When a fellow Avenger messaged me with the words “I’ve got the contract,” I knew this wasn’t just another glossy crypto website.

Not a pitch deck. Not a brochure. The actual Joint Venture Agreement investors are being told to sign. And contracts don’t lie.

What I found inside was alarming: promises of fixed monthly returns, clauses that let Goliath freeze withdrawals at will, and disclaimers so broad they erase every guarantee they just made.

Layer on top of that a website full of extraordinary claims, recycled team bios, paid-looking “press features,” and a title sponsorship at one of the biggest business conferences in America, and you’ve got the perfect recipe for investors to get hurt.

I read the contract so you don’t have to. What it says — and what their site conveniently leaves out — is why I’m publishing this exposé.

The Agreement They Don’t Want You to Read

On the one hand, it waves away regulation:

“This Agreement… is not an investment product, investment offering, investment advice, or a security in any way whatsoever.”

On the other hand, it sets out what any normal person would recognise as an investment with fixed returns and a capital guarantee:

Partner “shall contribute not less than $100,000 USD”…

“3% on contributions between $100,000 and $499,000… 4% for any contributions over $500,000.”

“Goliath hereby guarantees the return of principal… This guarantee is absolute and binding.”

Then come the escape hatches:

Goliath may “delay withdrawals for up to ninety (90) days” due to “suspicious activity,” “system hacks,” or “exchange delays.”

Upon termination, the partner “shall no longer have the right to receive any profits or rewards.”

“Goliath makes no representations, warranties or guarantees… as to the success of any venture and a partner’s right to receive any profits.”

Read those lines together. They promise the impossible (fixed monthly profits and guaranteed principal) while disclaiming accountability when it matters. Heads, they win. Tails, you lose. This is the cornerstone of the whole story—and it’s written in their own paperwork.

Extraordinary Claims, Zero Proof

Goliath hangs its legitimacy on three pillars — liquidity pools, Bitcoin mining, and two “active projects” (Medieval Empires and Kasta) — plus a lot of loose talk about “navigating the NASDAQ for blockchain stocks.” On paper it sounds impressive. In practice, there’s no evidence behind any of it.

If you actually operate liquidity pools, you can show it in seconds: contract addresses, LP token holdings, on-chain wallet history, fee revenue, even a simple dashboard. Goliath publishes none of that. No pool IDs, no wallet addresses, no DEX analytics, no third-party verification. Just definitions and marketing copy.

If you actually run Bitcoin mining, you talk in numbers: hashrate (PH/s), fleet mix (e.g., S19s, M30s), kilowatt pricing, hosting sites, PPAs, pool statements, mined-coin addresses. Credible miners show racks, facility photos, payout logs. Goliath’s mining page reads like a Wikipedia primer — all theory, zero telemetry.

And those “active projects” — Medieval Empires and Kasta — are presented as if they’re Goliath-led. There’s no reciprocal acknowledgement on official channels, no filings, no SAFTs, no cap table breadcrumbs. Until the other side names you back, it’s just borrowed branding.

The NASDAQ spiel is the same story. If you’re selecting and advising on public equities, you either hold the registrations and publish research notes with disclosures, or you don’t. Goliath talks like an allocator but disclaims like a promoter. Big claims without data aren’t accomplishments; they’re theatre.

Paid Credibility and Phantom Executives

When a company can’t prove operations, the next move is manufactured authority: buy visibility, rent prestige, and pad the team page.

Goliath points proudly to “media coverage,” but a closer look shows the pattern:

- CBS42.com (EIN Presswire) – not journalism, just a paid press release syndicated on a local TV station’s business page.

- USA Today–style feature – glossy advertorial copy dressed up as news.

- SeedHunter.com puff piece – Delgado positioned as an inspirational investor at a penthouse launch party in Dubai.

- Orlando Business Journal (by J.C. Carnahan) – the only piece that resembles real reporting, but raises the question: did the reporter know about the guaranteed-return contracts and escape clauses when profiling Delgado as a blockchain leader?

And then there’s the “20 Entrepreneurs Who Are Building Empires in 2023” article on USA Today’s contributor-content feed. It sits alongside names like Sam Altman and Alex Hormozi — but Delgado’s inclusion wasn’t the result of investigative reporting. It was a paid placement, sold to anyone willing to buy the slot. To the casual reader, it looks like mainstream validation. In reality, it’s advertising disguised as journalism.

Add to this a team page filled with impressive-sounding titles and LinkedIn icons. Yet when you click through, only one person even has a LinkedIn footprint — and he doesn’t list Goliath anywhere. The rest are shadows. Roles are duplicated (“Director of Partner Services” appears multiple times), family names repeat, and there’s no external trail: no conference appearances, no code commits, no publications.

Credible companies don’t need to pay for press, pad executive rosters, or build phantom executive teams. They show their work. Goliath shows only smoke.

Lifestyle Marketing and Investor Circles

The other half of the illusion is lifestyle. Delgado positions himself in elite spaces and drops recognizable Orlando names to project legitimacy. Whether those individuals are truly involved or simply being invoked without consent, the tactic is the same: build confidence by association, not by proof.

Meanwhile, Delgado is in the process of buying an $8.5 million house inside Isleworth, one of Florida’s most exclusive neighborhoods. Even the HOA has reportedly been warned about his activities, yet the deal still appears to be moving forward. Has proper due diligence been done, or has the lifestyle marketing worked its magic?

The performance doesn’t end there. Delgado is often seen traveling with socialite Shayla Pert Farnsworth, whose son (Hunter Smallback) works as his executive assistant. Farnsworth hosts lavish investor parties and flaunts private jet trips on social media, projecting the image of limitless wealth and success.

This is classic Ponzi theatre: surround yourself with jets, mansions, and familiar names, and most people stop asking hard questions. The illusion of success becomes the sales pitch, while the contract quietly gives Delgado the power to freeze or erase investor money.

Smoke and Mirrors on the Website

Their site looks polished at first glance—until you start checking anything that should be verifiable.

The “investments.” They claim three main lanes:

- Liquidity pools: no pool addresses, no wallet history, no on-chain proof. Any legit DeFi operator can show positions in seconds. Goliath shows none.

- Bitcoin mining: pages of generic explainer text (CPU vs GPU vs ASIC) but no hashrate, no facility photos, no power contracts, no mined-coin addresses.

- “Active projects” (Medieval Empires, Kasta): listed as if they’re Goliath-led. We found no reciprocal acknowledgement on the projects’ official channels and no evidence of ownership or funding—just Goliath’s claim on Goliath’s site.

The charity numbers. One page says $1M last year / $4M since 2019. Another says $500k in 2023 / $2M since inception. Can both be true? Maybe. Should a trustworthy firm keep its own totals consistent? Absolutely.

The fine print. Their privacy policy quietly lists a residential-style Apopka, Florida address, while the splashy pages trumpet Class-A offices and a “global footprint.” The branding says empire; the boilerplate says template.

Buying Legitimacy at The Vault 2025

Now the part that will lure fresh victims: Goliath Ventures is billed as a title sponsor of The Vault 2025 Conference in Orlando—Patrick Bet-David’s marquee event with 12,000+ founders and CEOs.

Sponsorship at that level doesn’t come from “passive yield.” It comes from big cheques. And in my experience, title sponsorships are the perfect tool for credibility laundering: stand on a stage near real operators, get your logo on the big screen, and let proximity do the selling. To an attendee, it feels like vetting. It isn’t.

If you’re headed to Vault: proximity is not due diligence. Ask for on-chain addresses, audited statements, real team bios, real operations—not selfies and stage time.

The Human Cost of the Circus

I hear this every week: “I’ll be smart—get in, get my 4% a month, and get out.” Here’s how it actually plays out:

You see early payouts (often funded by newer deposits). You increase your stake. You introduce friends and family because you want them to “benefit” too. Then withdrawals slow. Then they “temporarily pause” to “investigate activity” for up to 90 days (remember that clause?). Then they’re gone—and you’ve become part of the sales funnel that hurt people you care about.

If you recruit into something that guarantees returns and pays referrals, you’re not just taking risk—you’re creating it for others.

Asking for a Right of Reply

Fairness matters. I’ve written to Chris Delgado, CEO of Goliath Ventures, inviting a full response to specific questions:

- Proof of actual liquidity-pool positions, mining operations, or portfolio holdings (on-chain, audited, or independently attested).

- Why the contract guarantees principal and fixed monthly payouts while also disclaiming any right to profits.

- Whether their “media features” are paid placements, and why they’re presented as independent recognition.

- Verification of the leadership team’s employment and roles beyond the Goliath website.

If a response arrives, I’ll publish it in full. Silence will also be noted.

My Verdict

What Goliath says: elite partners, liquidity pools, mining, philanthropy, global leadership, title sponsor, game-changing impact.

What Goliath shows: a contract that promises the impossible and protects the house, a website of claims without proof, paid publicity in place of journalism, phantom executives, and a sponsorship strategy aimed at fresh pockets.

If it sounds too good to be true, it is. This doesn’t look like a technology company executing a sophisticated strategy. It looks like a marketing machine designed to pull deposits.

My mission is simple:

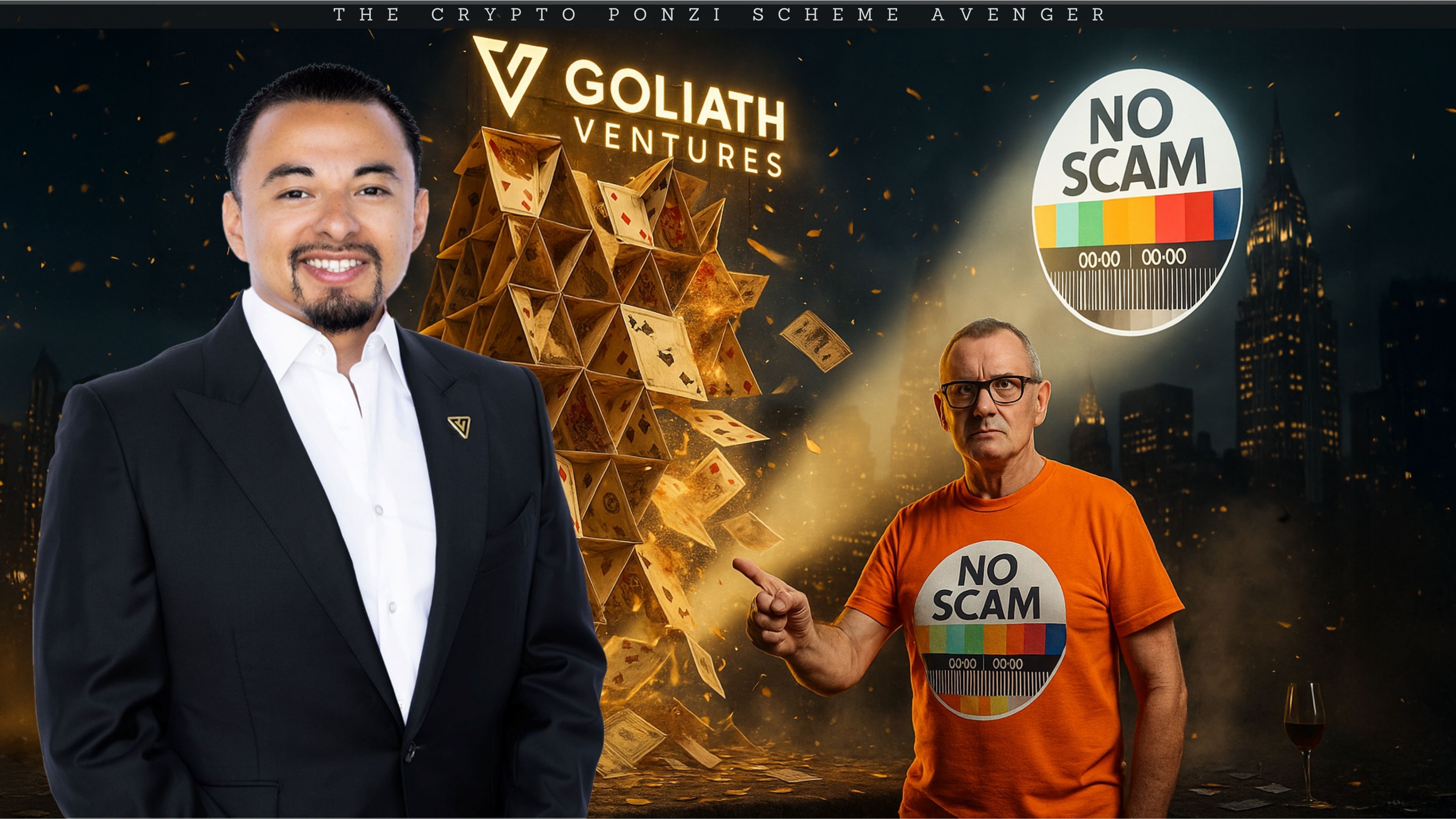

I am Danny de Hek, The Crypto Ponzi Scheme Avenger — here to name and shame anyone running or promoting a Ponzi scheme or scam.

Based on the documents I’ve reviewed and the claims they can’t substantiate, Goliath Ventures Inc. deserves that spotlight.

If you’ve been approached, walk away. If you’re already in, stop recruiting and start documenting everything. And if you’re on a stage or hosting an event, do your due diligence—your audience is trusting you with more than their ticket money.

Disclaimer: How This Investigation Was Conducted

This investigation relies entirely on OSINT — Open Source Intelligence — meaning every claim made here is based on publicly available records, archived web pages, corporate filings, domain data, social media activity, and open blockchain transactions. No private data, hacking, or unlawful access methods were used. OSINT is a powerful and ethical tool for exposing scams without violating privacy laws or overstepping legal boundaries.

About the Author

I’m DANNY DE HEK, a New Zealand–based YouTuber, investigative journalist, and OSINT researcher. I name and shame individuals promoting or marketing fraudulent schemes through my YOUTUBE CHANNEL. Every video I produce exposes the people behind scams, Ponzi schemes, and MLM frauds — holding them accountable in public.

My PODCAST is an extension of that work. It’s distributed across 18 major platforms — including Apple Podcasts, Spotify, Amazon Music, YouTube, and iHeartRadio — so when scammers try to hide, my content follows them everywhere. If you prefer listening to my investigations instead of watching, you’ll find them on every major podcast service.

You can BOOK ME for private consultations or SPEAKING ENGAGEMENTS, where I share first-hand experience from years of exposing large-scale fraud and helping victims recover.

“Stop losing your future to financial parasites. Subscribe. Expose. Protect.”

My work exposing crypto fraud has been featured in:

- Bloomberg Documentary (2025): A 20-minute exposé on Ponzi schemes and crypto card fraud

- News.com.au (2025): Profiled as one of the leading scam-busters in Australasia

- OpIndia (2025): Cited for uncovering Pakistani software houses linked to drug trafficking, visa scams, and global financial fraud

- The Press / Stuff.co.nz (2023): Successfully defeated $3.85M gag lawsuit; court ruled it was a vexatious attempt to silence whistleblowing

- The Guardian Australia (2023): National warning on crypto MLMs affecting Aussie families

- ABC News Australia (2023): Investigation into Blockchain Global and its collapse

- The New York Times (2022): A full two-page feature on dismantling HyperVerse and its global network

- Radio New Zealand (2022): “The Kiwi YouTuber Taking Down Crypto Scammers From His Christchurch Home”

- Otago Daily Times (2022): A profile on my investigative work and the impact of crypto fraud in New Zealand

Leave A Comment