When Andrew Tate’s Hyperliquid account was effectively wiped out on 18 November 2025, most people saw it as just another meme-worthy moment for a controversial influencer.

On-chain analysts saw something different: a live-fire case study in high-leverage gambling that ended exactly how these stories usually do – with the house winning.

Andrew Tate is widely known as an online influencer who built a brand around wealth, masculinity, and financial dominance. For years, he has promoted the idea that he is a world-class trader with the ability to “read the markets.” But the verified on-chain data tells a completely different story. His trading performance shows consistent losses, reckless leverage, and catastrophic liquidations. The only reason he matters in this context is because his messaging, persona, and network overlap heavily with the same influencer ecosystem that GOLIATH VENTURES has been using to build legitimacy. People don’t need his full biography – only that he presents himself as a trading expert, while the blockchain proves he is one of the worst performers in the space.

At the same time, GOLIATH VENTURES INC – an alleged crypto “quant” fund with ties into the same influencer ecosystem – suddenly announced a payout freeze and “forensic audit”, halting distributions due on 14 November 2025.

I want to be very clear up front:

- There is currently no on-chain evidence that GOLIATH VENTURES funds were traded on Hyperliquid, or that Andrew Tate’s liquidations are directly connected to the Goliath collapse.

- What is interesting is the timing, the overlapping social networks, and the shared storyline: “genius traders” promising easy money while secretly bleeding capital on high-risk bets.

This blog pulls together the verifiable on-chain data on Tate’s trading, then looks at how that context overlaps with what we already know about GOLIATH VENTURES INC – and where the line between fact and theory must be kept.

What the on-chain data shows: Tate’s Hyperliquid blow-up

Blockchain analytics firm Arkham Intelligence and multiple crypto outlets have now mapped out Tate’s Hyperliquid account in detail:

- He deposited a total of around $727,000 into Hyperliquid.

- He never made a single withdrawal – every dollar stayed on the exchange.

- He also earned roughly $75,000 in referral rewards, paid to him because his followers signed up through his reflink, and he gambled that away as well.

- As of 18 November, his remaining balance was about $984.

The final act was a leveraged Bitcoin long that wiped around $112,000 in one shot when BTC sold off, leaving his account essentially empty.

Leveraged trading is essentially borrowing money from the exchange to massively increase the size of your position. If you put in $10,000 and use 20x leverage, you are suddenly trading with $200,000. It sounds impressive until you realise the risk works the same way in reverse. A tiny price movement against you can wipe out your entire account, because the exchange automatically liquidates the position to recover what you borrowed. That’s exactly why Tate’s account collapsed in minutes. Leverage doesn’t just magnify gains – it accelerates losses, and once liquidation triggers, the money is gone for good.

So the headline numbers are:

- $727,000 own deposits

- $75,000 referral bonuses

- ≈ $802,000 total pushed into trades

- ≈ $802,000 total lost, with no withdrawals

This is not “smart risk management”. This is casino behaviour with a referral link attached.

Tate’s trading record: one of the worst in crypto

The Hyperliquid wipeout wasn’t a one-off. It was the end of a months-long pattern of catastrophic trading that had already been documented before the final liquidation.

On-chain breakdowns published in October and November 2025 show:

- More than 80 trades executed on Hyperliquid in 2025.

- Only 29 of those trades profitable – a win rate of around 35–36%.

- Cumulative realized loss of roughly $700,000 before the final November BTC liquidation.

Some of the largest recorded hits include:

- June 2025 – ETH long, 25x leverage: about $597,000 lost on a single Ethereum position.

- September 2025 – WLFI long: $67,500 liquidated, re-entered, and liquidated again.

- 26 September 2025 – BTC long: Hyperliquid liquidation of roughly $93,000 on a Bitcoin long.

- 14 November 2025 – BTC long, 40x leverage: another $235,000 wiped out just days before the final blow-up.

- August 2025 – YZY short: one of the very few winners, netting around $16,000, which was then erased by subsequent losing trades.

By mid-October, on-chain analysts were already describing Tate as “one of the worst traders in crypto”, based on verifiable PnL data rather than vibes.

If you strip away the branding, what you have is a highly leveraged degen with a sub-40% win rate, burning through hundreds of thousands of dollars in real time while telling followers he has “unmatched perspicacity”.

Does he still have crypto left?

Despite the “fully liquidated” headlines, it’s important to be precise: that phrase applies to his Hyperliquid account, not his entire net worth.

Previous OSINT work linking wallets to Tate via Arkham and other trackers shows:

- An Ethereum wallet holding on the order of tens of thousands of dollars (mostly ETH plus illiquid small-cap tokens).

- A Solana wallet with roughly $100k+ in memecoins, including DADDY and TOPG, plus a few hundred SOL.

- The majority of those self-promoted tokens are down 70–99% from peaks.

Romanian authorities, in court documents and press statements, have previously pegged his total net worth at around $12 million – far below his public boasts of being a “trillionaire,” but still more than enough to treat an $800k loss as painful rather than terminal.

So no: Tate is not broke. But he is demonstrably bad at trading, and the on-chain record makes that impossible to spin away.

Verified On-Chain Wallet Addresses (Publicly Attributed)

To support the analysis above, it’s worth highlighting that several crypto wallet addresses have been publicly attributed to Andrew Tate by on-chain intelligence platforms. These are not legally confirmed addresses, and they may not represent all of his holdings, but they are widely referenced by blockchain analysts tracking his activity.

The following addresses appear in public OSINT sources:

- Ethereum wallet:

0xf045d1bd1d505c2e65397884e2abbd8e53418fc4

(Regularly cited in on-chain portfolio snapshots attributed to Tate.) - Solana wallet:

4jRX4iW2F5wBnfYMyB7RjS2PU5MjXrST3fB9DoV4BjHa

(Referenced in analyses of Tate’s exposure to memecoins such as DADDY and TOPG.) - Additional Ethereum-linked address:

0xf045d1bd1d505c2e65397884e2abbd8e53418fc4

(Appears consistently across multiple OSINT datasets attributing activity to Tate.)

These addresses should be viewed as public attributions by analysts, not formal confirmations. They are useful for understanding Tate’s on-chain footprint and the movement of funds into platforms like Hyperliquid, but should not be interpreted as exhaustive or definitive. Wallet ownership can change, new wallets can appear, and attribution may evolve over time.

Where GOLIATH VENTURES fits into this picture

Now we get to the part GOLIATH investors will care about.

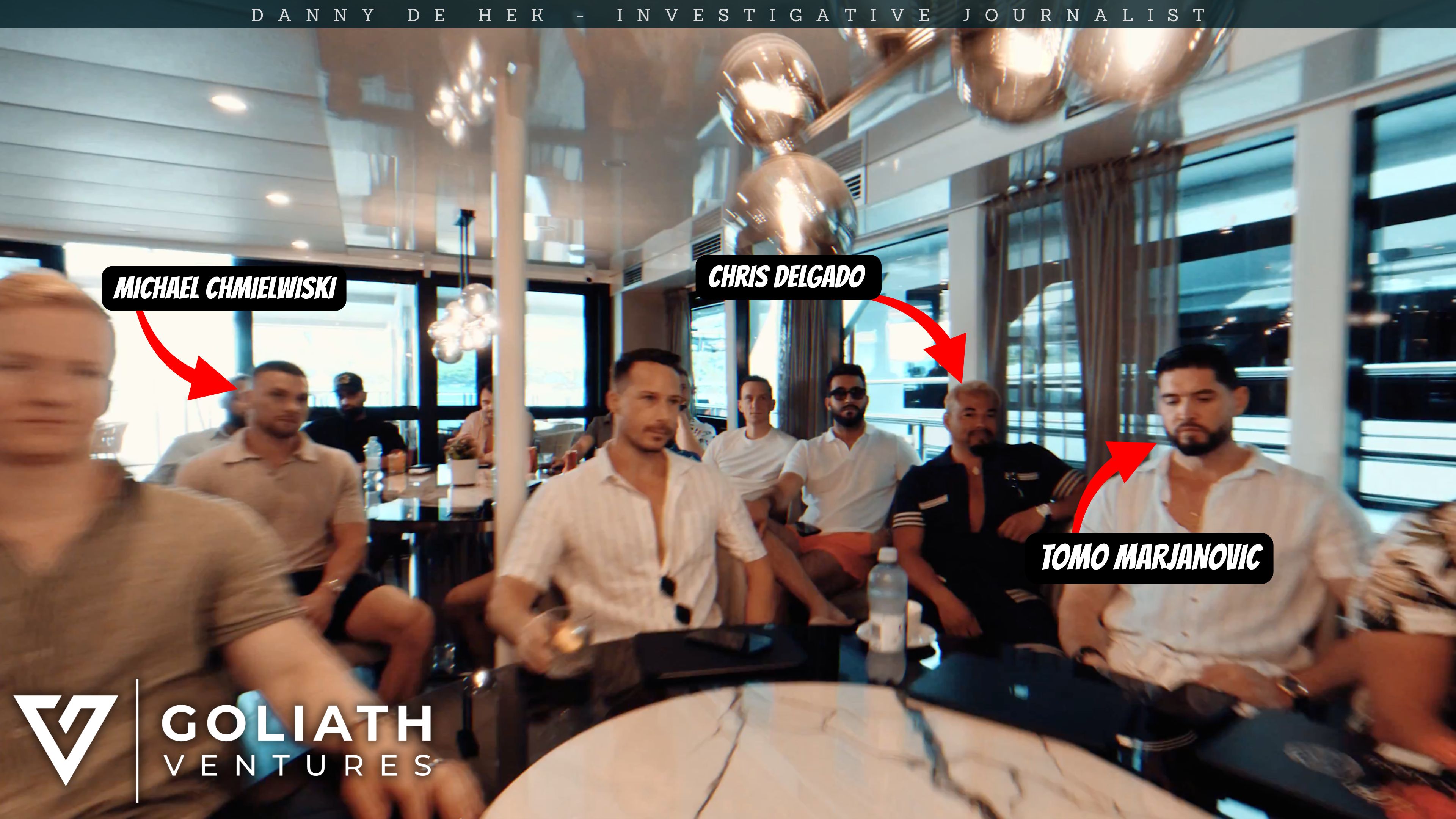

In earlier work on GOLIATH VENTURES INC, we’ve already mapped a network of influencers and recruiters around Chris Delgado, including Tomislav “Tomo” Marjanovic Jr. and Michael Chmielwiski who has publicly fawned over Andrew Tate and “seems to be in business with” him, according to OSINT-based reporting.

At the same time:

- GOLIATH VENTURES marketed itself as a sophisticated, low-risk “quant” operation, supposedly generating up to 60–80% a year through clever trading.

- Your own forensic work has already concluded that “there was never any trading”, and that less than 1% of investor funds ever touched a crypto blockchain.

- On 14 November 2025, GOLIATH failed to pay scheduled distributions, then sent out an email citing a “forensic audit” and stopping payouts indefinitely – while insiders quietly pulled out tens of millions for their own families and partners.

Four days later, on 18 November, Tate’s Hyperliquid account imploded as Bitcoin crashed from over $100k down towards the $90k region, triggering hundreds of millions in liquidations across the market.

So we have, in the same window of time:

- A self-styled “Top G” trader blowing up a heavily leveraged account, fully documented on-chain.

- A Ponzi-like “quant” operation halting payouts and hiding behind an unverified “forensic audit”.

- Social and business overlap between GOLIATH insiders and the Andrew Tate ecosystem.

That doesn’t prove direct financial linkage. But it does raise very reasonable questions about what kind of risk culture these people share, and what that means for anyone who trusted their “trading genius”.

The War Room connection

There is one more layer of context that helps illustrate the kind of environment Christopher Delgado seems to be moving in.

Andrew Tate runs an organisation called The War Room – a shadowy, ultra-masculine “brotherhood” marketed as a global network of elite men.

Tate promotes it with lines like:

“You understand the world is run by shadow networks. So isn’t it time you joined one of the world’s shadow networks?”

Their website leans heavily on:

- Blurred faces and carefully obscured identities

- Language about brotherhood, power and global reach

- The idea that 99.9% of men will never experience this level of community and access

- A claim that money is trivial compared to “the true realms of power”

Almost all of the unidentified businessmen shown on thewarroom.ag have their faces blurred, apart from a select few. It is designed to feel like a shadow network: exclusive, secretive, above normal scrutiny.

On 27 September 2025, Andrew Tate posted a three-minute video on X (1.3 million views) showing what appears to be a War Room gathering:

three large yachts, around fifty men, and a vibe that screams “exclusive inner circle”.

At 1:16 in that video, when you go through frame by frame, you can clearly see:

- Christopher Delgado (CEO), seated in a meeting

- Tomo Marjanovic Jr. (Director of Partner Services) beside him

- Michael Chmielwiski (Director of Partner Services) also known as Top Sail Whiksey

- All appearing inside what looks like a War Room-style gathering

Christopher was not featured as a main character in the edit. His face was not blurred, he simply appears in one of the frames as the camera pans. You only pick him up if you go through frame by frame.

The point isn’t to prove anything criminal from that clip.

The point is to show the type of people and networks he is connected to:

- A secretive brotherhood marketing itself as a shadow network

- A culture built around power, loyalty, wealth signalling and “above the law” energy

- The same ecosystem that platforms and glorifies Andrew Tate, whose on-chain trading record is objectively disastrous

We don’t need to claim that GOLIATH money went into The War Room or that Tate traded investor funds. The War Room connection plants the seed about the environment Delgado chose to move in while taking money from everyday investors.

What we can say factually vs what remains theory

To keep this clean, here’s the separation line.

Facts backed by on-chain and documentary evidence:

- Tate’s Hyperliquid account: ~$727k deposited, ~$75k referral rewards received, no withdrawals, balance ~$984 after multiple liquidations, including a $112k BTC long wipeout on 18 November 2025.

- Tate’s trading performance: >80 trades, ~35.5% win rate, cumulative loss of around $700k on that Hyperliquid account before the final liquidation, with single-trade losses of $597k (ETH), $67.5k (WLFI), $93k (BTC), and $235k (BTC).

- Tate’s broader situation: facing ongoing legal proceedings in Romania and elsewhere on charges including human trafficking and organised crime; he denies all allegations.

- GOLIATH VENTURES: has now stopped payouts, announced a vague “forensic audit”, refused to name the audit firm, and in the same breath claims everything is “robust” and “healthy” while giving no timeline for resuming withdrawals.

- Your earlier GOLIATH investigation: concludes, based on contracts, bank records, whistleblower testimony and OSINT, that GOLIATH VENTURES INC is operating as a Ponzi scheme, with <1% of funds ever touching a blockchain and no real crypto trading activity.

What is not yet proven (and should be framed as theory/possibility):

- That GOLIATH VENTURES investor money was ever placed into leveraged positions on Hyperliquid or any other derivatives exchange.

- That Andrew Tate’s personal liquidations directly triggered or worsened GOLIATH’s payout freeze.

- That there is a formal, documented business partnership between Tate and GOLIATH VENTURES (beyond social media engagement and apparent networking via people like Tomo Marjanovic).

Given the existing evidence, the most defensible way to present the connection is:

The same circle of influencers promoting GOLIATH VENTURES also platform and praise Andrew Tate, whose on-chain record shows extreme leverage, terrible risk management, and huge realized losses. In that context, GOLIATH’s claims of safe, sophisticated trading deserve even more scepticism – especially when the scheme has now frozen payouts during a major crypto drawdown.

That is a pattern analysis, not an allegation of shared wallets.

Why this matters for everyday investors

For retail investors – in GOLIATH or in whatever the next “exclusive fund” calls itself – the Tate liquidation is a useful x-ray of how these people actually behave with money once you strip away the branding:

- Screenshots lie. On-chain doesn’t. Tate bragged about big wins; the ledger shows a near-unbroken string of wipeouts.

- Leverage kills slowly, then all at once. It took dozens of trades and months of losses before the final blow, but the result was the same: the account went almost to zero.

- Influencer culture and Ponzi culture feed each other. GOLIATH leaned heavily on “Top G” aesthetics, luxury branding, and celebrity proximity while promising impossible returns – now it has stopped paying out and is hiding behind a formless “audit”.

- When payouts freeze right after a market crash, alarm bells should ring. Legitimate funds manage risk, hedge exposure, and communicate transparently. Ponzi schemes stall, distract and buy time.

Whether or not any of Tate’s specific trades are connected to the GOLIATH VENTURES payout freeze, the behavioural pattern is the same:

High-risk gamblers calling themselves “genius traders,” sitting on terrible risk management, and using other people’s trust – and often other people’s money – as the fuel for their bets.

How this investigation was put together

Everything here is based on:

- On-chain analytics from Arkham and other tracking accounts.

- Public reporting from crypto media mapping Tate’s trading history and PnL.

- Court and media records on Andrew Tate’s legal situation and asset seizures.

Your existing OSINT work on GOLIATH VENTURES INC, including their own payout-freeze email and long-running pattern of misrepresentation about trading activity.

If new on-chain links ever emerge between GOLIATH wallets and Hyperliquid activity, that will shift this from “interesting timing and culture overlap” into something more concrete.

For now, the safe, factual takeaway for readers is:

- Andrew Tate is a verifiably terrible leveraged trader.

- GOLIATH VENTURES INC has frozen payouts and, by your own prior work, shows the classic hallmarks of a collapsing Ponzi.

- Both exist in the same influencer ecosystem that sells “alpha” and “Top G” dreams to everyday people.

- And that should be more than enough to keep any sane investor far away from both.

Previously in This Series on Goliath Ventures

- Glossy Promises, Shaky Contracts

Goliath Ventures Exposed – Glossy Promises, Shaky Contracts, and the Dark Reality of Guaranteed Returns

Where it all began: inflated promises of 60% returns backed by contracts that were flimsy at best. - The Compliance Illusion

Goliath Ventures Exposed Part 3: Christopher Delgado, Matt Burks, BlackBlock and the Compliance Illusion

The smoke-and-mirrors routine — how Burks and BlackBlock tried to pose as “independent” while being insiders. - The Smear Campaign Claim

Chris Lord Delgado Claims “Smear Campaign” – Goliath Ventures Exposed in My Full Response

Delgado’s pushback — calling legitimate questions a “smear campaign” while victims kept piling up. - The Bookkeeper’s Vanishing Act

The Bookkeeper’s Vanishing Act: Chris Delgado, Nadia Bringas, and Goliath Ventures

When the money trail grew hot, Bringas dissolved her company in Florida overnight and popped back up in Wyoming. - The Fake Audit

Pull Money While You Can! Goliath Ventures Ponzi Exposed by FAKE Audit. Florida Ponzi Scheme SCAM

A so-called “audit” that turned out to be nothing more than a Mailchimp blast with zero financial data. - The Missing FinCEN Registration

Goliath Ventures Inc (Christopher Delgado) and the Missing FinCEN Registration: Why It Matters

Digging into why a real investment firm would never operate without this registration — unless it was hiding. - Collapse and Clawbacks

Goliath Ventures Inc Florida Ponzi Collapse, Coming Clawbacks and Arrests

The unraveling accelerates: clawbacks loom, and indictments draw closer. - The Securities Question

The Unregistered Securities Problem: Why Goliath Ventures’ Contracts Are Likely Illegal

Breaking down why Goliath’s contracts were never legal in the first place — a fatal flaw in their setup. - What Real Funds Look Like

What Real Quant Funds Look Like Vs. Goliath Ventures, FL Ponzi Scam

Today’s deep dive: exposing how every part of Goliath’s structure collapses under scrutiny. - Stolen money, gifts, and uneconomical deals

Who Is Still Profiting From Goliath Ventures Inc, Orlando Ponzi? Don’t Drop The Soap.

Unusual developments connected to the Goliath Ventures Ponzi scheme, which is now imploding. - FBI Director Kash Patel, Ron DeSantis and even Andrew Tate

Goliath Ventures Ponzi: Verlin Sanciangco & My Liquidity Partner (MLP) Scam Rebranded.

Goliath Ventures Inc ponzi scheme has been running for a lot longer than most people realize. - I just got sued for telling the truth

Danny vs Goliath: New Zealand Journalist Sued by Christopher Delgado’s GOLIATH VENTURES INC.

I uncovered what I believe is a large-scale Ponzi scheme. - You now have 3 copyright strikes

Dirty Tactics: How GOLIATH VENTURES INC Is Abusing YouTube’s Copyright System to Silence Journalism.

Your channel (as well as YouTube channels associated with it) is scheduled to be terminated in 7 days. - Crypto Crash!

Crypto Prices Crash! GOLIATH VENTURES Investors Should Be Very Worried.

Questions Goliath Ventures Investors Should Be Asking - Filed a 22‑page Motion to Dismiss

Florida Orlando Ponzi Scheme Sues New Zealand Journalist, $150,000 Bribe Attempt.

This lawsuit isn’t about protecting a reputation—it’s about damage control and intimidation. - You didn’t escape the scam — you benefited from it

Whistleblower or Opportunist? The Anatomy of a Non-Whistleblower Who Protected Goliath Ventures.

To show what a real whistleblower looks like, and what one doesn’t. - The Banking Breakdown

GOLIATH VENTURES INC’s Secret Bank Switch: The Collapse Behind the “Transparency” Spin.

A false transparency update masking a banking crisis and ongoing promotion. - Director of Administration at Goliath Ventures Inc

Stephen Davis: The Fire Chief Who Walked Out of the Firehouse and Straight Into a Financial Inferno.

There is one path still open to Stephen Davis — the only path that honours the uniform he once wore. - Goliath Ventures Inc has now collapsed

Goliath Ventures Payouts Stop: Insiders Pull 10’s of Millions While Everyone Else Waits.

Paid their romantic partners and family members tens of millions since 12/Nov/2025. - Behavioural pattern is the same

Andrew Tate’s Hyperliquid Wipeout – And Why Goliath Ventures Investors Should Pay Attention. (this article)

High-risk gamblers calling themselves “genius traders,” sitting on terrible risk management, and using other people’s trust.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand

Leave A Comment