“If a website shows you trading profits, it isn’t trading for you — it’s training you to give up more money.”

When people are pitched online “investment opportunities” through Telegram or WhatsApp, they almost always ask the same question: Is this website real?

That question misses the bigger picture.

This blog is not about one dodgy platform or one unlucky investor. It’s about how fake trading websites are mass-produced, how they’re marketed through private messaging apps, how they rely on fake dashboards, crypto-only payments, and scripted conversations, and why engaging with them at all — even “just to test” — means the scam has already worked.

It also addresses a reality many people don’t want to confront: these scams increasingly overlap with human trafficking and forced labour, and every interaction helps keep that system alive.

What follows is the full anatomy of one of these schemes, exposed end to end.

How This Investigation Started

I was contacted by someone who didn’t open with panic or embarrassment. He didn’t claim to have been scammed. He simply asked whether there was a way to shut something down.

He had been approached through Telegram by a group operating under the name SA SME FUNDS. The approach was deliberately quiet. There were no phone calls, no presentations, no webinars, and no obvious MLM structure. That absence of noise was not accidental — it was the first layer of trust-building.

Inside the Telegram group, members posted constant screenshots of supposed profits. Everything appeared calm, consistent, and reassuring. Nobody ever lost money. Nobody questioned the returns. The environment was carefully controlled.

From that group, he was directed into a private Telegram conversation with a person using a real-sounding name. That’s where the instructions became specific.

He was told to deposit Bitcoin into a wallet address.

No invoices.

No company bank account.

No paperwork.

After sending a small amount, he was told trading had begun on his behalf.

What he was then given wasn’t proof of trades.

It was a website.

The Fake Trading Website That Locks People In

The platform presented itself as a trading dashboard. It showed charts, balances, daily growth, and performance metrics. Within days, the account displayed dramatic gains — the kind of returns that simply do not exist in legitimate trading environments.

This is where critical thinking usually stops.

The website becomes the authority.

The Telegram contact fades into the background.

The numbers on the screen take over.

But this is the deception.

These websites do not connect to markets. They do not execute trades. They do not generate returns. They are interfaces designed to display numbers.

Charts move because they are programmed to move. Balances increase because someone typed them in. The dashboard exists to condition belief, not reflect reality.

Once the screen is trusted, everything else becomes negotiable.

The Withdrawal Trap

The illusion holds until one moment: withdrawal.

When the informant attempted to withdraw, the rules suddenly changed. He was told a 15% commission fee had to be paid upfront to “release” the funds.

Not deducted from profits.

Paid separately.

This is the classic advance-fee scam.

There is no withdrawal.

There never was.

The fee is simply the next extraction.

This is where most victims lose far more than they ever intended, because they’ve already seen “profits” and believe they’re one payment away from accessing them.

The informant stopped here. He did not pay again. Instead, he stepped back and examined the website itself.

That’s when everything unravelled.

What the Website Reveals When You Click It

At a glance, these platforms look professional. That’s intentional. But legitimacy isn’t about appearance — it’s about whether a site survives scrutiny.

When you actually click through the site, the cracks appear immediately.

Pages that should legally exist either don’t load or return errors:

- Licences and regulation

- Risk warnings

- Trading conditions

- Privacy policy

- Safety of funds

Footer links pretend these documents exist, but clicking them loops back to the homepage or a dead URL.

This isn’t sloppy development.

It’s compliance theatre.

The site reassures visually while offering nothing legally binding.

Crypto-Only Payments Are the Point

One of the biggest red flags people try to rationalise is the insistence on crypto.

There is never an option to pay into:

- a registered company bank account

- a named beneficiary

- a verifiable legal entity

Crypto removes chargebacks, banks, regulators, and recovery. Once funds are sent, they’re gone.

If this were legitimate, a bank account would exist.

It doesn’t — because that would expose the operation.

This Is a Clone Factory, Not a Business

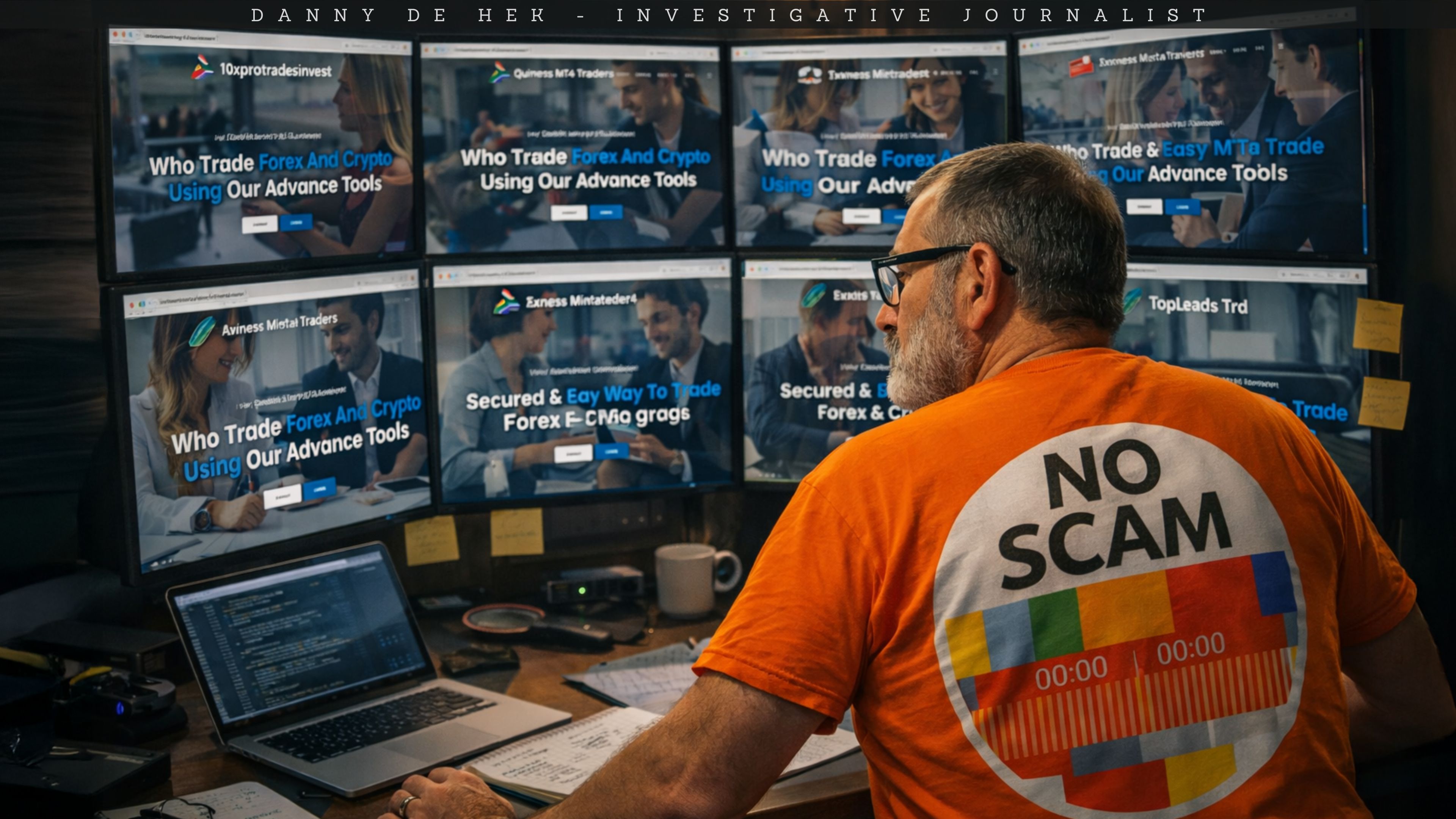

Once I checked the address and wording, the scale became obvious.

Multiple “trading” websites use the same physical address, the same layout, and identical wording, with only the branding changed.

Examples include:

- topleads[.]cc

- derievxmt4trades[.]com

- savxcalimitedgroep[.]com

- fxgmtrader.co[.]za

- esnesxmetatraders4[.]co[.]za

- quiltamt4trades[.]co[.]za

- cryptodigitaltrade[.]com

- 10xprotradesinvestcap[.]com

Different names.

Different logos.

Same address. Same content.

These are not competitors. They are clones.

The Identical “About Us” Page

Every one of these sites claims independence and experience — yet every one uses the exact same About Us page, word for word, including the same spelling mistake.

They all claim “10+ years of experience in standard professional services.”

Real companies do not share biographies.

Real companies do not copy origin stories.

Real companies do not repeat identical errors across brands.

This is mass production.

Why These Scams Look Like This

People naturally ask: Who is running this?

International reporting from Reuters, the Associated Press, the BBC, The Guardian, and the UN has documented the rise of large-scale scam compounds across Southeast Asia, particularly along the Thailand–Myanmar border.

These are human trafficking operations.

People are lured by fake job offers, trapped inside secured compounds, and forced to run online scams — including fake crypto trading schemes — under threat of violence. Survivors have described beatings, electric shocks, confinement, and punishment for missing quotas.

This explains the scripts.

The cloned websites.

The refusal to speak on the phone.

The relentless pressure to deposit and pay fees.

The people messaging you may themselves be victims — but every interaction sustains the system.

Stop “Testing the Waters”

This needs to be said plainly.

There is no such thing as safely testing a fake trading platform.

Sending a small amount does not make you careful.

Trying a small withdrawal does not protect you.

Getting money out does not make it legitimate.

Even connecting a wallet or submitting KYC details means the scammers have already won. Your data is now in circulation.

The scam doesn’t begin when you lose money.

It begins when you engage.

Why the Informant Reached Out

The informant didn’t reach out because he was unlucky. He reached out because he recognised the pattern.

He understood this wasn’t one bad website — it was a repeatable scam model designed to resurface endlessly under new names.

He asked whether it could be shut down. The truth is there’s no single switch. These operations burn domains and move on.

What works is exposure, pattern recognition, and stopping people before they send the second payment.

What This All Comes Down To

Fake trading platforms are not risky investments.

They are not misunderstood opportunities.

They are interfaces designed to extract belief, money, and data.

There is no better version.

There is no safe test.

There is no legitimate website hiding among them.

Protection doesn’t come from choosing better.

It comes from recognising the structure — and refusing to engage at all.

That is the line that stops the loss.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand

Leave A Comment