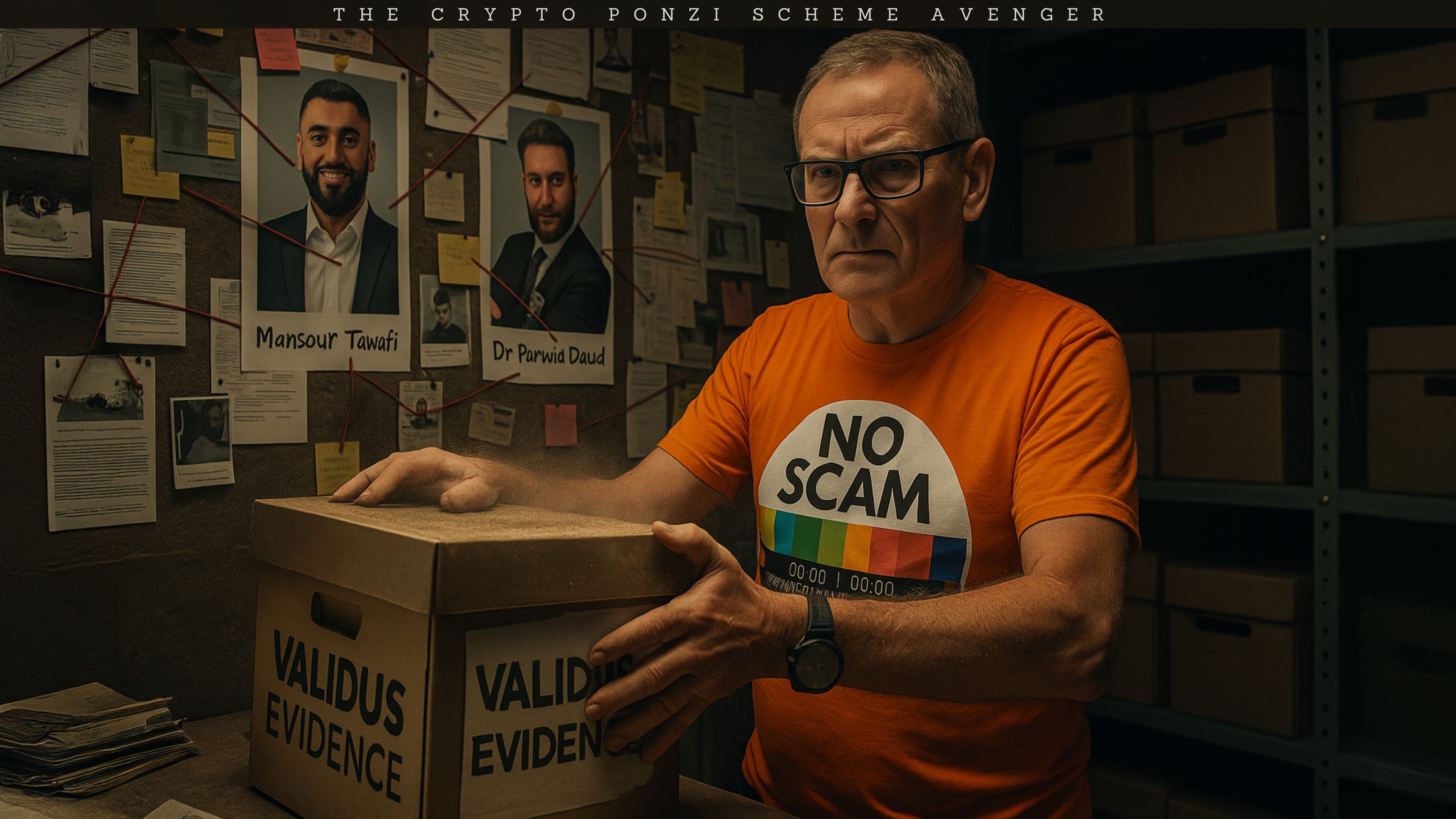

In the wake of Validus’s collapse in April 2023, the founders have split into two new projects — Mansour Tawafi now fronting ODECENT, and Dr Parwiz Daud behind Defily.

Both are repackaged iterations of the original fraud, each launched with familiar MLM playbooks and targeting the same vulnerable investor base.

While ODECENT is still actively running events and opening offices in regions like Dubai and Thailand, it continues to raise red flags. Despite recent promotional pushes, the underlying structure and regulatory risks remain unchanged, as extensively documented by BehindMLM.

BehindMLM: The Red Flags and Fraud Blueprint

Credit to Oz at BehindMLM, who provided a thorough breakdown of how ODECENT and DeFily are direct extensions of the Validus fraud:

- ODECENT offered no retail products — only access to an “AI trading bot.”

- Investors were promised 600%+ ROI caps, blatantly suggesting it was a passive investment program.

- The entire compensation model was MLM-driven, with binary team commissions, matching bonuses, rank bonuses, and promotional rewards like Rolex watches and even a Lamborghini.

- Entry levels ranged from $50 to $50,000, with higher tiers unlocking higher earning potential.

- ODECENT claimed to offer trading via managed bots or user-controlled exchange bots, the latter pitched as a “you control your money” option — a classic scam misdirection to give victims a false sense of security.

None of this was registered with any financial authority. Like Validus, ODECENT offered unlicensed securities and operated illegally in any jurisdiction that regulates investment schemes.

Meanwhile, Defily, launched by Dr Parwiz Daud, also fails to provide ownership details and follows the exact same scam structure:

- No retail products.

- Investment tiers ranging from $100 to $1,000,000.

- Promises of passive returns generated through another “AI trading bot.”

- MLM-based compensation, team ranks, and even gifts like iPhones, Rolexes, and a Tesla Cybertruck.

- $30 membership fee, plus thousands in “access” payments to join and earn.

Defily’s growth has reportedly stalled. As of April 2025, traffic was so low that SimilarWeb couldn’t even track it.

BehindMLM rightly states:

“The long and the short of it is if trading was taking place, Daud would just run Defily’s purported bot for himself.”

Both Odecent and Defily constitute securities fraud and likely operate as Ponzi and pyramid schemes. The strategy hasn’t changed — only the branding.

Mansour Tawafi’s Video: Excuses and Contradictions

In a video dated 12 September 2024, titled “Recent Developments | 12 SEP WITH MANSOUR TAWAFI”, Tawafi blamed dishonest partners, court delays, and slow recoveries while promoting ODECENT as a “side solution.”

He:

- Claimed $140 million in losses was being pursued legally.

- Pitched ODECENT as a backup plan to relieve pressure on the collapsed network.

- Contradicted himself by claiming 100% focus on recoveries while openly launching a new revenue stream.

Ten months later, no financial documents or updates followed. The YouTube channel went dark — yet the brand continues with offline events and regional growth, keeping the Ponzi flames alive.

Facebook Fables: Legal Victories Without Proof

A 12 April 2025 Facebook post from “Validus Team Global” claimed:

- Validus had “won its legal case.”

- At least $60 million in recoveries were guaranteed.

- Clients would be reimbursed before affiliates.

No legal filings or independent confirmations have surfaced to support these claims. This appears to be more reputation management theater designed to prevent backlash or lawsuits.

Those Who Enabled the Scam

From official documents and marketing materials, a number of individuals were found to have promoted or fronted the VALIDUS Ponzi scheme. These individuals played a role in recruiting others into the scheme — often profiting from referral commissions while encouraging others to invest in a fraudulent platform.

The following names were identified from Validus marketing content, pitch decks, and leadership documentation:

- Mansour Tawafi – Co-founder, public figurehead, and central executive force. Previously associated with OneCoin and AuLives before Validus.

- Howard Friend – Former CEO and advertised trader of investments.

- Billal Ali – Co-founder.

- Salman Shahzad – UK-based top recruiter.

- Philippe Moser (aka Phil Moser) – Executive and webinar host, active across Latin America and Africa.

- Parwiz Daud – Launched Defily, previously associated with OneCoin and AuLives.

- Angelica McCormack – Appears in due diligence materials as a key network leader.

- Julius Mbuti – Active promoter across Africa.

- Naveed Ahmed – Named among senior representatives in team-building events.

- Fahad Naeem – Involved in international expansion and training content.

- Nicolas Leonida – International trading trainer.

- Fadi Baba – Led teams in Oceania, first to achieve Crown Diamond, and key player assisting Tawafi with masterminding the scheme.

These individuals should be held accountable for their role in enabling what regulators across multiple countries have called a fraudulent investment scheme.

Call for Evidence

If you have information, documentation, or firsthand experience related to Validus, ODECENT, or Defily — including financial losses, leadership communications, or compensation structures — please consider reaching out. Confidentiality will be respected. We welcome any credible information that can help expose those behind these schemes and prevent future harm.

Conclusion: Rebrand, Relaunch, Repeat

This blog isn’t here to report on ODECENT or Defily’s hype — it’s to document the ongoing evolution of the same fraud, launched by the same people, using the same tactics.

Tracey Burgess’s reported legal action against Validus is a notable shift from within the original corporate network and will be monitored as it develops.

Let this be a warning:

- Validus was a Ponzi scheme.

- ODECENT is its rebrand.

- Defily is its replica.

Same actors. Same lies. Same damage.

I’m The Crypto Ponzi Scheme Avenger. If you’ve got intel, I want it. If you promoted this scam and think you’ve gotten away with it — think again.

Thanks again to BehindMLM for their tireless work exposing these fraudulent investment schemes.

If someone from Dubai approaches you about a trading opportunity with a multi-tier affiliate structure — run.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand

Thank you for the information.

There was another platform called Global Cycle. It also scammed a lot of people in Australia of hundreds of thousands of dollars.

Is there anything you can do to recover the money?

Please advise

Hi Jai, thanks for reaching out.

I haven’t come across Global Cycle before, but if it operated anything like VALIDUS or similar MLM Ponzi schemes, it likely followed the same playbook — anonymous founders, passive income promises, and heavy recruitment incentives.

Unfortunately, recovering funds from collapsed schemes like this is extremely difficult, especially when they were never legally registered. And be careful — most so-called “recovery agents” are scams themselves.

That said, if you’ve got screenshots, names, domains, or wallet info connected to Global Cycle, I’d be happy to take a look. If you’re open to it, I’ve recently launched a sponsored review service that allows me to do deeper investigations into schemes like this. While it’s totally optional, it helps me dedicate more time to exposing scams and raising awareness.

If you’d like to sponsor a review, you can do so here:

https://ko-fi.com/s/e450de6745

Appreciate the comment — and stay alert out there.

— Danny

The Crypto Ponzi Scheme Avenger