For decades, Pure Romance was a household name in the multi‑level marketing (MLM) world. The company built its empire selling intimacy products through independent consultants who hosted in‑home parties.

Recently, Pure Romance has been telling the world it is no longer an MLM. Instead, it is rebranding as a direct‑to‑consumer lifestyle and wellness brand.

So, what happened? And is this a genuine transformation or just a clever wardrobe change? Let’s break it down.

Introduction

On April 28, 2023, Pure Romance formally announced its intention to move away from the multi-level marketing (MLM) sales structure into an omnichannel retail model. This pivotal change was set to begin May 1, 2023, marking the official start of a fundamentally new era for the company and its existing network of over 20,000 certified consultants. The official press release and subsequent media coverage highlighted the company’s aim to modernize the customer experience, unify branding, and improve accessibility across all purchasing channels.

Transitioning a company with such an entrenched MLM history was no minor feat, and Pure Romance’s leadership recognized this as an “important next step” in a multiyear journey to adapt to rapidly changing consumer behaviors and expectations. The company’s press and executive communications signaled the intent not simply to tweak but to fundamentally overhaul both backend systems and the customer-facing experience.

Timeline of Major Events

- April 28, 2023: Official Press Release signals the move away from MLM.

- May 1, 2023: The new Omnichannel Model takes effect operationally.

- Spring–Summer 2023: Additional communications and updates to consultants, product launches, and rollout of new training and support resources.

- Spring 2024: Pure Romance sells its Loveland warehouse to fully integrate with third-party logistics providers, vastly improving shipping capabilities and efficiency, a clear operational move in concert with an omnichannel retail strategy.

- 2024: Relocation of company headquarters to downtown Cincinnati to further modernize operations and brand perception.

The swift pace of transition underscores the urgency with which the company needed to distance itself from waning MLM perceptions and to meet digital-era consumer expectations. - 2025: Pure Romance officially fires affiliates and the news breaks on Reddit that the MLM is shutting down business and rebranding.

The Early Days: Building an Empire One Party at a Time

Founded in 1993 by Patty Brisben in Cincinnati, Ohio, Pure Romance tapped into a niche market: relationship aids, lingerie, and wellness products sold in a comfortable, private setting. The sales method was straightforward: consultants hosted parties, demonstrated products, and took orders.

The company’s pitch was about more than just products. It promised empowerment, flexible income, and a supportive community. Consultants could earn money from their own sales and from recruiting others into their “downline.” The more people you recruited, the more you could earn from their sales.

However, like many MLMs, the model relied heavily on constant recruitment and maintaining sales quotas. Critics argued that this structure often left consultants with high expenses — buying inventory, hosting events, travel — and little profit. For some, it was less a lucrative side hustle and more an expensive hobby with a lot of awkward icebreakers.

Previous MLM Structure: How Pure Romance Worked Pre-2023

In its pre-2023 iteration, Pure Romance exemplified the classic MLM archetype. Its consultants, billed as independent business owners, were encouraged to purchase starter kits and inventory, maintain qualification thresholds via regular purchases, and sell products primarily through in-home “parties” or social events. Earnings came through two channels: direct sales profit (the markup between wholesale and retail pricing) and multi-level overrides/bonuses generated from the sales activities of their recruited downlines.

Earnings Scheme and Recruitment

- Starter Kit Requirement: Entry required consultants to purchase one of several high-priced starter kits, ranging from $179 to $599 in recent years.

- Active Status and Qualification: Consultants maintained “active” status by making regular monthly or bimonthly minimum purchases — reportedly $200 every two months and $750 in personal sales to qualify for downline commissions.

- Compensation Structure: Multiple commission and bonus levels, with upline consultants earning overrides on several layers deep within their downline trees (potentially up to four levels), provided requisite sales targets were met.

- Income Realities: According to company and industry disclosures, the vast majority of consultants earned modest sums, with more than 64% making under $2,500 annually, and the overwhelming majority unable to cover the costs of participation from actual sales profits.

Cultural and Operational Features

Pure Romance’s previous model heavily emphasized:

- In-home Party Selling: Social gatherings served as the company’s primary sales engine, blending product demonstration, “edutainment,” and lighthearted discussion around sexual health.

- Recruitment Focus: While direct sales were a necessity, most consultants relied on recruitment to supplement income, creating perennial pressure to expand their personal downlines.

- Expensive Inventory and Qualification: Consultants were often the largest purchasers, required to buy for demonstration, events, and to remain eligible for bonuses.

- High Attrition and Mixed Satisfaction: Reviews reflected a mix of empowerment experiences and significant financial or emotional exhaustion, with many consultants experiencing the classic MLM cycle of quick burnout and underwhelming profits.

Despite Pure Romance’s strong messaging around sexual wellness, the economic realities and social mechanisms of the system closely mirrored other MLMs.

The Growing Pressure on MLMs

By the late 2010s, MLM companies were facing unprecedented scrutiny. Documentaries, investigative reports, and social media accounts were exposing the realities of the industry: high turnover rates, low average earnings, and a business model that often rewarded recruitment over actual product sales.

Regulators like the U.S. Federal Trade Commission (FTC) were increasing oversight, warning companies about deceptive income claims and unfair business practices. At the same time, consumer habits were shifting. People were shopping online more than ever, and the idea of attending a sales party in someone’s living room was losing appeal.

Pure Romance began to feel the pressure. The company started experimenting with e‑commerce, building a stronger online presence, and reducing its reliance on in‑person events.

The Official Shift Away from MLM

Chris Cicchinelli, Pure Romance’s CEO, was the public face of the transition. His statements, echoed across news releases and industry coverage, consistently emphasized several themes:

“For 30 years, Pure Romance has been a pioneer in the sexual wellness industry, providing education, resources, and best-in-class products to our customers. This next chapter is a continuation of that legacy and will allow us to focus on improving our customer experience to make it as personalized and seamless as possible. We know it’s important to update the way we sell our products so we can best meet the shifting demands of consumers — including how they choose to shop. We are grateful for our talented team of employees and Consultants who are embracing this advancement and remain dedicated to the mission of our business.”

The rejection of MLM thus was more implicit than explicit — a necessary step to meet future-facing retail needs and eliminate the negative perceptions attached to “pyramid” structures.

This transition was not merely rhetorical but operationally rooted:

- Pure Romance executives cited a desire for seamless customer experience — heavily influenced by digital-era retail best practices, including real-time inventory, shipping speed, and omnipresence across digital and physical channels.

- The company specifically noted that multi-level compensation and deep pyramidal hierarchies were leading to negative perceptions and potentially legal and reputational risks in a changing regulatory environment.

- Selling its warehouse and adopting third-party logistics in 2024 further highlighted an overarching move toward agility, efficiency, and omnichannel alignment.

The New Business Model: Omnichannel Explained

An omnichannel business model means every customer touchpoint — from consultant parties, one-on-one consults, to the official website and e-commerce platforms — offers a unified, integrated experience. Customers can move seamlessly between digital channels, home-based events, and direct interactions, always encountering the same products, pricing, branding, and recommendations. For Pure Romance, This Transition signaled a radical break from reliance on recruitment as a core economic engine.

- Unified Branding: Whether a customer orders online, attends a party, or speaks with a consultant, their experience is cohesive, premium, and consistent.

- Multiple Purchase Channels: Customers can buy directly from the company’s online store, through consultants acting as product concierges, or via hybrid e-commerce affiliate links.

- Consultants as Brand Ambassadors and Concierges: Consultants remain, but their roles shift toward personalized guidance, product education, and lifestyle support rather than downline-building.

Consultants under this model are compensated primarily, if not exclusively, on direct sales attributed to them or their personalized affiliate links. The multi-level overrides, depth bonuses, and chain recruitment rewards have been drastically reduced or eliminated.

- Sales-Only Income: Consultants are paid a percentage of sales they personally generate or, in some cases, sales from direct recruits for up to one year. There are no distortive rewards for building deep downlines.

- Affiliate and Concierge Approach: The new structure borrows heavily from e-commerce affiliate and influencer models, focusing on personal brand building, word-of-mouth, and digital content rather than team-building.

- Elimination of Inventory Purchase Mandates: Consultants are less required (or not required at all) to stockpile inventory, lowering financial risk.

- Customer-Centric Experience: Every interaction is focused on providing tailored advice and support — a “concierge” approach, leveraging expert consultants.

- Premium Digital Commerce: The direct-to-consumer e-commerce site is central, leveraging verified product reviews, omnichannel inventory, and easy reordering.

- Personalization and Accessibility: Using data and unified customer profiles, product recommendations are more personalized, aiming for higher lifetime value.

- Agility and Speed: Enhanced logistics (e.g., two-day shipping nationwide) enabled by third-party partners reduce friction.

To support this seismic shift, Pure Romance partnered with branding agencies like Hyperquake to redefine its visual identity, product packaging, and in-market positioning. This effort went far beyond logo tweaks:

- Packaging Redesign: Over 120 product packages were reimagined within a year, modernizing appearance, simplifying information, and pivoting to a gender-neutral, premium look.

- Premiumization and Transparency: Rebranding sought to make the brand less about “parties and toys”, and more about holistic sexual wellness, health, and confidence.

- Storytelling and Experience: Immersive experiences, digital storytelling, and an expanded focus on education elevated the brand from a niche MLM product line to a broader wellness/lifestyle leader.

- Sub-Brand Expansion: Creation of up to six sub-brands, including lines for men’s self-care, luxury and skin care, and whole-body wellness.

The rebranding exercise culminated in the largest launch event in company history, designed to signal both to the public and the consultant base that Pure Romance aimed to set the standard for modern, inclusive, and science-based sexual wellness solutions. The shift to a digital-forward, omnichannel strategy was thus both visual and substantive.

For customers, the change means easier access to products without attending a party or joining a consultant’s team. For sellers, it means less pressure to recruit and more focus on building a personal customer base.

However, as with any sales opportunity, earnings will depend on effort, market demand, and competition. There is no guaranteed income, and success will require consistent work.

Is Pure Romance Still an MLM?

This is the question that keeps coming up. While the company no longer markets itself as an MLM and has removed many of the hallmarks of that model, it still uses independent sellers who earn commissions.

Critics argue that any system involving independent sellers can carry some of the same risks as MLMs. However, the key difference now is that income is tied almost entirely to product sales rather than recruitment. That makes it closer to an affiliate marketing model than a traditional MLM.

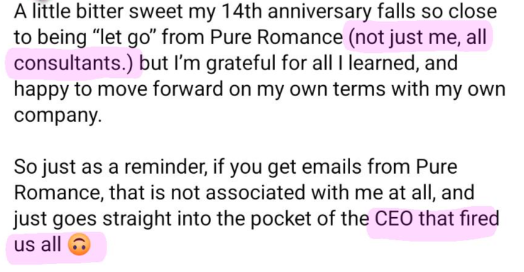

In a move that stunned many in its sales force, some time on or around August 31, 2025, Pure Romance allegedly made it’s largest change yet. The company terminated its remaining affiliate and consultant network, effectively ending the last remnants of its multi-level marketing (MLM) structure. Let’s take a moment to discuss what this means, if true.

Under the new direct selling model:

- No more upline commissions — all multi-level overrides and team bonuses are eliminated.

- Earnings are now based almost entirely on personal direct sales.

- Commissions from personally recruited sellers will only be paid for up to one year, after which no residual income is earned.

- Focus shifts from recruitment to customer acquisition, personal brand building, and product education.

For distributors, this means:

- No passive income from downlines.

- Reduced financial risk due to fewer inventory requirements.

- A sales-only income structure similar to affiliate marketing rather than traditional MLM.

For the company, the shift:

- Aligns with its direct-to-consumer retail strategy launched in 2023.

- Removes regulatory and reputational risks tied to MLM models.

- Positions Pure Romance as a modern, omnichannel sexual wellness brand with a customer-first approach.

In summary: This move marks a radical break from the company’s MLM past, replacing recruitment-driven earnings with a streamlined, sales-focused model designed to meet changing consumer habits and digital-era retail expectations.

For thousands of consultants, this probably feels like the final curtain call on years of relationship-building and team growth.

Euforia Products LLC is connected to Pure Romance — “Euforia” is the company’s luxury product line, featuring high‑end intimacy accessories, lubricants, jewelry, and sleepwear. The Cincinnati address you listed matches the company’s headquarters, and the Euforia branding is marketed as part of Pure Romance’s portfolio.

Some Industry Watchers and former consultants speculate that, over time, Pure Romance may wind down its core operations entirely, leaving Euforia as the primary — or only — surviving brand.

I will be monitoring developments closely and may update this article as new information and industry reactions emerge.

The Bigger Industry Trend

Pure Romance’s shift is part of a bigger industry shake-up. Competitors in personal care, wellness, and supplements — think Mary Kay, Avon, Herbalife — are dabbling in affiliate, influencer, or hybrid compensation models with mixed success and questionable transparency. Whether this is genuine reform or just a fresh coat of marketing paint will depend on how these companies actually operate in the years ahead.

By going all-in with an aggressive, public transition strategy and integrated omnichannel infrastructure, Pure Romance has sprinted ahead of many of its MLM-born peers in the modernization race.

For now, Pure Romance has traded its MLM badge for a sleeker, more modern image. Will customers and sellers fall in love with the new model, or will it be a case of “new outfit, same old dance”? Only time — and sales numbers — will tell.

By Beth Gibbons (Queen of Karma)

Beth Gibbons, known publicly as Queen of Karma, is a whistleblower and anti-MLM advocate who shares her personal experiences of being manipulated and financially harmed by multi-level marketing schemes. She writes and speaks candidly about the emotional and psychological toll these so-called “business opportunities” take on vulnerable individuals, especially women. Beth positions herself as a survivor-turned-activist, exposing MLMs as commercial cults and highlighting the cult-like tactics used to recruit, control, and silence members.

She has contributed blogs and participated in video interviews under the name Queen of Karma, often blending personal storytelling with direct confrontation of scammy business models. Her work aligns closely with scam awareness efforts, and she’s part of a growing community of voices pushing back against MLM exploitation, gaslighting, and financial abuse.

It’s a fascinating journey for sure. I haven’t seen their products, but I imagine it’s not items you will be buying monthly, like shakes or vitamins or even skincare. It will be interesting to see if they can survive on the new model, thanks for the great article.

They sell intimate products *wink wink* which I don’t recommend buying from a multi-level marketing scheme. Usually they make cheaper versions of the products already on the market, and in this specific industry, that can be dangerous! I will be sure to update everyone and let them know how things go with the new model and how people are reacting to the news. Thank you for such a thoughtful comment!