As the alleged Goliath Ventures Inc Ponzi scheme continues to unravel, one glaring omission stands out: there is no evidence that Goliath Ventures ever registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB).

That missing registration isn’t a minor paperwork slip. For a crypto investment operation handling pooled customer funds, MSB registration is foundational. Without it, Goliath’s entire enterprise appears to have been operating outside of basic federal anti–money laundering (AML) oversight.

Link to FinCEN’s MSB Search Tool: fincen.gov

Link to Wyoming’s Money Transmitter Search Tool: wyomingbankingdivision.wyo.gov

What MSB Registration Is — and Why It’s Required

FinCEN, a bureau of the U.S. Treasury Department, requires any company that accepts, transmits, exchanges, or administers convertible virtual currency on behalf of others to register as an MSB under the Bank Secrecy Act (BSA).

Typical MSB obligations include:

- Registration with FinCEN, renewed every two years

- Written AML program, with internal controls and independent audit provisions

- Know Your Customer (KYC) procedures for verifying customer identity

- Suspicious Activity Reporting (SAR) for unusual or large transactions

- Recordkeeping and reporting obligations

These rules are not optional. Even if a company calls itself a “joint venture” or “private fund,” if it pools and transmits customer crypto funds, it fits FinCEN’s definition of a money transmitter and must comply.

Why This Is a Problem for Goliath Ventures

Public filings show Goliath Ventures promised investors fixed monthly returns (3–4%) and guaranteed principal, allegedly funded by pooled crypto investments. Internal materials mention centralized monthly distributions between the 15th and 18th of each month—but provide no blockchain evidence, no wallet addresses, and no custody attestations.

This operational model—accepting investor money, commingling it, and paying out “dividends”—squarely fits the definition of money transmission under federal law. Yet:

- No FinCEN MSB registration exists for Goliath Ventures

- No state money transmitter licenses (MTLs) appear to be on file in Florida, Wyoming, or other jurisdictions where investors were solicited

If confirmed, that means Goliath was moving hundreds of millions in customer funds without the most basic oversight mechanisms.

What Could Happen to Chris Delgado, Matt Burks, and Piers Curry Personally

Legal responsibility for unregistered MSB activity can extend not only to the corporation, but also to individuals who direct, control, or participate in the business. In Goliath’s case, this includes:

- Christopher “Chris” Delgado (CEO and public face of Goliath Ventures)

- Matt Burks (CEO of BlackBlock and head of compliance)

- Piers Curry (former partner of BlackBlock and WealthMD; co-led promotional or operational activities)

Possible Legal and Criminal Consequences

1. Operating an Unlicensed Money Transmitting Business

- Under 18 U.S.C. § 1960, it is a felony to conduct money transmitting operations without registering as an MSB.

- Penalties: up to 5 years in prison and $250,000 in fines per violation.

2. Asset Forfeiture and Freezes

- Governments can freeze or seize personal assets, including bank accounts, property, or crypto holdings.

3. Civil Penalties

- $5,000 per day that the business or individual operated without proper registration.

4. Conspiracy and Aiding Liability

- Leaders can be charged with conspiracy to evade regulatory requirements.

- If Curry helped structure the entity to appear compliant, his actions may be treated as knowing and deliberate.

5. Wire Fraud / Money Laundering

- If funds were routed through banks or exchanges, wire fraud or money laundering charges may apply.

6. ERISA / Retirement Accounts

- With WealthMD’s IRA and 401(k) rollovers, ERISA fiduciary violations are possible, including personal liability to restore investor losses.

7. Enhanced Liability for Compliance Leadership

- Matt Burks may face greater exposure as compliance chief if he knowingly ignored MSB requirements.

- Chris Delgado, as CEO and signatory, qualifies as a controlling person.

- Piers Curry may still face civil or reputational liability, even as a former partner, if violations occurred during his tenure.

The Legal and Regulatory Consequences for the Company

Operating without MSB registration exposes Goliath Ventures itself to severe consequences:

- Criminal Penalties: up to 5 years in prison and substantial fines

- Civil Fines: $5,000 per day of unregistered operation

- Asset Forfeiture: seizure of corporate assets tied to the scheme

- Cease-and-Desist Orders: immediate halt of operations

- Parallel Enforcement: SEC and state regulators may pursue securities and licensing violations

Why It Matters to Investors, Partners, and the Public

For investors, this is more than just missing paperwork. It means:

- No AML safeguards — funds unvetted

- No KYC — illicit actors may be involved

- No oversight — no recourse through federal systems

For partners (charities, sponsors, etc.), there’s legal and reputational risk in funding, hosting, or promoting an unregistered MSB.

The Bigger Picture

Goliath Ventures’ failure to register as an MSB, despite public claims of being “insured,” “bonded,” or compliant, reveals compliance theater—the performance of regulation without substance.

Regulators may view the MSB omission as one of the clearest enforcement paths—directly implicating Delgado, Burks, and Curry. Even without proving the Ponzi features, FinCEN enforcement is a hard, provable violation with serious consequences.

Key Takeaway

Goliath Ventures appears to have handled hundreds of millions in pooled investor crypto funds without ever registering as a Money Services Business with FinCEN.

That omission alone could expose its leaders—Chris Delgado, Matt Burks, and Piers Curry—to criminal prosecution, civil penalties, personal asset forfeiture, and regulatory shutdowns.

In crypto ventures, failing to register as an MSB is not a paperwork oversight—it’s exposing yourself to one of the clearest legal traps out there.

Previously in This Series on Goliath Ventures

- Glossy Promises, Shaky Contracts

Goliath Ventures Exposed – Glossy Promises, Shaky Contracts, and the Dark Reality of Guaranteed Returns

Where it all began: inflated promises of 60% returns backed by contracts that were flimsy at best. - The Compliance Illusion

Goliath Ventures Exposed Part 3: Christopher Delgado, Matt Burks, BlackBlock and the Compliance Illusion

The smoke-and-mirrors routine — how Burks and BlackBlock tried to pose as “independent” while being insiders. - The Smear Campaign Claim

Chris Lord Delgado Claims “Smear Campaign” – Goliath Ventures Exposed in My Full Response

Delgado’s pushback — calling legitimate questions a “smear campaign” while victims kept piling up. - The Bookkeeper’s Vanishing Act

The Bookkeeper’s Vanishing Act: Chris Delgado, Nadia Bringas, and Goliath Ventures

When the money trail grew hot, Bringas dissolved her company in Florida overnight and popped back up in Wyoming. - The Fake Audit

Pull Money While You Can! Goliath Ventures Ponzi Exposed by FAKE Audit. Florida Ponzi Scheme SCAM

A so-called “audit” that turned out to be nothing more than a Mailchimp blast with zero financial data. - The Missing FinCEN Registration

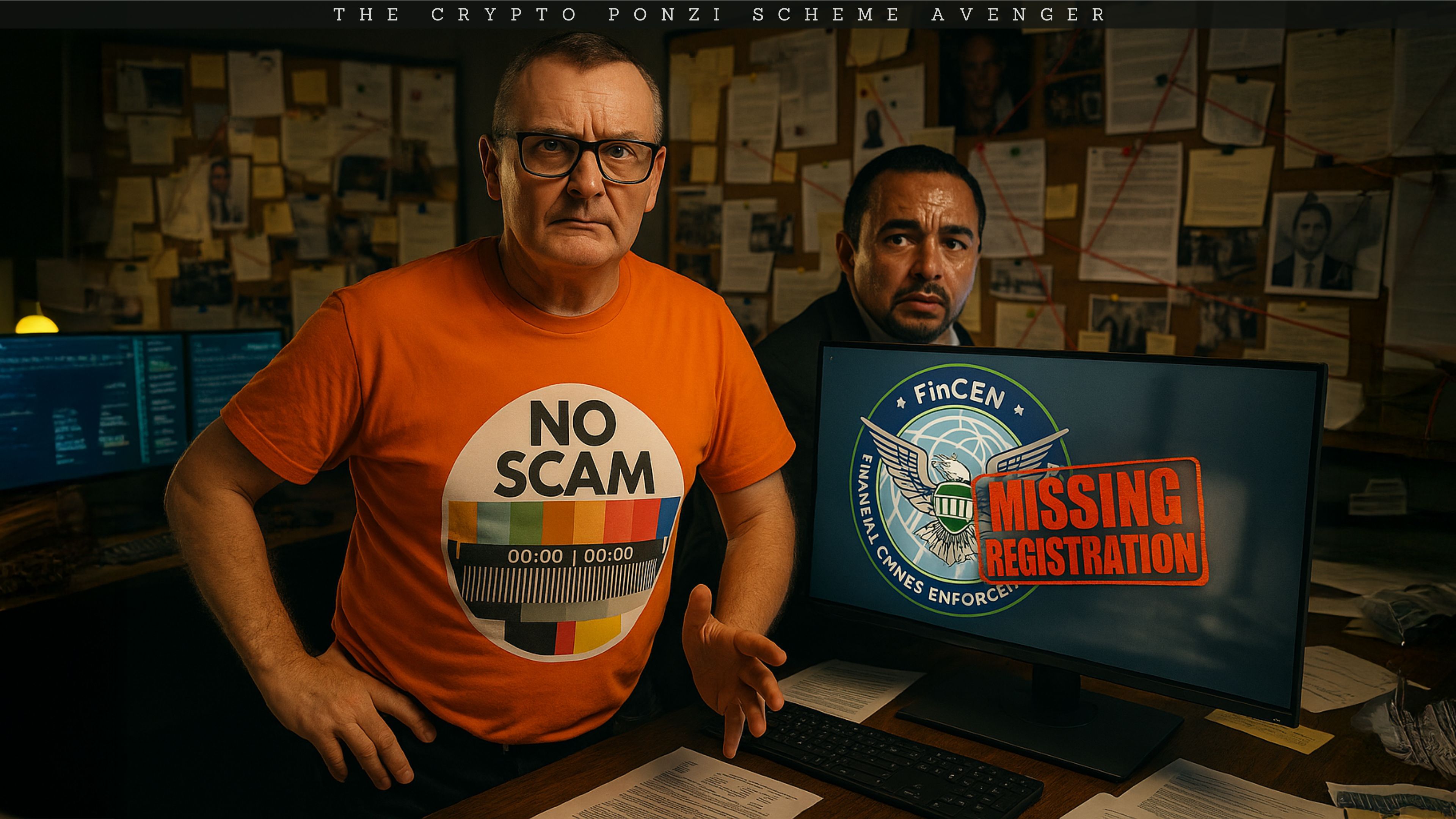

Goliath Ventures Inc (Christopher Delgado) and the Missing FinCEN Registration: Why It Matters (this article)

Digging into why a real investment firm would never operate without this registration — unless it was hiding.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand

Leave A Comment