RIMAN, a South Korean multi-level marketing (MLM) company, has rapidly ascended to prominence in the global direct selling industry since its founding in 2018. With a focus on K-beauty and wellness products, RIMAN has expanded its operations from Korea to North America and beyond, attracting both praise for its product innovation and scrutiny for its business practices.

Behind the luxury skincare and influencer gloss, RIMAN’s rise reveals a darker blueprint — one built on secrecy, control, and high-stakes recruitment. For many recruits, the real makeover is financial ruin and psychological entrapment. If it looks like skincare and acts like a cult, it demands a closer look.

Pulling Back the Curtain

RIMAN presents itself as a premium South Korean beauty and wellness direct-selling company offering skincare, cosmetics, and dietary supplements. Public-facing marketing emphasizes K-beauty aesthetics, limited product drops, and lifestyle aspirational messaging, paired with high-energy recruitment events and influencer endorsements. The company claims a rapidly growing footprint beyond South Korea into other Asian markets and North America.

On the surface RIMAN looks like dozens of modern MLMs: glossy products and aspirational storytelling. Under that veneer, however, patterns reported by former distributors and preliminary records indicate structural features that prioritize recruitment-driven revenue and create repeated harms for lower-level participants.

Starter kits, “founder packs,” and tiered product bundles are commonly used to onboard new distributors. Recruits report mandatory initial purchases to qualify as distributors plus recurring inventory minimums tied to rank qualifications and bonus eligibility. These buy-ins shift financial risk onto recruits rather than the company.

Internal training materials and recruitment webinars reportedly emphasize building a downline and achieving rank targets more than cultivating external retail customers. Compensation incentives — fast ranks, recruitment bonuses, and team volume multipliers — create systemic pressure to recruit friends and family. When distributors rely primarily on selling to other recruits or on their own inventory purchases to meet quotas, the business resembles a recruitment-centric model (a pyramid scheme) rather than a retail-first company. That distinction is central to consumer and regulatory scrutiny.

There have been frequent entity name changes, shifting registered addresses, or complex webs of holding companies which are common in cases where accountability is diffuse. Preliminary mapping suggests multiple corporate entities and international registrations tied to the brand; this kind of structure can complicate enforcement and civil claims.

There has also been use of third-party event promoters, separate logistics companies, and offshore payment processors can be legitimate business choices — but they also increase the difficulty of tracing problematic financial flows and holding specific individuals or entities accountable.

At present, we report serious concerns about predatory business practices and systemic consumer harm. Evidence publicly available so far does not conclusively demonstrate organized-crime ownership; however, opaque corporate structures and suspicious financial routing merit a focused forensic accounting inquiry.

Despite the presence of high-profile executives, RIMAN has been criticized for not disclosing detailed executive or ownership information on its official websites, particularly in English-language versions. This lack of transparency is unusual for a company of its size and has been cited as a major red flag, raising questions about accountability and regulatory compliance.

The key executives linked to RIMAN are as follows:

- KyungJung Kim (KJ Kim): CEO of RIMAN, both globally and for the US market. Kim is the public face of the company at major events and is credited with leading RIMAN’s international expansion.

- Joong Hyun Ahn: Chairman of RIMAN, cited as the founder and strategic visionary behind the company’s product philosophy and global ambitions.

- Betty Perez: President of Sales for North America, responsible for adapting RIMAN’s approach to the US market and emphasizing transparency and compliance.

- Candice Riman: Global VP of Strategic Partnerships & E-Commerce, leading global talent strategy and omnichannel growth, with a focus on North America, Mexico, Singapore, and emerging markets.

- Tim Herr and Christopher Kim: First National Directors in the USA, recognized as industry veterans with a combined 43 years of direct selling experience, instrumental in building RIMAN’s North American distributor network.

Problematic Products

RIMAN’s product portfolio is centered on K-beauty and wellness, with a strong emphasis on proprietary ingredients and patented technologies (according to them). The main brands and product lines include:

- Incellderm: The flagship skincare line, featuring products formulated with “giant byoungpool” (a patented strain of centella asiatica), liposome technology, and other traditional Korean herbal ingredients.

- Botalab: A line focused on personal care and nutrition, including gut health and collagen products. The Botalab trademark is registered in the US by RIMAN Co. Ltd.

- Lifening: Nutrition and wellness products, including supplements for gut health and collagen support.

- Giant Byoungpool: The proprietary, patented centella asiatica extract, marketed as a “miracle elixir” for skin regeneration and healing.

Here is a sample of RIMAN’s product offerings, product descriptions (based on their website) and retail prices (USD):

- Vieton Oil Mist: Moisturizing facial mist — $35

- Active Cream Ex: Enhances skin elasticity — $60

- Snow Enzyme Cleanser Ex: Gentle cleanser — $25

- Beauty Collagen Ampoule: Hydrolyzed fish collagen, high bioavailability — $90

- Purecell Cleansing Oil: Makeup and oil cleanser — $30

- Daily Aqua BB: Skin brightening, wrinkle care — $30

- Vieton Multi Stick Balm: Improves skin radiance — $25

- Calming Balance Gel: Soothes skin, reduces redness — $35

- Radiansome100 Microfluidizer Essential Toner: Prepares skin, protection barrier — $70

- Radiansome100 Microfluidizer Ampoule: Anti-aging complexes — $110

- 4D Lustre Cushion: High refractive index oils for light reflection — $50

- Active Clean-Up Powder: Enzyme exfoliation — $30

- Aqua Protection Sunscreen: SPF 50+UVA/UVB protection — $30

- Deep Talk Plus (Supplement): Detox, prebiotic, immune support — $68 (28 sachets)

RIMAN claims to hold 13 patents and claims to have won over 28 industry awards for its products, with over 30 million units sold since inception.

RIMAN’s marketing emphasizes the fusion of traditional Korean herbal medicine with modern biotechnology, particularly the use of “giant byoungpool.” However, I must note the lack of peer-reviewed scientific studies substantiating the claimed superiority of RIMAN’s proprietary extracts over standard centella asiatica products. The company’s pricing is positioned at a premium but is not considered exorbitant compared to other K-beauty brands. Nonetheless, the efficacy and uniqueness of the products remain subject to consumer trial skepticism, especially given the crowded market for centella asiatica-based skincare.

Corrupt Compensation

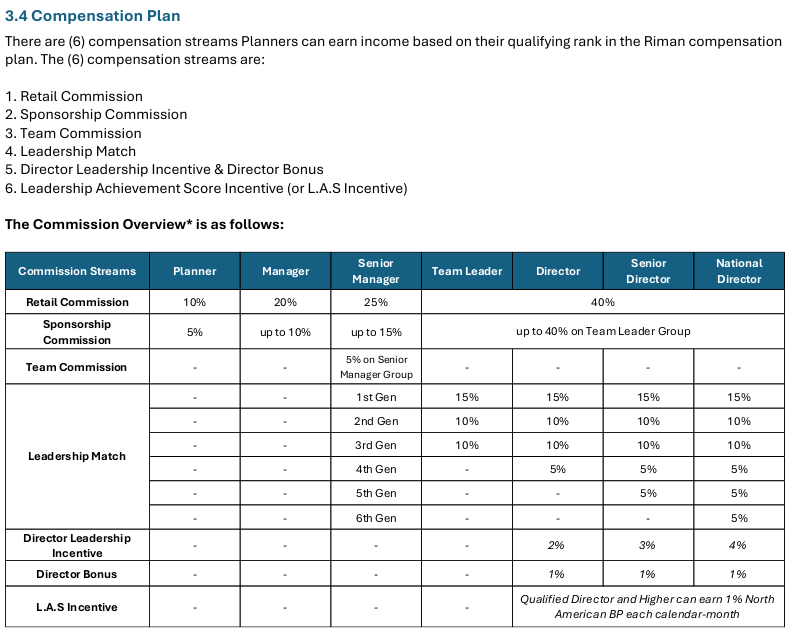

RIMAN’s Compensation Plan is complex, multi-tiered, and it is an MLM model and includes retail commissions, rebates, referral bonuses, unilevel residuals, matching bonuses, and leadership incentives. The plan is designed to reward both retail sales and recruitment (allegedly) but I am criticizing its complexity and how it disproportionately favors higher-ranked distributors.

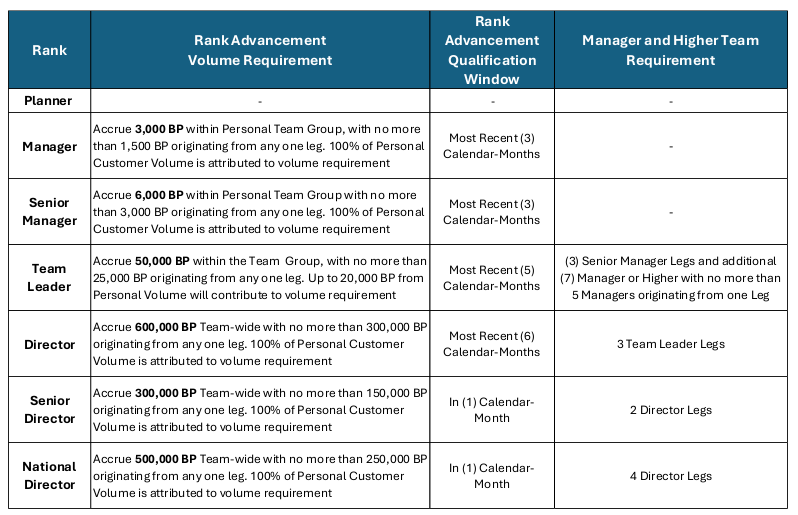

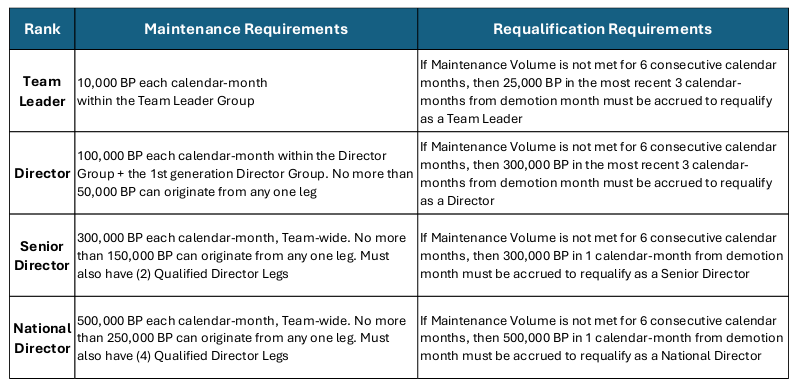

RIMAN distributor ranks and qualification criteria is as follows:

- Planner: Sign up as a distributor

- Manager: 3,000 BP in Personal Team Group (max 1, 500 from any one leg) over 3 months, 3 retail customers.

- Senior Manager: 6, 000 BP in Personal Team Group (max 3,000 from any one leg) over 3 months, 3 retail customers.

- Team Leader: 50, 000 BP in Team Group (Max 25,000 from any one leg, up to 20,000 from personal volume) over 5 months, 10,000 BP/month in Team Leader Group, 3 Senior Manager legs, 7 Managers team-wide, 5 retail customers.

- Director: 600,000 BP Team-wide (max 300,000 from any one leg) over 6 months, 100,000 BP/month in Director Group, 3 Team Leader legs, 5 retail customers.

- Senior Director: 300,000 BP Team-wide (max 150,000 from any one leg) in 1 month, 300,000 BP/month in Senior Director Group, 2 Director legs, 5 retail customers.

- National Director: 500,000 BP Team-wide (max 250,000 from any one leg) in 1 month, 500,000 BP/month in National Director Groups, 4 Director legs, 5 retail customers.

Note: BP = Business Points, typically 90% of USD value; retail customer purchases required for all ranks above Planner.

Independent analysts have described RIMAN’s compensation plan as “overly complicated,” with numerous restrictive conditions and “gotchas” that make it difficult for lower-ranked distributors to earn meaningful income. Retail commissions are tiered by rank rather than sales volume, penalizing those who do not rapidly ascend the hierarchy. The plan’s structure appears to favor those at the top, with the majority of commissions and bonuses flowing to higher ranks, a common criticism of MLM models. Additionally, the requirements for ongoing retail customer acquisition and high group volumes for rank maintenance creates pressure for aggressive recruitment and sales tactics.

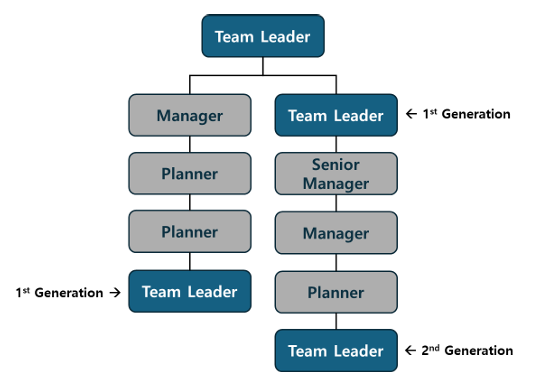

They also claim to do a “Leadership Match.” Leadership Match is a commission reserved for Team Leaders and Higher that pays said Planners a percentage of their Qualified Team Leaders and Higher’s Leadership Match Commissions.

Leadership Match Eligible Commissions:

- 50% of a Team Leader’s Rebate

- 50% of a Team Leader’s Retail Commission

- 100% of a Sponsorship Commission

- 100% of Director Leadership Incentive

But if your charts look like you’re drawing pyramids, guess what?

Expanding The Scheme

RIMAN’s North American launch in 2023 was marked by high-profile events in Las Vegas, attended by thousands of distributors and industry leaders. The company’s recruitment messaging emphasizes:

- Financial Opportunity: Promises of lucrative commissions, flexible work, and the potential for six-figure incomes for top performers.

- Product Efficacy: Testimonials and before/after imagery highlighting visible skin improvements, leveraging the popularity of K-beauty trends.

- Community and Support: Access to training, mentorship, and a supportive distribution network, including weekly Zoom sessions and conventions.

- Integration with Existing Businesses: Targeting spa and salon owners as ideal partners to cross-sell RIMAN products and create new revenue streams.

Recruitment is conducted through a combination of social media marketing, in-person events, “pop up” skincare parties, and direct outreach by existing distributors. The company provides business launch worksheets and strategic planning tools to help new recruits set sales and recruitment goals.

There is evidence of aggressive recruitment and upselling tactics, particularly in North America. Survivor accounts on platforms like Reddit describe experiences where individuals were pressured to provide sensitive personal information (such as Social Security Numbers) to qualify for commissions, and were subjected to persistent follow-up and pressure to host sales parties and recruit friends and family. Some accounts detail discomfort with the pushiness of distributors and the ethical dilemma of selling expensive skincare products with unproven universal efficacy.

RIMAN’s international expansion has been rapid and strategic:

- 2018: Founded in South Korea

- 2023: Official launch in North America (USA and Canada) with grand opening events and rapid distributor recruitment

- 2024: Expansion into Taiwan and Hong Kong

- 2025: Entry into Mexico, Singapore, Malaysia, the Philippines, and the United Kingdom

- Planned for 2026: Further expansion planned for Italy, Spain, Ireland, Chile, Colombia, and Peru

In 2025 alone, RIMAN’s North American revenue is reported at $3B. Their revenue in 2024 in South Korea was $545M. So the company seems to be expanding its sales as well. RIMAN is even ranked the #1 direct sales beauty brand in Korea by the Korea Fair Trade Commission and is listed #23 on the DSN Global 100 List. The company claims over 400,000 “Beauty Planners” (distributors) and more than 30 million units sold. In North America, their customer base is over 630,000 members, though these figures are self-reported and not independently verified.

Regulatory Relapse

RIMAN Korea has faced significant regulatory scrutiny and penalties:

- 2025: The Korea Fair Trade Commission (KFTC) penalized RIMAN Korea for operating an illegal multi-level marketing scheme while registered as a “sponsorship door-to-door sales business” rather than as a multi-level marketing business. This allowed RIMAN to evade stricter regulations, including capital requirements, consumer damage compensation insurance, and limits on sponsorship commission payments. The KFTC filed a complaint with the prosecution and imposed corrective orders. RIMAN Korea was found to have established sales organizations with three or more levels and paid commissions based on subordinate sales performance without proper registration.

- Name Registration Issues: RIMAN Korea was also found to have approved name changes for salespersons, allowing individuals not registered as multi-level salespersons to act as such, further violating regulatory requirements.

- Consent Resolution Rejected: RIMAN Korea applied for a consent resolution (a process to close cases quickly with corrective measures), but the KFTC rejected the application due to the seriousness of the violations and public interest considerations.

These actions are significant, as they represent a rare case of a sponsorship door-to-door sales company being sanctioned for operating as an unregistered MLM, raising compliance awareness across the industry.

As of November 2025, there are no public records of major regulatory actions or penalties against RIMAN in the United States or Canada. The company’s North American compensation plan and marketing materials have been updated to emphasize compliance with local laws, including the Federal Trade Commission (FTC) Act in the USA and provincial consumer protection laws in Canada.

However, RIMAN’s English-language websites and compensation disclosures lag behind FTC standards for transparency, particularly regarding executive information and income disclosure statements. The company’s complex compensation plan and aggressive recruitment tactics could attract future regulatory scrutiny, especially if complaints from distributors or consumers increase. No major lawsuits or criminal cases involving RIMAN or its executives have been reported in South Korea, North America, or other markets as of the current date. However, the regulatory penalties in Korea and the company’s history of operating in a legal gray area are notable risk factors.

Despite the absence of direct criminal links, several red flags warrant caution for potential recruits and investors:

- Opaque Ownership and Executive Disclosure: Lack of transparency about ownership and executive team on public websites.

- Regulatory Evasion: Documented history of evading stricter MLM regulations in Korea.

- Complex Compensation Plan: Structure that disproportionately rewards top ranks and may incentivize aggressive recruitment over retail sales.

- Aggressive Recruitment Tactics: Reports of pressure to provide sensitive personal information and persistent upselling by distributors.

- Inventory Loading Risks: Requirements for high personal and group sales volumes may encourage inventory loading, though RIMAN claims to police this practice.

Crazy Controversies

RIMAN has received significant positive coverage in industry publications, being ranked as a “Triple AAA+ Opportunity” by Business for Home and listed among the top MLM companies in Korea and globally. The company is praised for its product innovation, rapid growth, and the success of its distributor network.

Independent MLM watchdogs and consumer advocates have raised concerns about RIMAN’s business practices:

- BehindMLM: Criticized RIMAN for lack of executive transparency, an overly complicated compensation plan, and structures that penalize lower-ranked distributors. The review also questioned the scientific substantial of product claims and the company’s approach to regulatory compliance in English-speaking markets.

- Scam Detector: Assigned RIMAN’s website a medium-high trust score (75.5/100), noting no evidence of phishing or malware but advising caution due to proximity to other suspicious websites and the need for more transparency.

The majority of commissions and bonuses in this MLM are concentrated among higher-ranked distributors (Team Leaders and above), with lower-ranked members earning significantly less. This is consistent with industry patterns, where a small percentage of distributors capture the majority of payouts, while most earn little or lose money after expenses. Although this is the case with most MLM companies, it is of note here since RIMAN claims to be among the top 5 MLM companies in South Korea and North America.

Summing It All Up

RIMAN has established itself as a major player in the global direct selling industry, leveraging the popularity of K-beauty and wellness products to achieve rapid growth and international expansion. The company’s innovative product lines, aggressive recruitment strategies, and complex compensation plan have attracted both enthusiastic distributors and critical scrutiny. While RIMAN has not been directly linked to organized crime or financial fraud, its regulatory violations in Korea, lack of executive transparency, and aggressive business practices raise significant red flags for potential recruits and consumers.

For those considering joining or purchasing from RIMAN, it is essential to conduct thorough due diligence, understand the risks and rewards of MLM participation, and be aware of available consumer protection remedies. Regulatory agencies in both Korea and North America continue to monitor the company’s activities, and future legal compliance challenges may arise as RIMAN expands into new markets.

In summary, RIMAN represents both the promise and peril of modern MLMs: a company with innovative products and global ambitions, but also with a history of regulatory evasion, complex compensation structures, and aggressive recruitment tactics that warrant careful scrutiny and caution. In other words, I wouldn’t touch this one with a 10-foot pole!

By Beth Gibbons (Queen of Karma)

Beth Gibbons, known publicly as Queen of Karma, is a whistleblower and anti-MLM advocate who shares her personal experiences of being manipulated and financially harmed by multi-level marketing schemes. She writes and speaks candidly about the emotional and psychological toll these so-called “business opportunities” take on vulnerable individuals, especially women. Beth positions herself as a survivor-turned-activist, exposing MLMs as commercial cults and highlighting the cult-like tactics used to recruit, control, and silence members.

She has contributed blogs and participated in video interviews under the name Queen of Karma, often blending personal storytelling with direct confrontation of scammy business models. Her work aligns closely with scam awareness efforts, and she’s part of a growing community of voices pushing back against MLM exploitation, gaslighting, and financial abuse.

Leave A Comment