If you’ve watched me dismantle OnPassive and its orbit of hype, you already know the pattern: anonymous operators, AI-fluff marketing, and a faux-philanthropy wrapper to make a pay-to-play scheme look like “community.”

BuildGiver checks every single box. Let’s go deeper so you can spot the tells before they empty your wallet and discuss the man behind it, with a history you need to know.

The Man Behind the Curtain: Roem Emverda

BuildGiver hides behind a Facebook alias: “Roem BuildGiver.” That profile has been renamed at least three times — a classic tactic to shake off past scam associations while keeping the same network of followers.

Dig into the photo history and you find the real identity: Roem Emverda.

Roem Emervda is a California-based serial promoter of fraudulent schemes. His resume of red flags includes a failed crypto social network called “Focus,” a pyramid scheme called “Empower Life” and another familiar scam.

If Roem looks familiar to you, that’s because he was also in OnPassive. OnPassive is the so-called “AI-with-heart-powered” MLM that the SEC sued for fraud in 2023. Founder Ashraf Mufareh Settled for $32 million earlier this year.

What BuildGiver Really Is

BuildGiver isn’t selling a product or service. The only thing changing hands is money, flowing “up” the chain through a series of gifts from new recruits to earlier entrants. They label this “private activity giving” to sound charitable, but the mechanics are pure gifting scheme: you “donate” to qualify, then you’re told you’ll receive more when you bring others in.

- Anonymity: No executive diclosures, no verifiable ownership, and a trail that relies on aliases and private groups. That’s intentional opacity, not “privacy.”

- Hidden paywalls: The actual payment amounts, tiers, and rules aren’t plainly published. When the price of entry is obscured, it’s not compliance — it’s concealment.

- Phases and matrices: The “phase” language typically maps to tiered matrices, where every new phase requires a higher buy-in, and the payout hinges on how many people you push in beneath you.

Direct translation: no retail value, no external revenue, only recruitment-funded transfers. That’s not “giving;” it’s redistribution among participants, which inevitably runs dry.

Why “Donations” Don’t Legalize It

Slapping the word “donation” on a transfer doesn’t convert a commercial scheme into a lawful charity. In the U.S. and Canada, regulators focus on the substance:

- No product = red flag: If compensation comes from new participants’ money, not sales to the public, it’s typically treated as a pyramid or gifting arrangement.

- Pseudo-compliance: Phrases like “private activity,” “peer-to-peer giving,” and “member-to-member donations” are cosmetic. If the plan pays you for recruiting, you’re in pyramid territory.

- Tax and fraud exposure: Calling a buy-in a “gift” doesn’t shield it from fraud scrutiny or tax consequences. Misrepresenting payments as donations can compound the risk.

Bottom line: regulators look at what you do, not what you call it.

The Math That Buries the Latecomers

Every gifting scheme depends on exponential expansion. Even small “bring just a few” pitches explode into impossible numbers quickly.

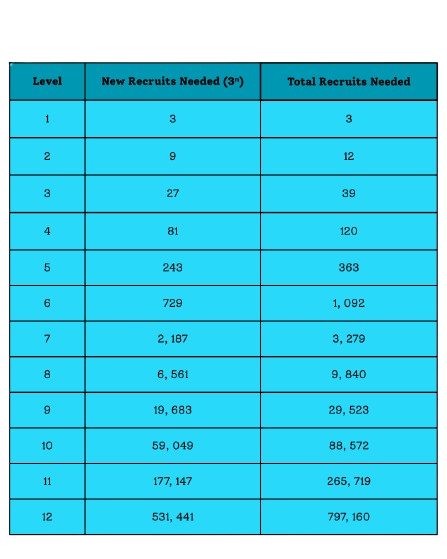

Example: If each participant much recruit 3 new people to “cycle” to the next stage, the number of recruits needed grows exponentially.

- At Level 1, you recruit 3 people

- At Level 2, each of those 3 recruits their own 3 so that’s 9 new people.

- By Level 10, you’d need 88, 572 new recruits in total.

- By Level 12, that number explodes to 797, 160

What that means in reality:

And here’s the kicker: there simply aren’t enough real participants to sustain that growth. The structure guarantees that most people will lose money, not because they didn’t “try hard enough,” but because the math makes it impossible for everyone to win.

Red Flags You Can Spot in Minutes

- No Retail Product: You can’t name a thing outsiders buy. Only membership or positions.

- Undisclosed pay-in: You can’t find the exact amounts or rules before you’re inside a private group.

- Private channels only: Unlisted videos, locked groups, coded language (“phases,” “cycles,” “boards”).

- Borrowed credibility: Stirring AI-generated hype, vague references to “AI tools,“ and recycled graphics to feign legitimacy.

- False charity framing: Overuse of “donation,” “blessing,” “community,” “give to receive” as a moral shield.

If you see three or more of these, you’re not evaluating a business — you’re being recruited.

If Someone Pitches You BuildGiver

- Ask for specifics: “What is the relateable product?” “What are the published payout rules and entry amounts?” If they are vague then walk away.

- Refuse private payments: Don’t “gift” via cash apps, crypto, or peer-to-peer methods. These are designed to be irreversible.

- Save evidence: Screenshots, presentations, payment requests, and usernames. You’ll need them if it unravels.

- Check regulators: Search for the name with terms like “pyramid,” “gifting,” “complaint,” “cease and desist.” Also check dehek.com and BehindMLM to see if there’s a review.

- Trust the friction: If you’re told “don’t share this,” “keep it private,” or “we’ll explain after you join,” that’s not exclusivity, it’s evasion.

If You’re Already In

- Stop payments now: Don’t “top up” to unlock the next phase. Sunk costs don’t recover with more risk.

- Document everything: Names, handles, wallets, receipts, promotional claims. Back them up off-platform.

- Seek chargebacks: If you paid by card, contact your bank promptly and describe a misrepresented scheme. For crypto or P2P, share transaction IDs anyway — patterns matter.

- Report it: In the United States, you can report to the FTC, IC3, your State Attorney General. In Canada, you can report to the Competition Bureau, Canadian Anti-Fraud Centre, and your provincial securities regulator if “returns” were promised.

- Warn your circle: Keep it factual: “No product, earnings tied to recruitment, and hidden pay ins. High risk of loss.” Shame helps scammers; facts help people.

The Pattern I’ve Seen a Hundred Times

Schemes like BuildGiver aren’t accidents; they’re repeatable templates. Launch quietly, push donation language, hide math and money flows, ride the hype curve, then pivot to the next board/phase/company before accountability lands. The branding changes. The mechanics don’t.

I’m the Queen of Karma because I believe consequences catch up. Don’t let them catch up to you. Keep your money, keep your receipts, and keep your eyes open.

By Beth Gibbons (Queen of Karma)

Beth Gibbons, known publicly as Queen of Karma, is a whistleblower and anti-MLM advocate who shares her personal experiences of being manipulated and financially harmed by multi-level marketing schemes. She writes and speaks candidly about the emotional and psychological toll these so-called “business opportunities” take on vulnerable individuals, especially women. Beth positions herself as a survivor-turned-activist, exposing MLMs as commercial cults and highlighting the cult-like tactics used to recruit, control, and silence members.

She has contributed blogs and participated in video interviews under the name Queen of Karma, often blending personal storytelling with direct confrontation of scammy business models. Her work aligns closely with scam awareness efforts, and she’s part of a growing community of voices pushing back against MLM exploitation, gaslighting, and financial abuse.

Leave A Comment