In the rapidly evolving world of online finance, cryptocurrency, and multi-level marketing (MLM), new schemes emerge with alarming frequency, often blurring the lines between legitimate innovation and outright fraud. One of the most recent and egregious examples is Des Alpes, a company that has drawn the attention of regulators, consumer advocates, and investigative journalists across Canada and beyond.

The scam drew in promoters like Arla Mendenhal, invoked the name of Daniel Desalpes to project legitimacy, and even poached members from other controversial ventures such as Onpassive, a scheme I have been covering for many years.

The Pitch

Des Alpes presents itself as a cutting-edge opportunity at the intersection of cryptocurrency and affiliate marketing. According to its promotional materials and recruitment presentations, Des Alpes offers individuals the chance to earn “substantial income” through a combination of a 2×20 matrix compensation plan and a purported “cashback shopping” program. The company claims to be an international platform, accessible to anyone willing to pay an upfront fee and participate in its network-driven business model.

Its marketing emphasizes low barriers to entry (a one-time payment of $129 USD, with options to unlock higher earning levels for additional fees), global reach, and the promise of recurring, passive income. The company touts features such as:

- A 2×20 matrix compensation plan: Affiliates are incentivized to recruit others, who in turn recruit more, filling a matrix that theoretically pays out commissions at each level.

- Matching bonuses: Additional rewards are offered based on the recruitment success of one’s downline.

- Cashback shopping: Des Alpes claims to offer a shopping platform with deep discounts and cashback rewards, though evidence of genuine retail activity is lacking.

- Crypto payments: All transactions are conducted in USDC (USD Coin), a stablecoin, and sometimes USDT (Tether), with promises of global, fast, and secure payments.

Despite its slick marketing and promises of financial empowerment, Des Alpes fails to provide any verifiable information about its ownership, executive team, or physical location on its websites. The only “product” available is the right to recruit others into the scheme. The so-called cashback shopping element appears to be little more than a compliance fig leaf, with no evidence of actual retail customers outside the affiliate base.

Regulators and independent analysts have repeatedly flagged Des Alpes as a classic MLM crypto pyramid scheme, where money from new recruits is funneled up to earlier joiners, with the owner and inner circle taking the lion’s share. The business model is unsustainable by design, and most participants are destined to lose their investments once recruitment slows or stops.

Anatomy of the Scheme

Des Alpes operates primarily through several names and domains, often shifting branding to evade scrutiny:

- desalpes.world: The primary domain, registered October 24, 2024, with no public-facing content beyond affiliate login forms. It was registered through GoDaddy.com LLC, with all contact information shielded by Domains By Proxy LLC. The domain is set to expire on October 25, 2025, and is hosted on generic DNS-parking servers, further obscuring its origins.

- gracedesalpes.ca: Marketed as “The Grace Team,” this site is used for recruitment and promotional activities, often headed by key promoters. It is similarly registered with privacy protection.

- innitshop.com: Branded as an e-commerce platform, but with no evidence of genuine retail activity.

- La Communauté des Alpes and Grâce des Alpes: Alternate business names used in marketing and regulatory filings.

These domains are frequently cited in regulatory warnings and investigative reports as being directly associated with the scam.

At its core, Des Alpes is structured as a pyramid scheme disguised as an MLM opportunity, with a crypto twist. The mechanics are straighforward:

- Pay to Join: New affiliates pay an upfront fee (starting at $129 USDC) to unlock the first level of the matrix. Higher levels require additional payments, up to $2,100 USDC for full access.

- Monthly Fees: To remain eligible for commissions, affiliates must pay recurring monthly fees, which increase with each unlocked level.

- Recruitment-Driven Earnings: The only way to earn is by recruiting others, who also pay to join and unlock levels. Each new recruit fills a slot in the matrix, triggering a commission for their upline.

- Matching Bonuses: Affiliates receive a percentage of the recruitment commissions earned by their downline, incentivizing the aggressive recruitment.

- Pseudo-Product Compliance: The “cashback shopping” feature is presented as a retail offering, but there is no evidence of real customers or product sales outside the affiliate network.

This structure is emblematic of crypto pyramid schemes, where the promise of high returns and passive income is used to lure participants, but the only real source of revenue is the constant influx of new recruits. Again, once recruitment slows, the scheme collapses, leaving the majority of participants with losses.

Flow of Funds

The vast majority of funds collected by Des Alpes are funneled up the matrix to the owner (Daniel Dalpe) and early joiners. Commissions are paid out only when new recruits join and pay their fees, creating a constant need for fresh victims. Once recruitment slows, the flow of funds dries up, triggering a collapse that leaves most participants with losses.

Des Alpes’ financial model is built on a series of upfront recurring fees, all payable in cryptocurrency (primarily USDC, sometimes USDT):

- Initial fee: 129 USDC to unlock Level 1 of the matrix.

- Level unlock fees: Additional payments required to access higher levels, up to 2,100 USDC for full access.

- Monthly fees: Ongoing payments (ranging from 100 to 400 USDC per month) to remain eligible for commissions at each level.

- Optional affiliate membership: An additional 29 USDC monthly fee is sometimes charged for “affiliate membership.”

All payments are made via crypto wallets, with no traditional banking or credit card options. This not only facilitates rapid, borderless transactions but also makes it difficult for victims to recover funds or trace the flow of money.

Des Alpes claims to offer a “cashback shopping” program, promising deep discounts and rewards for purchases made through its platform. However, investigative measures and regulatory warnings consistently show that there is no evidence of genuine retail customers or product sales outside the affiliate base. The cashback feature appears to be a thinly veiled attempt at compliance, designed to create the illusion of a real business model while masking the underlying pyramid structure.

Every product is “coming soon” and the mall does not exist. Their “cashback shopping” program was supposed to include an online marketplace. Once again, there are no products or services sold.

The Founder, Daniel Dalpe (Desalpes)

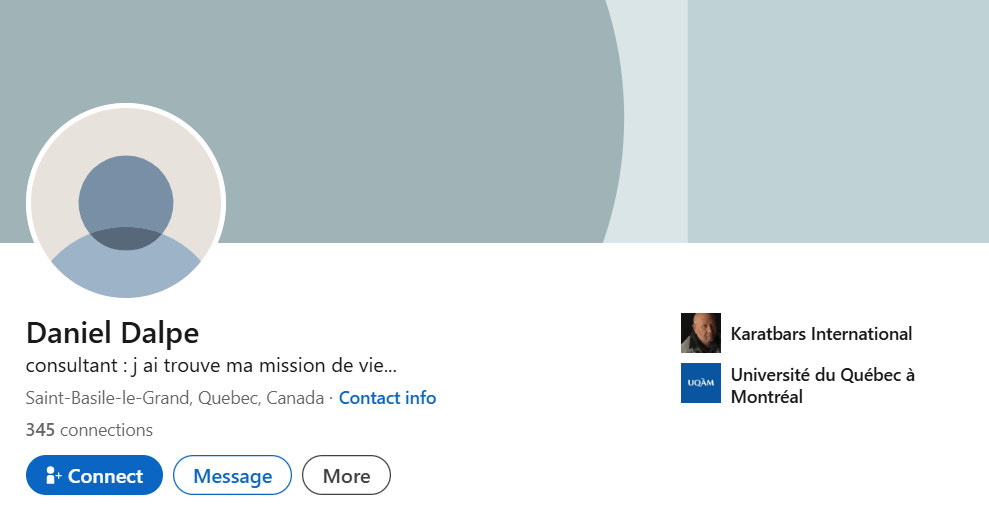

Daniel Dalpe (also known as Daniel Desalpes or Daniel Dalpé) is he founder and CEO of Des Alpes. He is a Swiss-sounding founder figurehead intended to anchor trust in the brand. Based in Saint-Basile-le-Grand, Quebec, Dalpe’s professional background includes roles as a consultant, business owner, and director at Karatbars International, another controversial MLM company. His linked in profile emphasizes his passion for human relations, leadership, and training, but provides little detail about his involvement in Des Alpes or other crypto-MLM ventures.

Dalpe’s public appearances are characterized by appeals to community, faith, and gratitude. In a February 2025 video, he expressed appreciation for the “incredible community” surrounding him and reaffirmed his commitment to “serving with purpose and integrity.” However, these statements stand in stark contrast to the opaque and fraudulent nature of Des Alpes’ business operations.

Dalpe is widely cited as the architect and primary beneficiary of the Des Alpes scheme. Investigative reports and regulatory filings consistently identify him as the CEO and presumed founder, responsible for designing the compensation plan, overseeing recruitment efforts, and controlling the flow of funds within the system.

Despite his central role, Dalpe has taken pains to obscure his identity in official company materials, with no executive information provided on Des Alpes’ websites and all domains registered privately. This lack of transparency is a common tactic among operators of fraudulent MLM and crypto schemes, designed to evade accountability and regulatory scrutiny.

Dalpe’s history with Karatbars International is particularly noteworthy. Karatbars has faced its own share of regulatory warnings and accusations of operating as a pyramid scheme, further casting doubt on Dalpe’s credibility and intentions. His experience in MLM recruitment and management provided the foundation for the structure and tactics employed in Des Alpes.

Arla Mendenhall: Serial Promoter

Arla Mendenhall is emblematic of a certain class of MLM scam promoters: individuals who move from one fraudulent scheme to another, leveraging their networks and persuasive skills to recruit new victims. Her history includes:

- Zeek Rewards: Mendenhall was named as a net-winner in the $850 million Ponzi scheme, refusing to return illicit gains and facing ongoing legal action.

- Blessing Gold Club: Participated in cash gifting schemes, recruiting others into illegal gifting circles.

- DBM Masterminds: Promoted a scheme promising 210-220% returns, which collapsed in late 2024.

- Achieve Community: Aggressively promoted the Ponzi scheme, claiming ignorance when it was shut down by the SEC. She attempted to intervene in the SEC’s civil case to prioritize her own restitution, a move denied by the court.

Her activities have been extensively covered by BehindMLM, particularly in 2015. She has a documented history of being in schemes that spans well over a decade. BehindMLM’s coverage highlighted her tendency to feign ignorance of the illegality of Ponzi and pyramid schemes, despite a long track record of participation and promotion. The site notes:

“With a low-level Ponzi scheme and gifting scheme already under her belt, clearly when Mendenhall signed up for Achieve she was no stranger to scams. Perhaps the smoking gun though was her involvement in the $850 million dollar Ponzi scheme, Zeek Rewards. How much money Mendenhall stole from Zeek’s victims is unclear, but she was named by the court-appointed Receiver as a US net-winner who made more than $1000 in the scheme. Mendenhall’s name appears on a list of some 9000 Zeek investors who refused to pay back the money they stole from victims.“

Her attempts to intervene in Achieve Community SEC case were rebuffed, with the court noting that her claims were indistinguishable from those of other victims and that her intervention would not serve the interests of justice.

Mendenhall’s modus operandi is to join new schemes early, promote them aggressively through social media and personal networks, and then claim ignorance or victimhood when regulatory action is taken. This pattern is consistent with her involvement in Des Alpes and serves as a warning to potential participants: those promoting such schemes are often seasoned operators with little regard for the well-being of their recruits.

The “Grace Team” and Associated Promoters

Des Alpes relies on a network of aggressive promoters to drive recruitment and maintain the illusion of legitimacy. The most prominent of these are:

- Yolene Gray: Headed “The Grace Team,” responsible for organizing webinars, recruitment drives, and promotional events. Gray is frequently cited in regulatory warnings as a key promoter of Des Alpes and its associated domains.

- Pastor Noah: Another leader of “The Grace Team,” involved in community outreach and recruitment, particularly targeting faith-based groups.

- Armel Ndounkeu (Coach Armel): Active recruiter and motivational speaker, leveraging his personal brand to attract new affiliates.

These individuals are instrumental in expanding Des Alpes’ reach, particularly among French-speaking communities in Quebec and international audiences in India and Africa. Their activities are characterized by high-pressure recruitment tactics, promises of financial freedom, and appeals to community and faith.

Des Alpes has rapidly expanded its operations beyond Quebec, targeting vulnerable populations in India, Africa, and other regions with limited financial literacy and regulatory oversight. Numerous unnamed affiliates and promoters are responsible for this growth, often operating through private social media groups, WhatsApp chats, and online webinars.

One of the more revealing aspects of Des Alpes’ recruitment strategy was its targeting of members from other controversial ventures. Des Alpes promoters actively poached participants from Onpassive, another scheme that faced scrutiny from the US Securities and Exchange Commission (SEC). A notable case was Jeffrey Morlock, who had been deposed in the Onpassive vs. SEC proceedings. Morlock briefly joined Des Alpes and produced promotional videos endorsing the scheme. However, upon realizing it was fraudulent after my coverage of his involvement on my channel, he deleted all his videos and appeared to distance himself from the operation. His involvement illustrates how Des Alpes preyed on communities already entangled in high-risk ventures, exploiting existing trust networks to accelerate recruitment.

The company’s international ambitions are reflected in its acceptance of global crypto payments (USDC, USDT) and its marketing materials, which emphasize accessibility and inclusivity. However, this expansion has also attracted the attention of international regulators and consumer advocates, who warn that the scheme is likely to collapse, leaving thousands of victims in its wake.

Other Individuals Seen In Des Alpes Materials

Below is a list of individuals who appeared in Des Alpes–related screenshots, chats, or promotional material. Their presence here is not an accusation of wrongdoing. At this stage, their level of involvement is unknown — some may be customers, observers, or people added to groups without understanding the wider scheme. We include the names only for transparency and documentation. If your name appears here and you wish to clarify your association with Des Alpes or request removal, please contact us and we will review it confidentially.

Names appearing in the Des Alpes ecosystem:

Arla Mendenhall, Victoria Harris, Pat Moshier, Barbara King, Caryl Stohr, Twanda McBride, Patrick Lopez, Daniel Behan, Ashley Norman, Linda Thompson, Kevin Blackburn, Becky White, Bev Witnish, Nilda Gomez, Oscar Vidal, Christine Gauthier, Joe Turek, Fred Moshier, Dennis Goff, Chasity Knapp, Al Rodriguez, Patty Hogan, Nicole Sanchez, Karen Agyekum, Anita Bradford, Linda Miller, Jenna Watanabe, Joshua Reed, Janine Guerro, Sherry Lamb, Eddie Guerro, Gaylon Hogan, Amy Riley Stutzman, Travis Thurston, Duane Murdock, Kirstin Korinski, Brenda McFarland Benoit, Sharon Moody, Jamison Weakly, Colleen Campbell, Maximillian Howell, Carla Carey, Adrina Futshane, Nixon Chasaya, Matt Powell, Sherry Lamb, Kim Reed, Glen Vogue, Steven Anderson, Darlene Graley, Charles Harbin, Peter Morrison, Vince Mummau, Chaney Yoder, Paul Llona, Nat Scatergood, Gary Carr, David Miller, Dinah Shtuum, Cassidy Yoder, Paul Saleu, Robin Faith Kaur, Anitha Otto Pohak, Clinton Huaisengi, Abel Yowi, Richard Nopu, Trevor Victor Ramba, Easo Henry, Mark Saliau, Leethoy Palan, Victor Babona, Bryon Kimerling Wamaro, Michael Jr Grai, Derrila Ramba, Jirehpha Setu, Jeromy Takomba, Jethro Klewarin, Lawrence David Tarri, Svetlana Karshov, Marina KC, Maor Shtuum, Lyubov Morozuv, Olga Prokopyev, Nadia Nexo, Olga Barnes, Raymsen Kisaka, Henry Paro, Malcham Nare, Demelyn Homboku and Davao Peter.

Regulatory Warnings and Actions

Autorité des marchés financiers (AMF) – Quebec

On September 19, 2025, the Autorité des marchés financiers (AMF), Quebec’s financial regulator, issued a Formal Warning against Des Alpes (DesAlpes LLC). The warning stated:

“DesAlpes LLC is not registered with the Autorité des marchés financiers (AMF) and is not authorized to solicit investors in Quebec.“

The AMF’s warning emphasized that Des Alpes is operating illegally, soliciting investments without proper registration or authorization. The regulator urged the public to exercise caution and to consult official registers before investing in any financial product or service. The AMF also highlighted the use of multiple domains and business names as a tactic to evade detection and regulatory action.

Alberta Securities Commission (ASC)

On October 17, 2025, the Alberta Securities Commission (ASC) added Des Alpes (DesAlpes LLC) to its Investment Caution List, stating:

“DesAlpes LLC is not registered to trade in or advise on securities or derivatives in Alberta. It is recommended that investors should not deal or engage with firms that are not registered as there is no assurance of any investor protections.“

The ASC’s warning mirrored that of the AMF, citing the same associated domains and business names. The regulator specifically noted the involvement of “La Communauté des Alpes” and “Grace des Alpes” as operating under DesAlpes LLC. The ASC urged investors to verify the registration of any firm or platform before investing and provided resources for checking registration status.

Canadian Securities Administrators (CSA)

The Canadian Securities Administrators (CSA), an umbrella organization representing provincial and territorial securities regulators, has also issued Alerts regarding Des Alpes, consolidating warnings from both the AMF and ASC. The CSA’s alerts are intended to assist the public and the securities industry in conducting due diligence and avoiding high-risk entities.

Victim Experiences

Numerous victims have come forward with reports of inability to withdraw funds, blocked accounts, and unresponsive customer service. Common complaints include:

- Withdrawal issues: Affiliates are unable to access their earnings, with requests for withdrawals ignored or delayed indefinitely.

- Additional fees: Victims are sometimes asked to pay further fees to “unlock” withdrawals, a classic tactic in scam operations.

- Ghosting: Once funds are deposited, communication from the company ceases, and victims are left with no recourse.

Some victims have sought the assistance of specialized recovery firms, such as 57 Investigations Ltd, which claim to use blockchain analysis to trace and recover stolen funds. While there are anecdotal reports of successful nature of crypto transactions and the risk of falling victim to secondary “recovery scams.” So instead of using them, reach out to us.

Regulatory authorities, including the AMF and ASC, urge victims to:

- Preserve all documentation: Keep records of transactions, communications, and account details.

- Report the incident: File complaints with relevant financial authorities and law enforcement agencies.

- Be weary of recovery scams: Avoid firms that demand upfront fees or guarantee recovery, as these are often fraudulent.

The AMF provides detailed guidance on how to file complaints and report fraud, emphasizing the importance of acting quickly and providing as much information as possible. I would recommend reporting to the AMF in Quebec, as that’s where Des Alpes is supposed to be registered.

What Des Alpes Teaches Us

The Des Alpes saga is a cautionary tale for anyone considering participation in online investment opportunities, particularly those involving cryptocurrency and multi-level marketing. Despite its promises of financial empowerment, community and innovation, Des Alpes is, at its core, a crypto pyramid scheme designed to enrich its founder and early promoters at the expense of the vast majority of participants.

It teaches us:

- Transparency matters: Legitimate businesses provide clear information about ownership, products, and regulatory status. Des Alpes offers none of these.

- Recruitment-driven earnings are a red flag: If the only way to make money is by recruiting others, the scheme is most certainly fraudulent.

- Crypto payments complicate recovery: Once funds are sent via cryptocurrency, they are difficult to trace and recover.

- Regulatory warnings should not be ignored: Multiple financial authorities have flagged Des Alpes as illegal and high-risk.

- Serial promoters are not to be trusted: Individuals like Arla Mendenhall have a long history of profiting from scams and should be avoided.

- Victims have recourse: Regulatory authorities provide mechanisms for filing complaints and reporting fraud, but swift action is essential.

As the world of online fraud continues to evolve, so too do the tactics of scammers. Vigilance, skepticism, and due diligence are the best defenses against falling victim to schemes like Des Alpes. If an opportunity seems too good to be true, especially when wrapped in language of crypto and passive income, it most certainly is.

If you or someone you know has been affected by Des Alpes or a similar scheme, contact your local financial regulator immediately and preserve all documentation. Your actions can help prevent further victimization and bring perpetrators to justice.

By Beth Gibbons (Queen of Karma)

Beth Gibbons, known publicly as Queen of Karma, is a whistleblower and anti-MLM advocate who shares her personal experiences of being manipulated and financially harmed by multi-level marketing schemes. She writes and speaks candidly about the emotional and psychological toll these so-called “business opportunities” take on vulnerable individuals, especially women. Beth positions herself as a survivor-turned-activist, exposing MLMs as commercial cults and highlighting the cult-like tactics used to recruit, control, and silence members.

She has contributed blogs and participated in video interviews under the name Queen of Karma, often blending personal storytelling with direct confrontation of scammy business models. Her work aligns closely with scam awareness efforts, and she’s part of a growing community of voices pushing back against MLM exploitation, gaslighting, and financial abuse.

Leave A Comment