumed by Goliath and is now not an independent third party.”

A subsidiary auditing its parent company is not an independent audit. This is fraudulent misrepresentation designed to scam investors.

Sale of Unregistered Securities and Running Unlicensed Money Transmission Service – Laws Being Broken Now

Goliath Ventures pitches constitute an unregistered security in direct violation of Section 5 of the Securities Act of 1933, which prohibits the offer or sale of securities without SEC registration.

The presence of general solicitation and advertising without proper registration or exemption compliance is a significant violation of U.S. law. Simply claiming that an investment product is “not a security” does not exempt it when the substance meets the Howey Test criteria: an investment of money in a common enterprise with expectation of profits derived from the efforts of others.

Goliath Ventures is also running a large “money transmission service” and violating U.S. federal and state laws. Operating as an unlicensed money transmitter violates 18 U.S.C. § 1960, carrying criminal penalties of up to five years imprisonment.

Federal law requires registration with FinCEN as a Money Services Business (MSB) and compliance with Bank Secrecy Act obligations, including anti-money laundering (AML) programs and Suspicious Activity Reports (SARs).

The failure to file SARs under 31 U.S.C. § 5318(g) can result in civil penalties up to $250,000 per violation, and willful failure can constitute money laundering conspiracy (18 U.S.C. § 1956) with up to 20 years imprisonment.

Dissolution of Florida Company With No Notification To Investors

Once Danny de Hek exposed Goliath Ventures on September 3, 2025, Goliath Ventures Inc. filed Articles of Dissolution in Florida – the same day Christopher Delgado signed incorporation documents in Wyoming, creating a new GOLIATH VENTURES INC under the same name. Wyoming is notorious for corporate secrecy laws.

A day before, bookkeeper Nadia Bringas dissolved “Bringas Bookkeeping” in Florida (September 2, 2025) and reincorporated in Wyoming the same day. Both dissolutions were handled by the same CPA: Harry M. Samuels, believed to play a significant role in the Goliath Ventures Ponzi scheme.

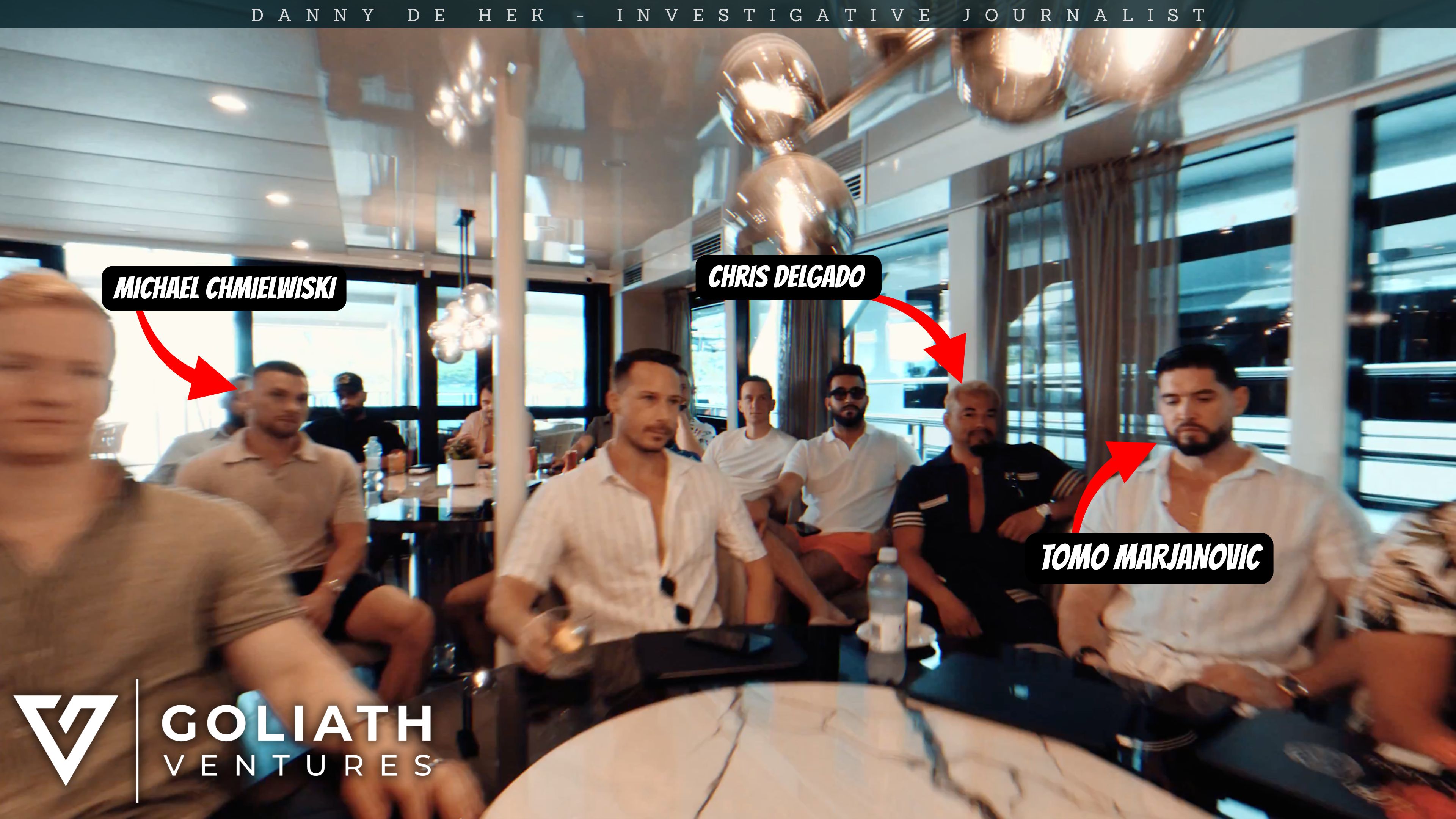

Oh Canada! And Superrecruiters Jayson “Jay” Newton, Michael Chmielewski and Vince Gratta

Goliath Ventures has systematically targeted Ontario, Canada, with Canadian investors – particularly from the Greater Toronto Area (GTA) – representing a large portion of the victim pool. Conservative estimates indicate Canadian investors account for 30-40% of total funds invested, with projected Canadian losses exceeding USD $120 million.

Two key figures orchestrating the Canadian recruitment pipeline are Jayson “Jay” Newton of Canada and Vince Gratta, a Re/Max realtor who leveraged his network to funnel unsuspecting clients into Goliath’s web. Michael Chmielewski (@truemoneymike) has recruited many Canadians into this fraud scheme running the ponzi feeder fund Prime Ledger Capital.

Little Big City of Rich People

Isleworth, Orlando’s ultra-exclusive gated community where Tiger Woods once lived and Shaquille O’Neal still has a mansion, is the epicenter of Goliath Ventures fraud. This enclave of multimillion-dollar estates and championship golf courses has provided Chris Delgado with a concentrated pool of high-net-worth targets, resulting in investment by Orlando’s hospitality, medical and business elite.

The medical community has been particularly targeted. At least 16 doctors from the Orlando area have fallen victim to the scheme, with many Indian investors also caught in the scam.

Perhaps most disturbing is the involvement of members of the Siegel family, the dynasty behind Westgate Resorts and subjects of the documentary “The Queen of Versailles.” Their connection to Delgado has lent the scheme a veneer of legitimacy among Orlando’s wealthy circles.

However, not all of Orlando’s elite have been fooled. Multiple sources within Isleworth and the city’s “old money” community report that Chris Delgado is widely despised.

Several exclusive clubs have reportedly banned Delgado from their premises after members complained about his aggressive recruitment tactics and ostentatious displays of questionable wealth.

The concentration of victims in Orlando’s wealthiest zip codes – Isleworth, Windermere and Bay Hill – represents a deliberate targeting strategy, identifying residents through public records, charity events, and bribed employees at luxury retailers like Rolex and Tiffany.

Another Email, Same Problem: Why the MSB Excuse Doesn’t Explain Missing Money

Investors haven’t been paid for months. Now a lawyer blames MSB delays. This breakdown explains why the excuse fails and asks the real question: where is the money?

Hyper-Compound Illusions: How GOLIATH VENTURES INC Leaves Investors Watching Dashboards Not Payments

Investors are watching balances grow while withdrawals fail. This investigation exposes how hyper-compounding is used to delay exits and hide a large-scale scam.

How to Report Goliath Ventures Inc and Take Action If You’ve Lost Money

Lost money with Goliath Ventures Inc? This guide explains how to report investment losses to U.S. state and federal authorities and take action.

The Origins of GOLIATH VENTURES INC: How Proximity Replaced Proof as Millions Were Raised

A whistleblower-led investigation tracing how Goliath raised millions through proximity, social trust, and recycled narratives—without proof of real operations.

Goliath Ventures Inc: The Deleted Video, The Rewritten Narrative, And The Quiet Exit

A deleted video, frozen withdrawals, and a rewritten future. This investigation breaks down what Goliath Ventures Inc said, removed, and why it matters.

The Collapse of GOLIATH Ventures Inc: Missed Promises, Narrative Control: The Calm Before the Storm

An evidence-based analysis of missed payments, shifting narratives, missing proof, and why investor confidence in Goliath Ventures is rapidly eroding.

Goliath Ventures Inc Dec 15–18: Payouts Promised – Where is The Money? Where is Christopher Delgado?

Investors were promised payouts. Social media was wiped, executives distanced themselves, and the CEO headed to Dubai. This blog follows the money.

Tomo Marjanovic, #GoliathStrong and the Miami Dinner That Exposes Goliath’s Collapse

A loyalty sermon from Tomo Marjanovic exposes rising panic inside Goliath Ventures Inc and reveals why attending the Miami dinner may be a serious risk.

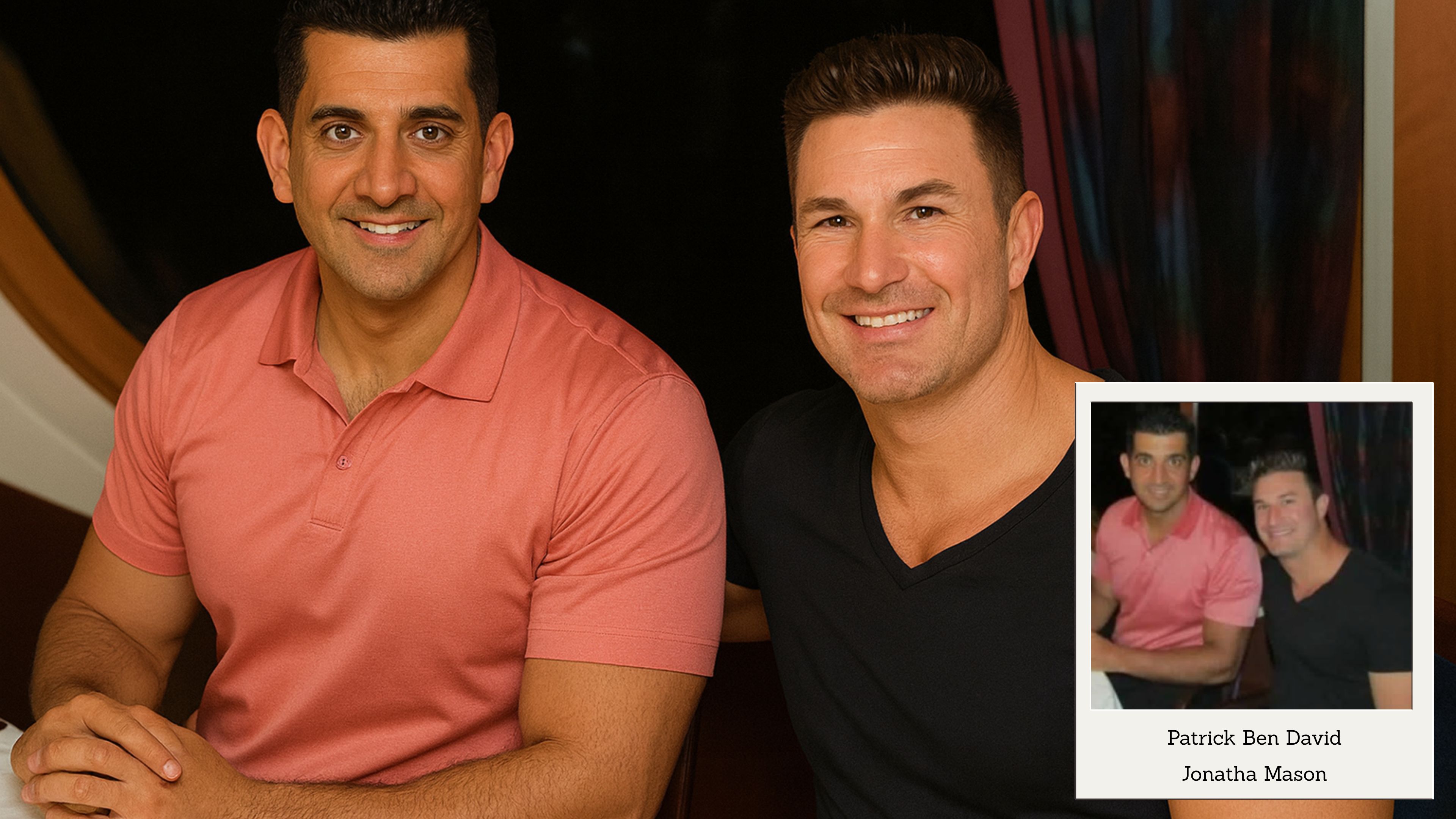

Goliath Ventures: Chris Delgado and Jonathan Mason Ruin Christmas! Canadians, Hide Your Wallets!

Goliath Ventures’ promised payouts, frozen accounts, intimidation tactics and a suspicious December event reveal a crisis investors can no longer ignore.

Andrew Tate’s Hyperliquid Wipeout – And Why Goliath Ventures Investors Should Pay Attention

Andrew Tate’s $802k Hyperliquid wipeout exposes a reckless trading culture that overlaps with the Goliath Ventures collapse and its shadow-network connections.

Goliath Ventures Payouts Stop: Insiders Pull 10’s of Millions While Everyone Else Waits

Goliath Ventures has frozen payouts while insiders quietly withdraw millions. A deep dive into the lies, red flags, and forensic audit excuse investors were never told.

Stephen Davis: The Fire Chief Who Walked Out of the Firehouse and Straight Into a Financial Inferno

A sponsored article recasts Stephen Davis as a hero, but behind the PR shine lies his role inside Goliath Ventures as investigations close in.

GOLIATH VENTURES INC’s Secret Bank Switch: The Collapse Behind the “Transparency” Spin

GOLIATH VENTURES INC claims new “banking collaborations” as panic grows. Here’s what their latest newsletter really means for investors.

Whistleblower or Opportunist? The Anatomy of a Non-Whistleblower Who Protected Goliath Ventures

A supposed whistleblower from Goliath Ventures turns out to be an investor hiding profits, not exposing truth. Silence isn’t safety—it’s complicity.

Florida Orlando Ponzi Scheme Sues New Zealand Journalist, $150,000 Bribe Attempt

New Zealand journalist exposes Goliath Ventures — a Florida Orlando Ponzi scheme accused of fraud, bribery, and using Florida courts to silence critics.

Crypto Prices Crash! Goliath Ventures Investors Should Be Very Worried

Billions vanish in the biggest crypto crash yet — and Goliath Ventures investors may be next. It’s time to ask where your money really is.

Dirty Tactics: How GOLIATH VENTURES INC Is Abusing YouTube’s Copyright System to Silence Journalism

Goliath Ventures and Shavez Ahmed Siddiqui are using fake copyright strikes to silence journalism exposing their Ponzi-style crypto investment scams.

Danny vs Goliath: New Zealand Journalist Sued by Christopher Delgado’s Goliath Ventures Inc.

New Zealand journalist Danny de Hek faces GOLIATH VENTURES INC in a dramatic U.S. lawsuit led by Christopher Delgado. Truth meets power in court.

Tyler Peters & Lauren Peters: The Double Agents Who Tried to Silence an Investigation

Tyler and Lauren Peters tried to silence an investigation after being caught partying with alleged Ponzi operators. The full call now exposes their deceit.

Goliath Ventures Ponzi: Verlin Sanciangco & My Liquidity Partner (MLP) Scam Rebranded

Leveraging photo ops and name-drops with high-profile political figures such as Kash Patel, Mike Johnson, and Eric Trump to project an illusion of legitimacy and powerful connections.

Who Is Still Profiting From Goliath Ventures Inc, Orlando Ponzi? Don’t Drop The Soap.

A $500M Ponzi in Orlando is collapsing. Delgado and Goliath Ventures are exposed — but who else is still profiting from stolen investor money?

What Real Quant Funds Look Like Vs. Goliath Ventures, FL Ponzi Scam

Goliath Ventures claims $500M under management, but behind the hype lies no real team, no audits, and every red flag of a Florida Ponzi scheme.

The Unregistered Securities Problem: Why Goliath Ventures’ Contracts Are Likely Illegal

Goliath Ventures faces collapse as unregistered securities, fake audits, and Ponzi clawbacks threaten investors, recruiters, and insiders.

Goliath Ventures Inc Florida Ponzi Collapse, Coming Clawbacks and Arrests

Goliath Ventures faces collapse. Investors may lose “profits” to clawbacks while recruiters risk prison for selling unregistered securities.

Goliath Ventures Inc (Christopher Delgado) and the Missing FinCEN Registration: Why It Matters

Goliath Ventures skipped FinCEN MSB registration, exposing its leaders to fraud charges, asset seizures, and major regulatory enforcement.

Pull Money While You Can! Goliath Ventures Ponzi Exposed by FAKE Audit. Florida Ponzi Scheme SCAM

Goliath Ventures, Wealth MD, and BlackBlock exposed as a Ponzi network. Investors urged to demand withdrawals now before it’s too late.

Response to Cease and Desist Letter – Goliath Ventures / Chris Delgado

Our reply to Goliath Ventures’ lawyers challenges why they defend Chris Delgado amid allegations of securities fraud and running a crypto Ponzi scheme.

Orlando Crypto Ponzi Scheme: Chris Delgado, Nadia Bringas (The Bookkeeper), and Goliath Ventures

Chris Delgado’s empire unravels as bookkeeper Nadia Bringas dissolves her company while signing off his $3.2M mansion. The paper trail is vanishing.

Chris Lord Delgado Claims “Smear Campaign” – Goliath Ventures Exposed in My Full Response

Chris Delgado of Goliath Ventures hits back at exposure with a four-page PDF. My full reply shows why this is more smoke than substance.

Goliath Ventures Exposed Part 3: Christopher Delgado, Matt Burks, BlackBlock and the Compliance Illusion

Leaked video exposes Goliath Ventures’ compliance theatre, fake audits, and conflicts of interest involving Matt Burks and BlackBlock.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand